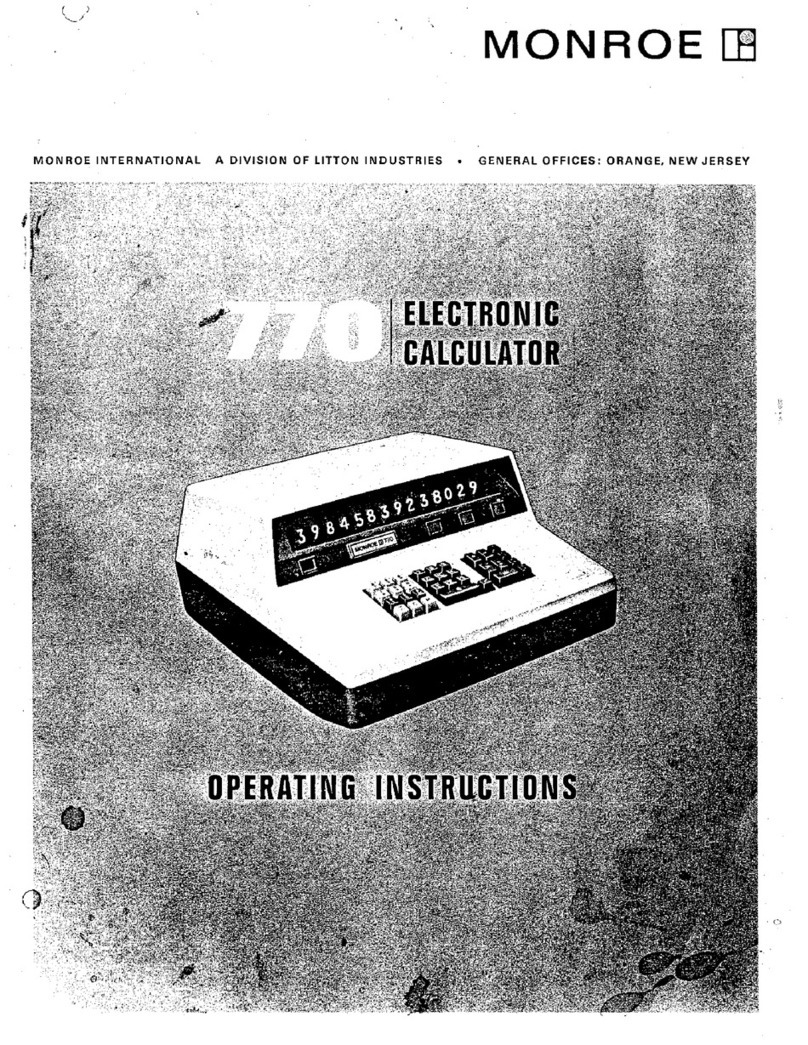

Monroe Trader III User manual

Other Monroe Calculator manuals

Monroe

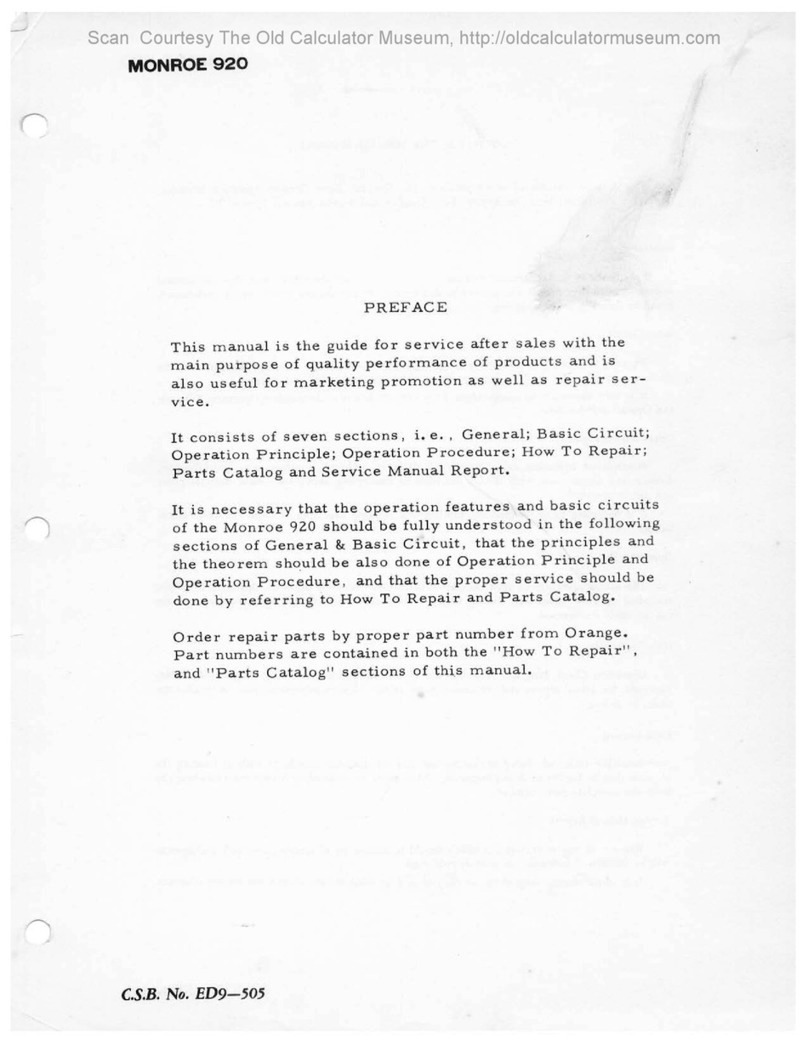

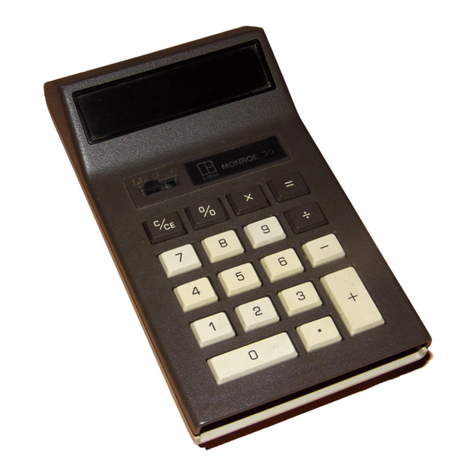

Monroe 920 User manual

Monroe

Monroe 1920 User manual

Monroe

Monroe Ultimate User manual

Monroe

Monroe 30 User manual

Monroe

Monroe SB612 User manual

Monroe

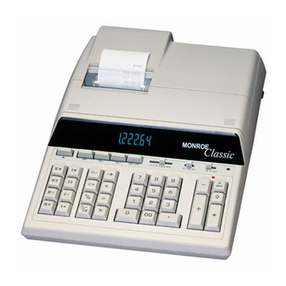

