14.25

03/12/2015

TU2 .01.19

T–Mobile UK

GPRS

GPRS

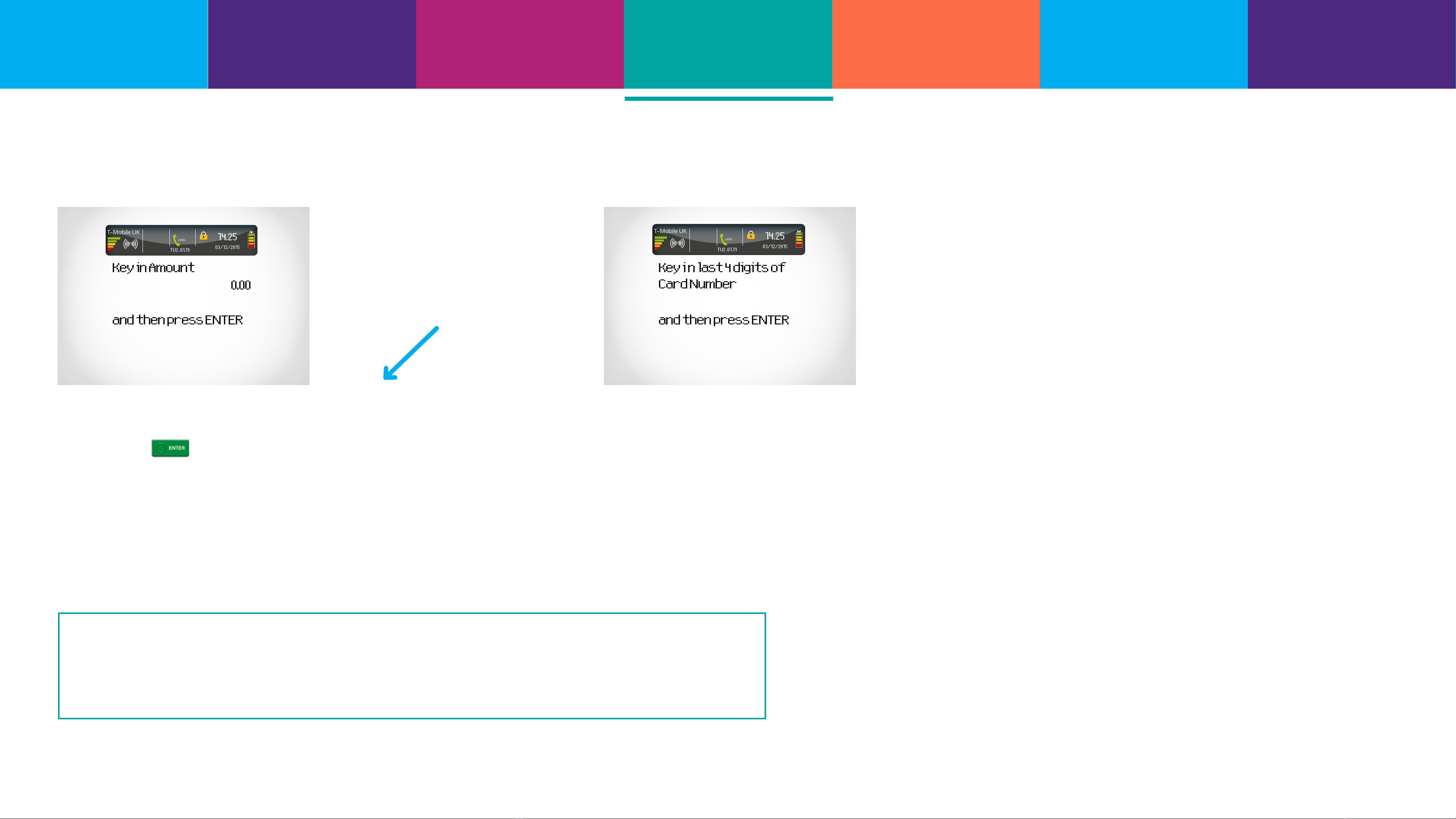

KeyinAmount

0.00

andthenpressENTER

14.25

03/12/2015

