INTRODUCTION

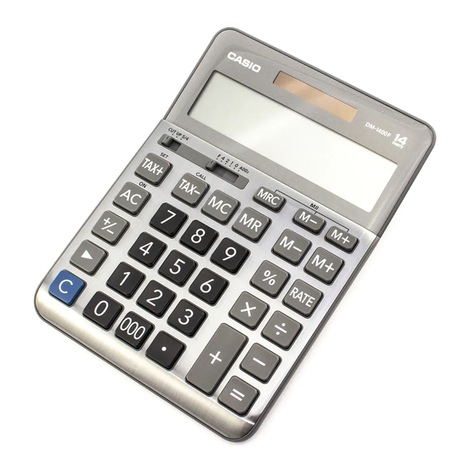

Welcome to the world of CASIO Financial Consultant calculator.

The intention of this 4-part reader is to supplement the User’s Guide of FC-

100V/FC-200V. We adopt the work-example approach as we believe this makes the

reader both effective and efficient for use. Some examples are slightly methodical,

but you should find them useful nonetheless. The goals of the 4 parts are:

Part 1 – Help users get started and explore the interface and setting.

Part 2 – Using CMPD and AMRT for loan and annuity related calculations.

Part 3 – Help users get familiar with CASH and CNVR modes.

Part 4 – Using FC-200V Bond and Depreciation calculations

The FC-200V is an extended version of the FC-100V, and for your convenience we

include a comparison chart of both models in the reader. Key-strokes for all financial

modes for both models are cleverly remained the same by CASIO, with the

exception to Bond, Depreciation and Break-Even Value, which are functions only

available on the FC-200V. User will also find that operations of some scientific

calculations are different too. We refer ONLY to FC-200V in all examples but owner

of FC-100V will find that the examples provided also work on their machine.

We have referred to these resources for inspiration: (i) Schaum’s Outlines on

Mathematics of Finance and (ii) Casio’s Financial Activity for TVM. Screenshots in

the pages are screen dumps from the Casio AFX-2.0+. For this we would like to

thank Marco Corporation (M) Sdn. Bhd. for their technical support.

We did our best to reduce number of mistakes within this reader. But if you do see

us your feedbacks.

Mun Chou, Fong

Product Specialist

QED Education Scientific Sdn. Bhd.

First publication: June 2006, Edition 1

This publication: June 2007, Edition 2

All Rights Reserved. Permission to print, store or transmit is hereby given to reader for personal use. However, no part of

this booklet may be reproduced, store or transmitted in any form by any means for commercial purposes without prior

notice to QE Education Scientific Sdn. Bhd.

This publication makes reference to the Casio FC-200V and FC-100V Financial Consultants. These model descriptions are

the registered trademark of Casio Computer Inc.