Monroe Classic User manual

Monroe

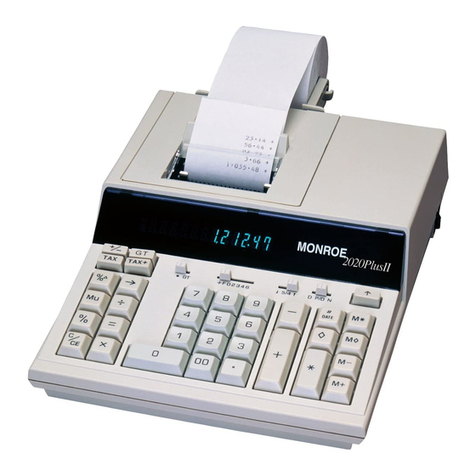

Monroe 2020Plus II User manual

Monroe

Monroe 1930 User manual

Monroe

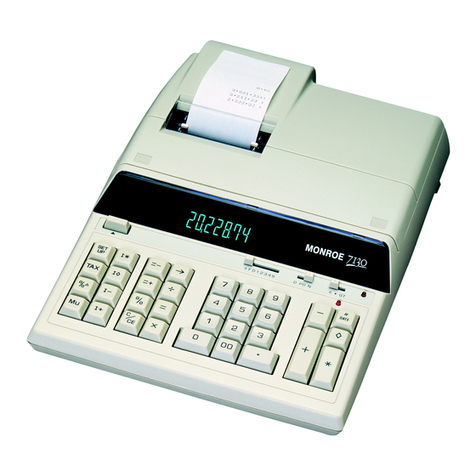

Monroe 7130 User manual

Monroe

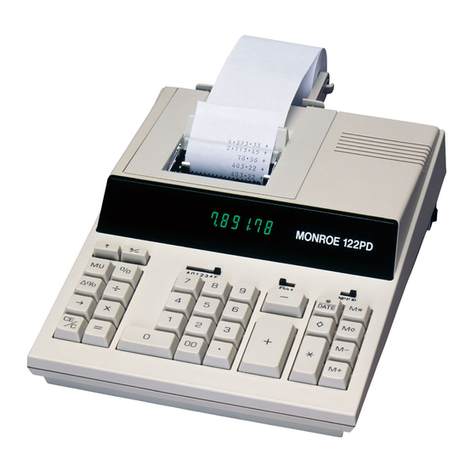

Monroe 122PD II User manual

Monroe

Monroe 2020PlusX User manual

Monroe

Monroe Pro User manual

Monroe

Monroe 122PDX User manual