TU2 .01.19

T–Mobile UK

GPRS

GPRS

Amount 55.00

Cardholderto key PIN

PIN ****

Enter=OK Clear=REKEY

14.25

03/12/2015

TU2 .01.19

T–Mobile UK

GPRS

GPRS

14.25

03/12/2015

TU2 .01.19

T–Mobile UK

GPRS

GPRS

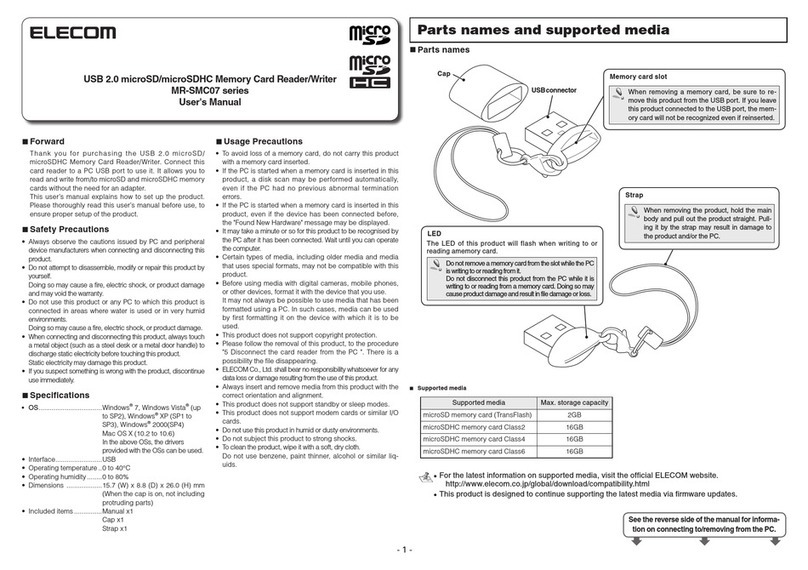

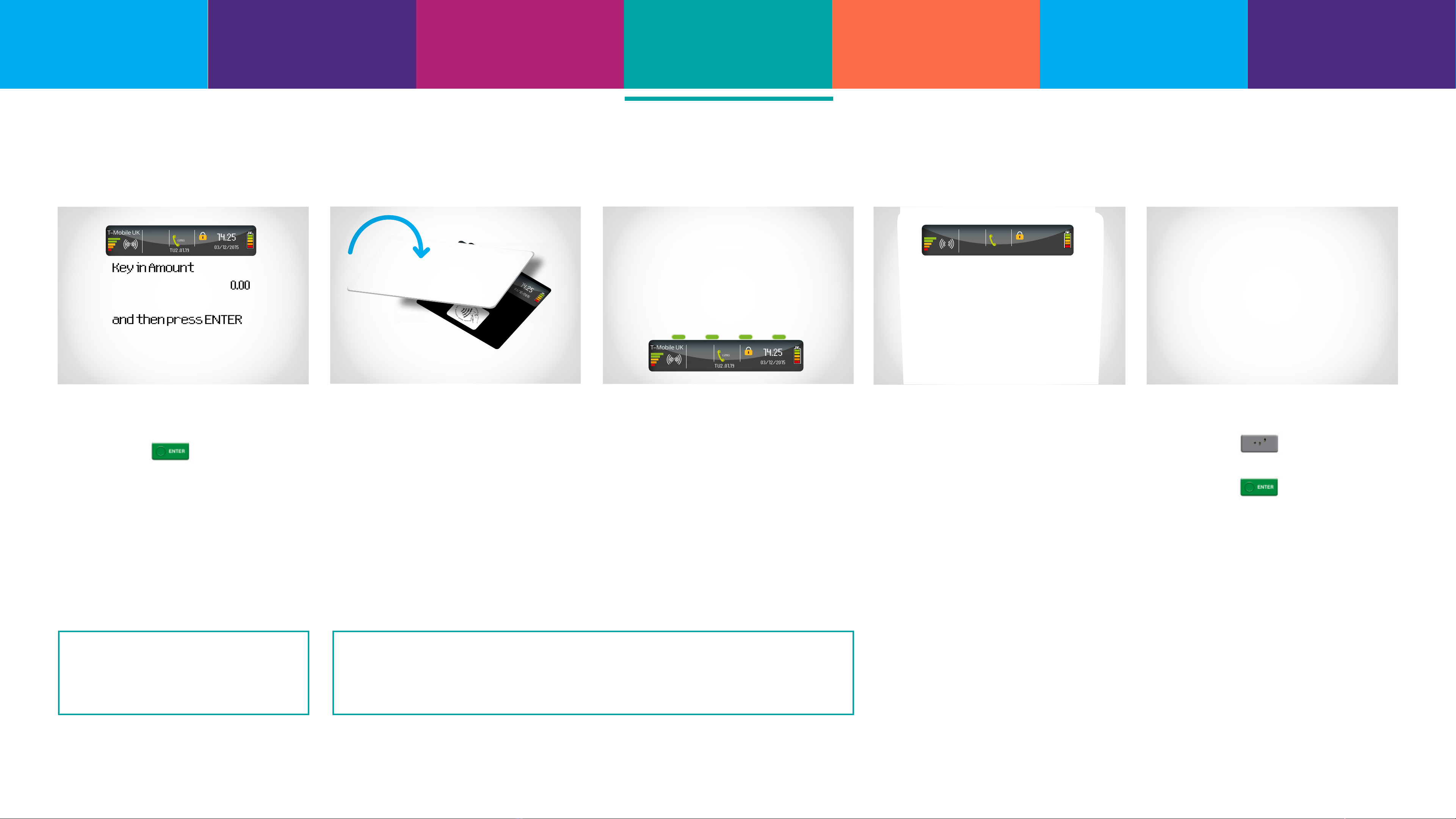

