Contents 9

Error 4: Memory.......................................................................................... 182

Error 5: Compound Interest........................................................................ 182

Error 6: Storage Registers.......................................................................... 183

Error 7: IRR ................................................................................................ 183

Error 8: Calendar ........................................................................................ 184

Error 9: Service........................................................................................... 184

Pr Error ....................................................................................................... 184

Appendix E: Formulas Used ............................................................ 185

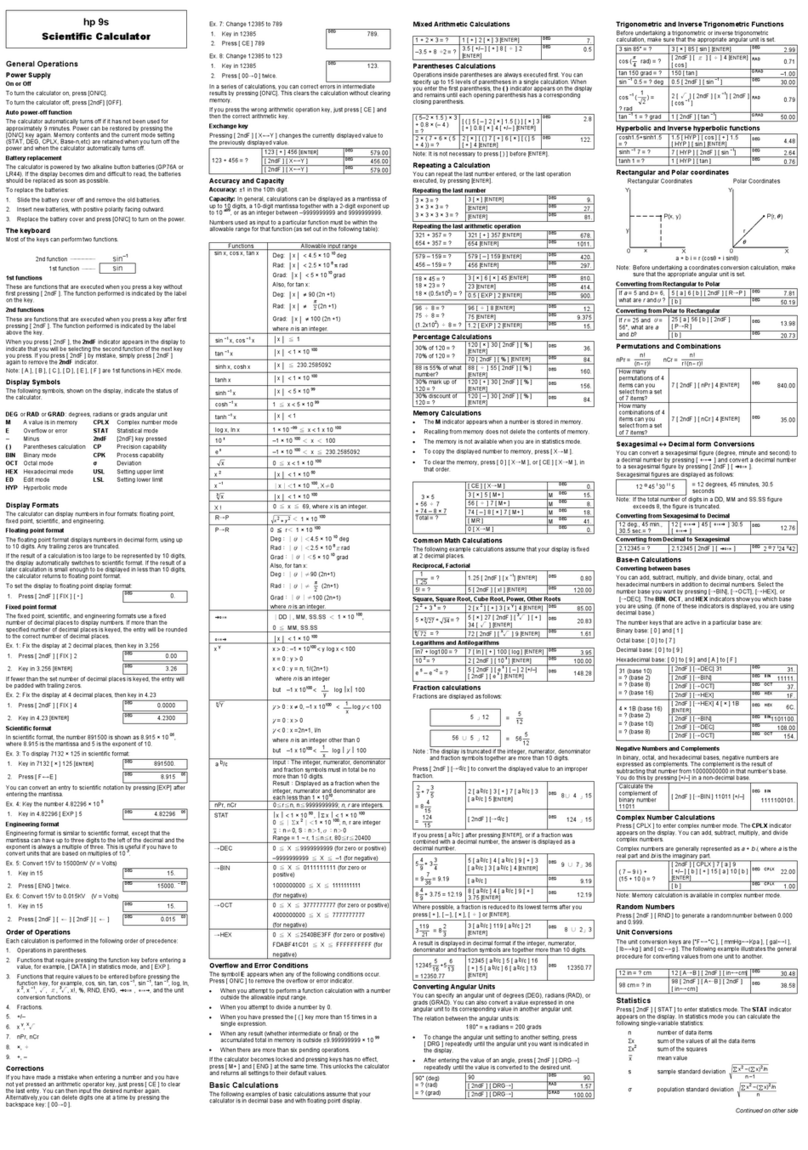

Percentage ................................................................................................. 185

Interest........................................................................................................ 185

Simple Interest...................................................................................... 185

Compound Interest............................................................................... 185

Amortization................................................................................................ 186

Discounted Cash Flow Analysis ................................................................. 187

Net Present Value ................................................................................ 187

Internal Rate of Return ......................................................................... 187

Calendar..................................................................................................... 187

Actual Day Basis .................................................................................. 187

30/360 Day Basis ................................................................................. 188

Bonds ......................................................................................................... 188

Depreciation ............................................................................................... 189

Straight-Line Depreciation .................................................................... 189

Sum-of-the-Years-Digits Depreciation.................................................. 190

Declining-Balance Depreciation ........................................................... 190

Modified Internal Rate of Return................................................................. 190

Advance Payments..................................................................................... 191

Interest Rate Conversions .......................................................................... 191

Finite Compounding ............................................................................. 191

Continuous Compounding.................................................................... 191

Statistics ..................................................................................................... 191

Mean..................................................................................................... 191

Weighted Mean .................................................................................... 192

Linear Estimation.................................................................................. 192

Standard Deviation............................................................................... 192

Factorial................................................................................................ 192

The Rent or Buy Decision........................................................................... 193

Appendix F: Battery, Warranty, and Service Information ........ 195

Battery ........................................................................................................ 195

Low-Power Indication ................................................................................. 195

Installing a New Battery........................................................................ 195

Verifying Proper Operation (Self-Tests) ..................................................... 196

Warranty ..................................................................................................... 198

Service........................................................................................................ 200

Potential For Radio/Television Interference (for U.S.A. Only) .................... 201

Temperature Specifications........................................................................ 201

Noise Declaration ....................................................................................... 201

Regulation applying to The Netherlands .................................................... 202