Monroe

Monroe 3180 User manual

Monroe

Monroe 8125 User manual

Monroe

Monroe 8130X User manual

Monroe

Monroe 20 User manual

Monroe

Monroe 6120 User manual

Monroe

Monroe 3180 User manual

Monroe

Monroe Hand Operated LN User manual

Popular Calculator manuals by other brands

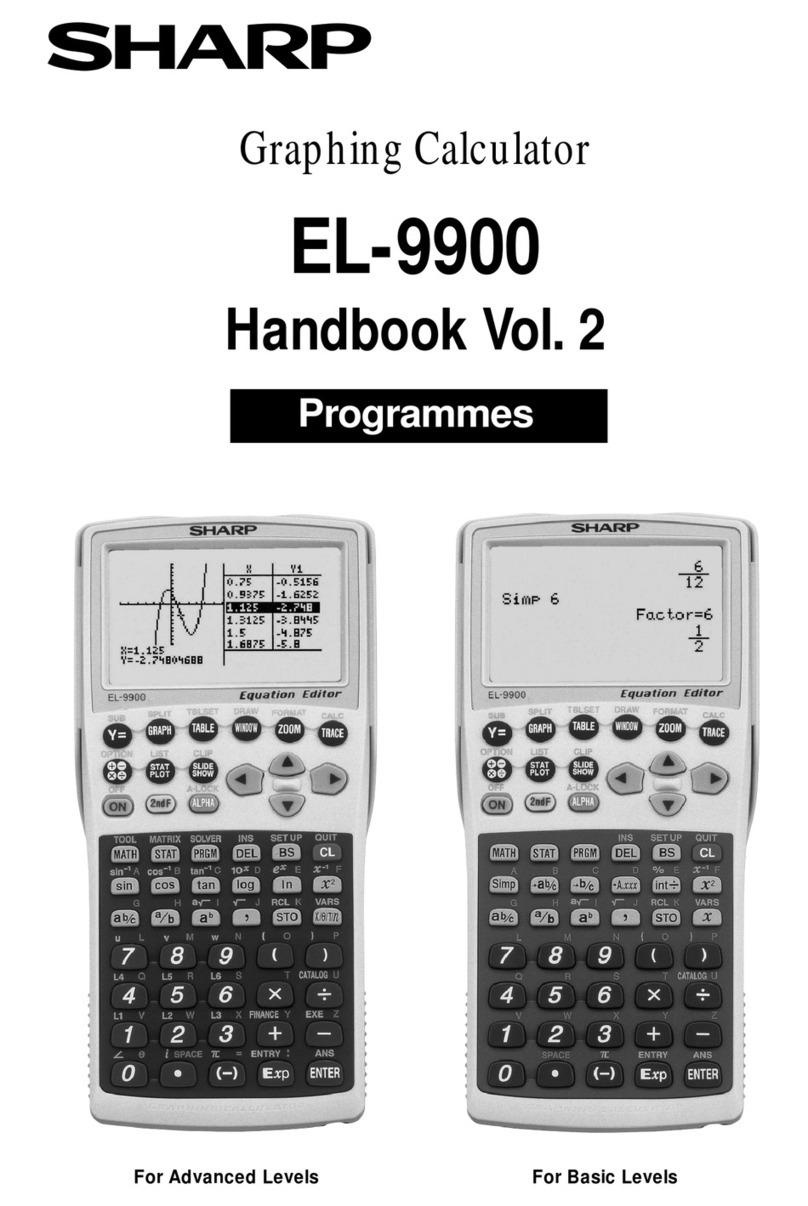

Texas Instruments

Texas Instruments BA II Plus user guide

Kompernass