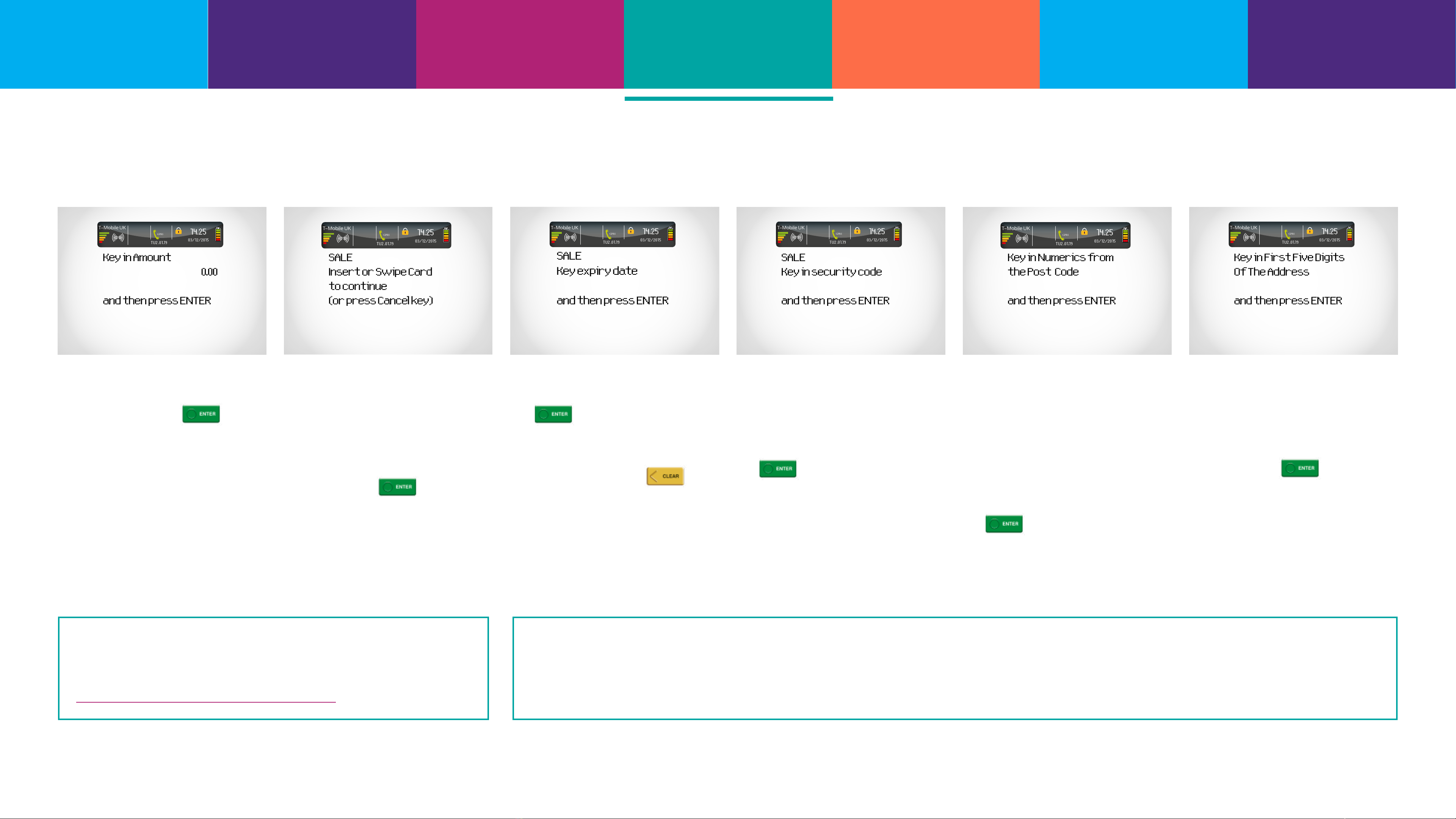

Chip and PIN payments

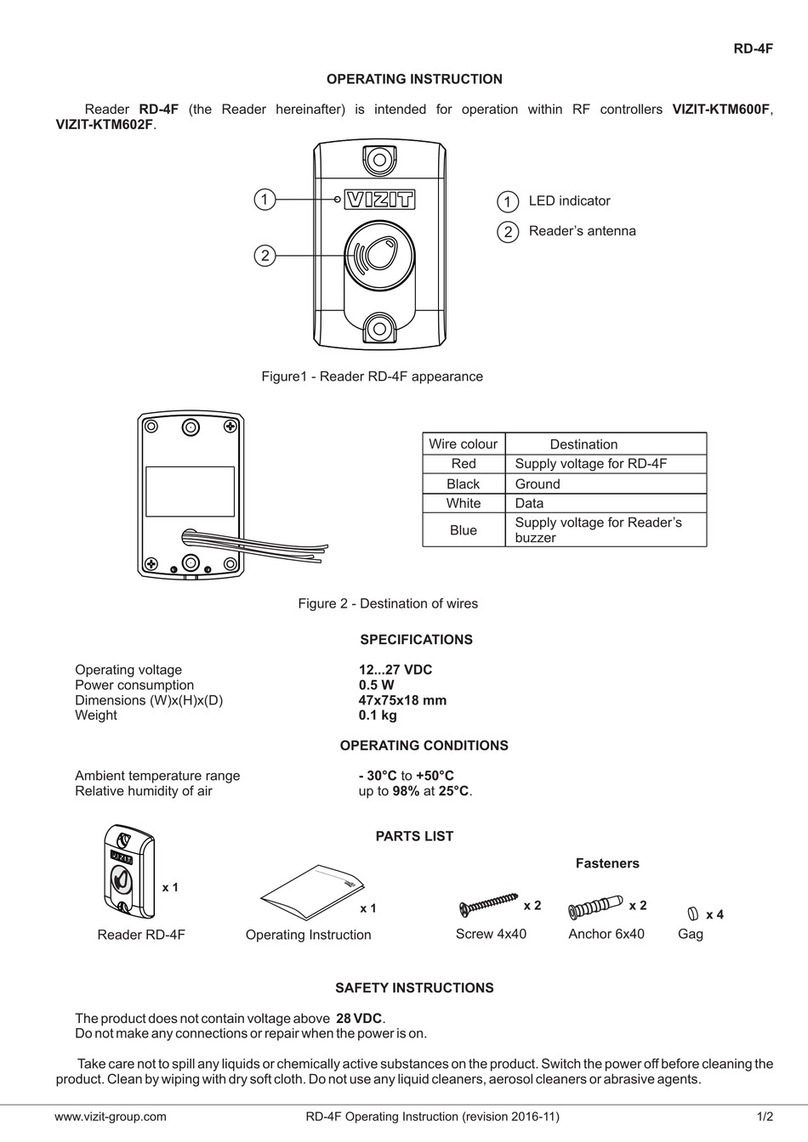

1At the ‘ready’ prompt, key in the

amount.

Press the button.

