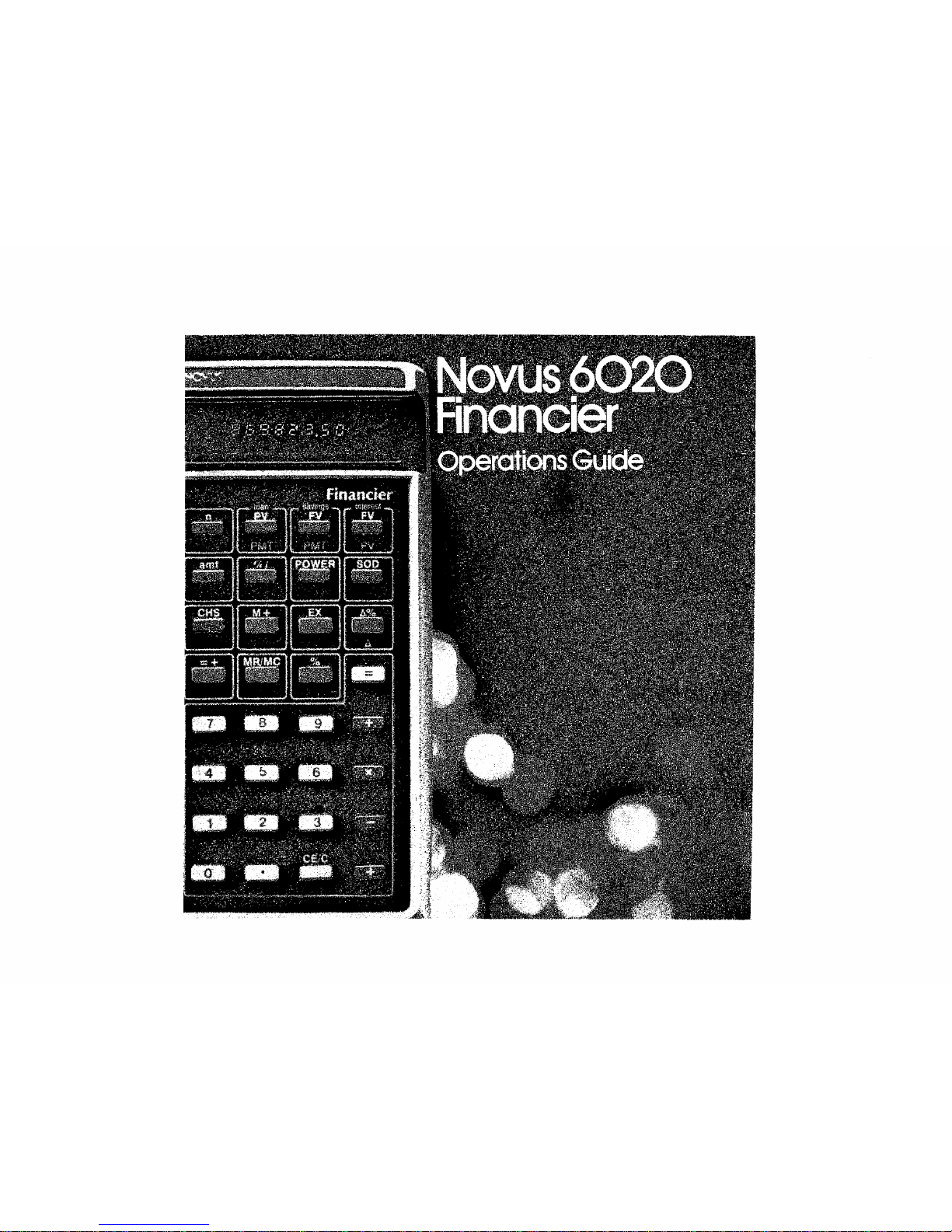

Getting Started

Turn your Novus Financier

on

with the switch on the

Ieft side of the calculator. The calculator

is

auto-

matically cleared and the display should now show

O.

If

it

does not, check to see if the batteries are

properly connected. Battery

Installation

Your Novus Financier is powered by a9-volt transistor

battery which should give you about two months

of operation with normal

use,

The Financier will show

adecimal point

on

the extreme left side of the display

as

alow-battery indicator, Although calculations can

still

be

made while the low-battery indicator

is

on,

the battery should be replaced

as

soon

as

possible.

Continued

use

on

aweak battery may result

in

inac-

curate answers,

To

change batteries, turn the machine

over, place asmall coin

in

the slot at the top of the

battery door and gently

pUll

toward you. The battery

door will slip out.

BE

SURE

THE

CALCULATOR

IS

TURNED

OFF

BEFORE REPLACING

THE

BATTERY,

Slip the bottom of the battery door back

in

place and

squeezing gently on the two prongs on the door,

snap it back in place.

2

AC

Adaptor

You can use your Financier

on

regular AC current by

connecting the Novus AC adaptor to the jack at the

top of the machine.

BE

SURE

YOUR

CALCULATOR

IS

TURNED

OFF

BEFORE

CONNECTING

THE

ADAPTOR,

Operation

Display,

Overflow

and

Error

Indication

The Novus Financier will accept and display any

positive or negative number between 0.0000001 and

99999999. Any result larger than 99999999 or smaller

than -99999999 or any logic error

(Le.

division by

zero) will result

in

an

error indicated by

all

zeros and

all decimal points showing

in

the display. Touching

I

CE/C

Iwill clear the error irtdication permitting-

further calculations.

Automatic Display

Shutoff

To

save battery life, the Novus Financier will shut off

the display and show

all

decimal points if

no

key

has been touched for apprOXimately 25 seconds, No

data has been changed and further entries or opera-

tions will bring back the display,

To

restore the display

without changing its cOrttents, touch I

CHS

Itwice.

I

EX

IExchanges the number

in

the display with

the number last

in

the display.

ICE/C ITouched before afunction key, one touch

of

ICE/cl

clears the iast number entry,

and enables you to continue calculations;

two touches of tCE/CI clears everythirtg

but memory, Touched after afunction

key,

orte touch ofICE/C Iclears everything

but memory,

I

CHS

IChanges the sigrt of rtumber in the display.

Negative Numbers

To

enter anegative number, key

in

the desired

number and touch I

CHS

I,