EMV Chip echnology and Contactless Payments

WHA IS EMV CHIP ECHNOLOGY?

(EMV) Europay, MasterCard, Visa is a global standard for interoperability between chip based payment

applications and acceptance terminals for secure credit and debit payments. All EMV cards (smartcards) are the

same size and thickness as magstripe cards and are embedded with a micro computer chip that stores information

required to authenticate, authorize, and process transactions, increasing security and reducing fraud. When the

card is inserted into a POS terminal a metal contact in the reader provides power to the microchip and then both

devices are able to communicate.

CON AC PAYMEN S

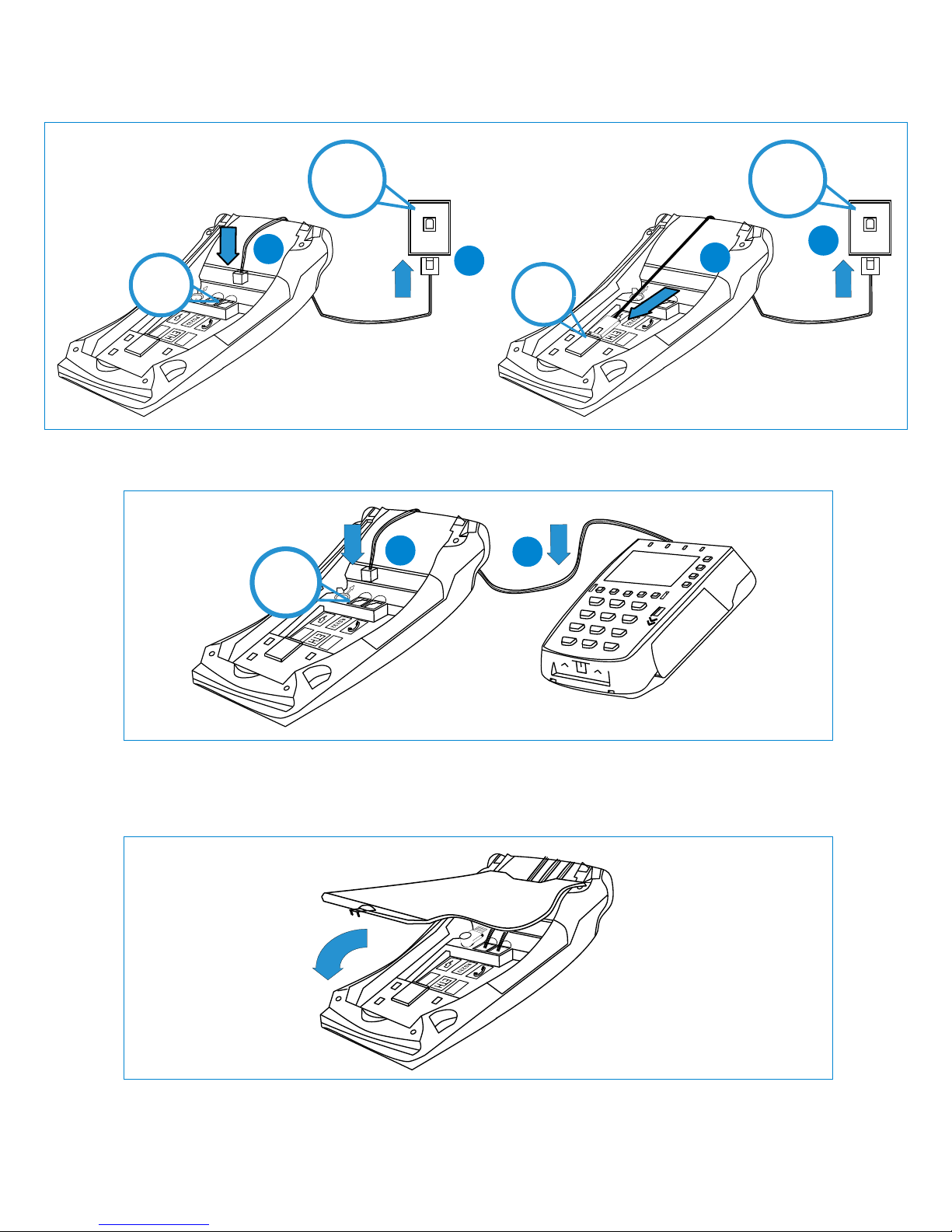

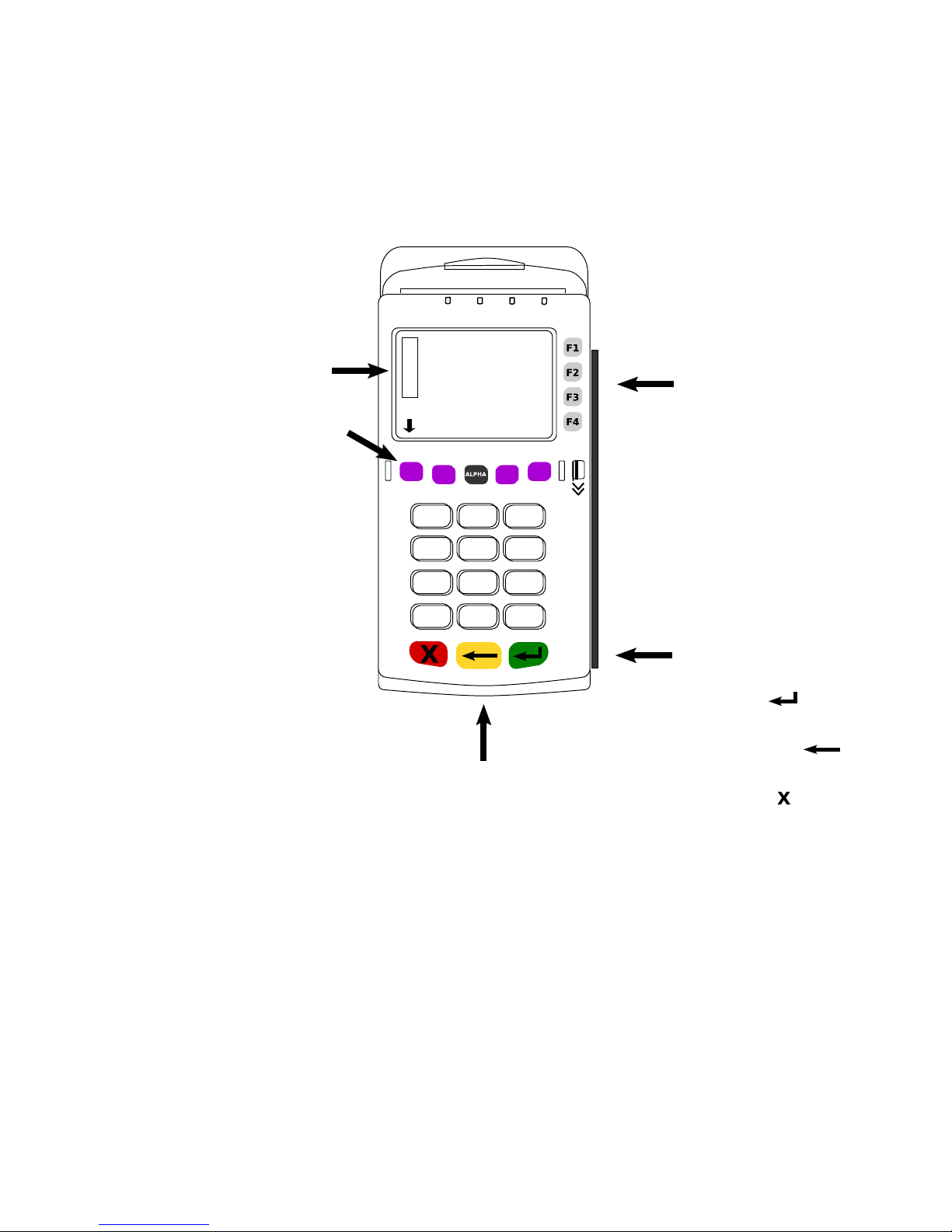

Your Verifone terminal supports smartcard contact payments. When a customer presents a smartcard you should

initiate a sale and then pass the terminal to the customer (where practical, or if you do not have an attached PI

pad). The customer should insert their card into the chip reader at the bottom of the terminal where it will remain

until the transaction is complete. Your terminal will instruct the customer when to remove their card.

CON AC LESS PAYMEN S

Your Verifone terminal may also support contactless payments. Some customers may present a dual interface card

(a card capable of both contact and contactless transactions), a fob, or may want to use their mobile phone to pay.

You should initiate a sale and them pass the terminal to the customer, when the contactless symbol is displayed

the customer will tap or hold their contactless device above the display, your terminal will process the transaction

the same as if a card were inserted. In most cases a separate PI pad may be attached to your terminal allowing

your customers to complete contact or contactless transactions with a customer facing device.

CUS OMER VERIFICA ION ME HODS

Depending on the card, customer identity verification is completed with either a customer signature on the receipt

or by the customer entering a PI number. Your terminal will recognize the card and prompt you and the customer

to follow the required verification process.

FORGO EN PINS

If a customer has forgotten their PI , instruct them to contact their card-issuing bank to have their PI reset. You

should ask for another payment method to complete the sale.

RESOLVING LOCKED PINS

If the wrong PI has been entered too many times in a row the PI will lock and render the card temporarily

unusable. Your terminal display will inform you whether the transaction can be completed using a signature or if

the customers needs to provide a different method of payment. Instruct the customer to contact their card-issuing

bank to unlock the PI .

MAGNE IC S RIPE CARDS

You can continue to accept cards that do not have an embedded micro chip (magnetic stripe only). All smartcards

will also be embedded with a magnetic stripe to meet international requirements as well as fall back for some cards

where the chip has malfunctioned and a swipe of the card is allowed.

6