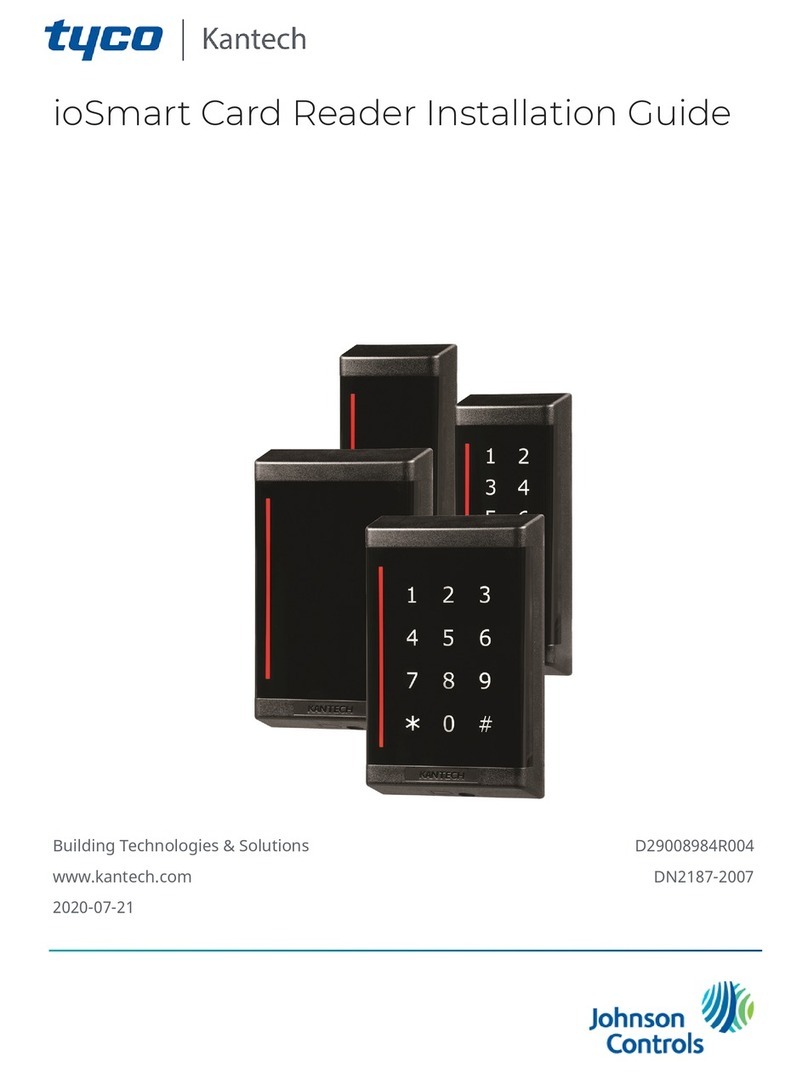

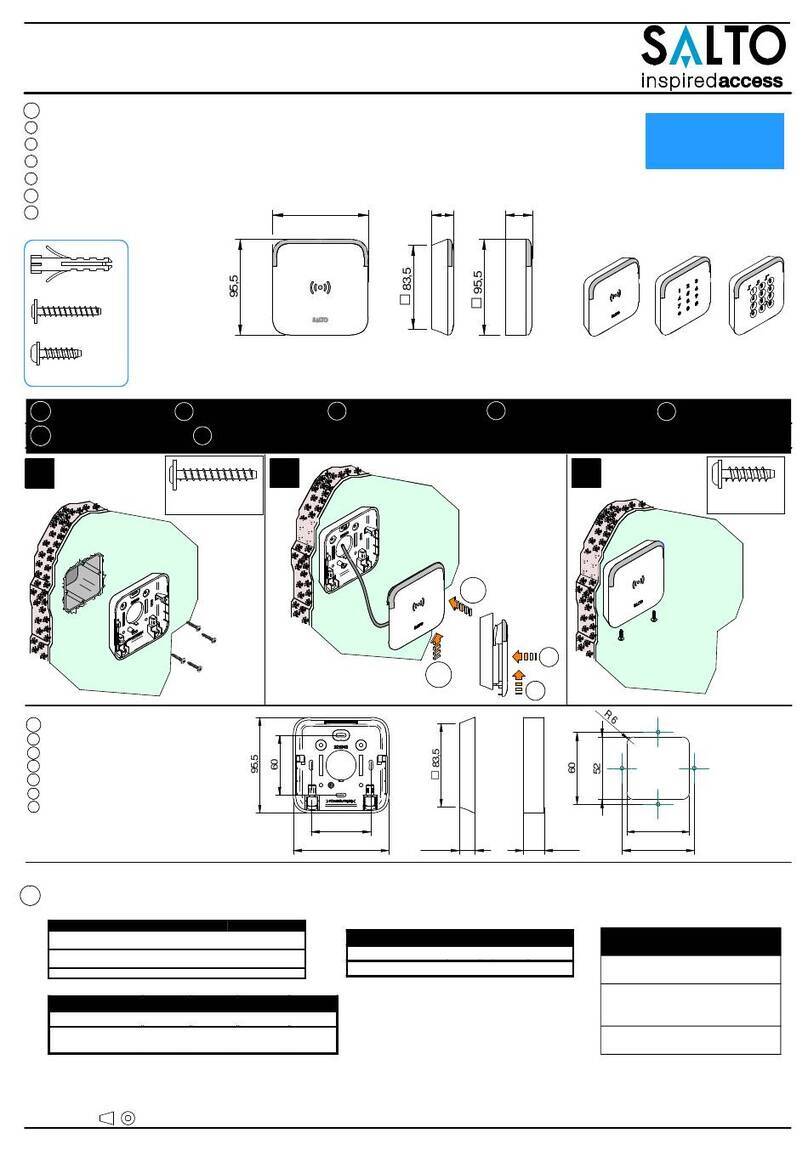

2 Ask your customer to insert

their card into the card reader.

3 Ask your customer to enter their

PIN and confirm by pressing the

button.

4 Your card machine will contact

Barclaycard to request

authorisation for the sale. If

the sale does not go through,

then it will display a warning

message, otherwise it will

continue to print the receipts.

6

5 Follow the instructions on

screen and your card machine

will print two receipts, one for

you to give to your customer,

labelled ‘customer copy’, and a

second for you to keep for your

records, labelled

‘merchant copy’.

Sale

Connectingto

Barclaycard

If you have waiter features set up, then you’ll see ‘waiter ID’ on screen.

Key in the relevant waiter ID before pressing enter. Learn about waiter

features by clicking the ‘Waiters’ tab in the navigation bar.

If your card machine is set up to take gratuities (or tips) then it will oer your customer the chance to add

one. They can decline by pressing the clear button or add a tip by pressing the enter button. They should

then key in the amount and press the enter button to move on.

Contact

information Contents Essentials Taking a

payment Waiters Troubleshooting Important

information