Kompernass KH 2283 instruction manual

Helwett Packard

Helwett Packard 9100A Operating and programming manual

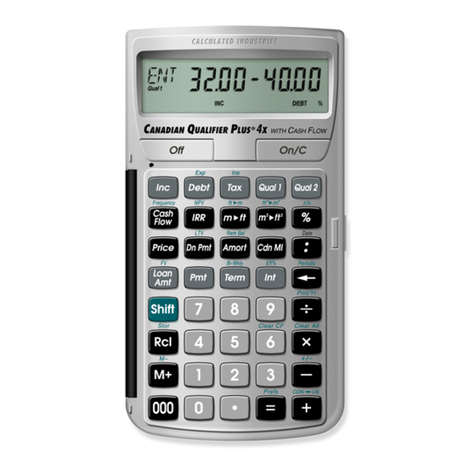

Calculated Industries

Calculated Industries 3423 user guide

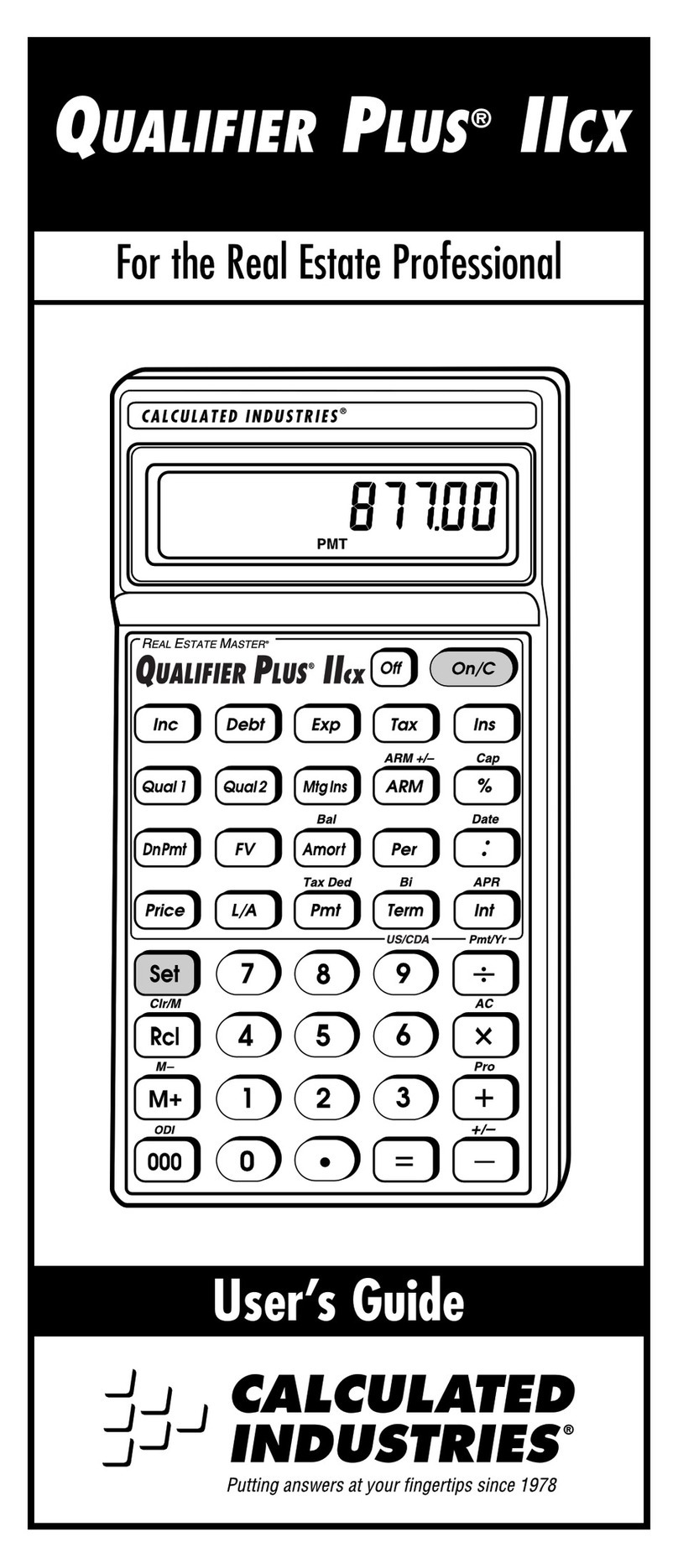

Calculated Industries

Calculated Industries Qualifier Plus IIcx user guide

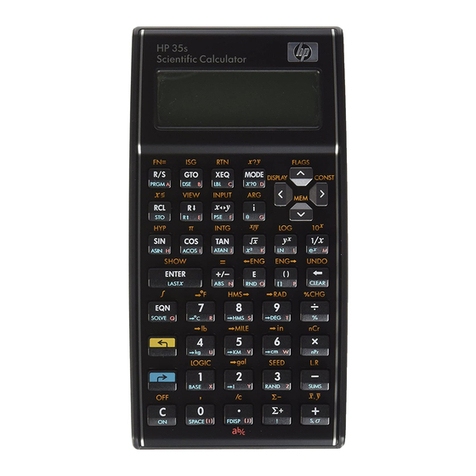

HP

HP 35s Instruction guide