SIX yomani AUTONOM User manual

User guide

yomani AUTONOM

yomani COMPACT

yomani PINPAD

22

1 Security requirements 3

1.1 Electromagnetic compatibility 3

1.2 Where wireless technologies are used 3

2 Product info 5

2.1 Customer terminal 5

2.2 Cash register terminal (yomani AUTONOM) 6

2.3 Abbreviations/Information 7

2.4 Payment procedure with ep2 8

2.5 Technical information 8

3 Start-up 9

3.1 Installation 9

3.2 Conguration/Initialization 10

4 Menu tree (illustration) 11

4.1 Main menu 11

4.2 Transactions 12

5 Transactions 13

5.1 Purchase 13

5.2 Purchaseauthorizedperphone 18

5.3 Cancellation 19

5.4 Credit 20

5.5 Additional transactions 21

6 Balances 22

6.1 Start user shift/end user shift, daily closing, data transmission 22

7 Queries (totals), settings 23

8 Setup 24

9 Maintenance and handling 25

9.1 Identifying and solving errors 25

9.2 Changing the paper roll 26

Table of contents

3

1 Security requirements

1.1 Electromagnetic compatibility

When connecting additional or other compo-

nents the “Electromagnetic Compatibility Direc-

tive” (EMC) must be adhered to.

Hearing aids

Under certain circumstances, terminals can

cause some hearing aids to malfunction. Con-

tact the dealer/manufacturer of your hearing aid.

Other medical equipment

If you use a medical device, please contact the

manufacturer to determine whether it is suf-

ciently protected against electromagnetic

waves. If necessary, your attending physician

could be helpful in obtaining this information.

Equipment is often used in hospitals, medical

ofcesandotherfacilitieswhichishighlysensi-

tive to external electromagnetic waves. Do not

use the terminal in such locations.

Aeroplanes

To avoid interfering with the communication

systems, do not use the terminal during the

ight.Onlyactivatetheterminalontheground

with permission from the ground personnel.

Potentially explosive areas

Do not use the terminal in explosive zones or

areas bearing signs with “Switch off sending/

receiving devices”. Do not use the terminal in

such potentially explosive locations.

Appropriately marked locations

Follow instructions and do not use the terminal

in locations with obvious signs and instructions

prohibiting such use.

While driving

Radio frequencies can interfere with electronic

systems in vehicles, such as car radios or secu-

rity devices, etc.

Vehicles equipped with airbags

An enormous force is released when airbags are

activated. Therefore, do not place the terminal in

the area above the airbag or in the space in which

the airbag could deploy. Terminals that are

improperly installed can cause serious injury

upon deployment of an airbag.

Electronic devices

Most morn electronic devices, such as those

used in hospitals and vehicles, are protected

against radio frequencies. However, this is not

the case with all electronic devices. Do not use

your terminal in the proximity of medical equip-

ment without obtaining prior permission.

Heart pacemaker/other medical devices

Terminals can affect the functioning of implanted

heart pacemakers and other medically implanted

devices. Patients with a heart pacemaker should

be informed that the use of terminals in the

immediate vicinity of a pacemaker can lead to

malfunctions. Do not pass the terminal over the

pacemaker. The risk of a malfunction however, is

minor if a minimum distance of 15 cm between

the terminal and the pacemaker is maintained. If

you suspect that malfunctions are occurring, put

the terminal aside. If necessary, consult your car-

diologist. If other medical devices are used in or

on the body, then the equipment manufacturer

should be consulted as to whether such devices

aresufcientlyprotectedagainstradiofrequency

signals. Do not use the terminal where the devices

are implanted.

1.2 Where wireless technologies are used

4

Every effort has been made to ensure that the information in

this document is complete and exact at the date of printing.

Further developments in the eld of electronic payment trafc

and technological progress could result in changes that might

deviate from the description in this user guide.

Consequently, SIX Payment Services Ltd accepts no responsi-

bility for the information provided in the operating instructions

being current, complete or correct. Furthermore, to the extent

permitted under the relevant legal provisions, SIXPayment

Services Ltd accepts no responsibility in connection with the

operating instructions.

The menu navigation on the terminal has been designed to

be self-explanatory, making this document necessary only in

case of emergency.

The latest version of the user guide, together with any updates,

can be found on our homepage at:

www.six-payment-services.com

5

2 Product info

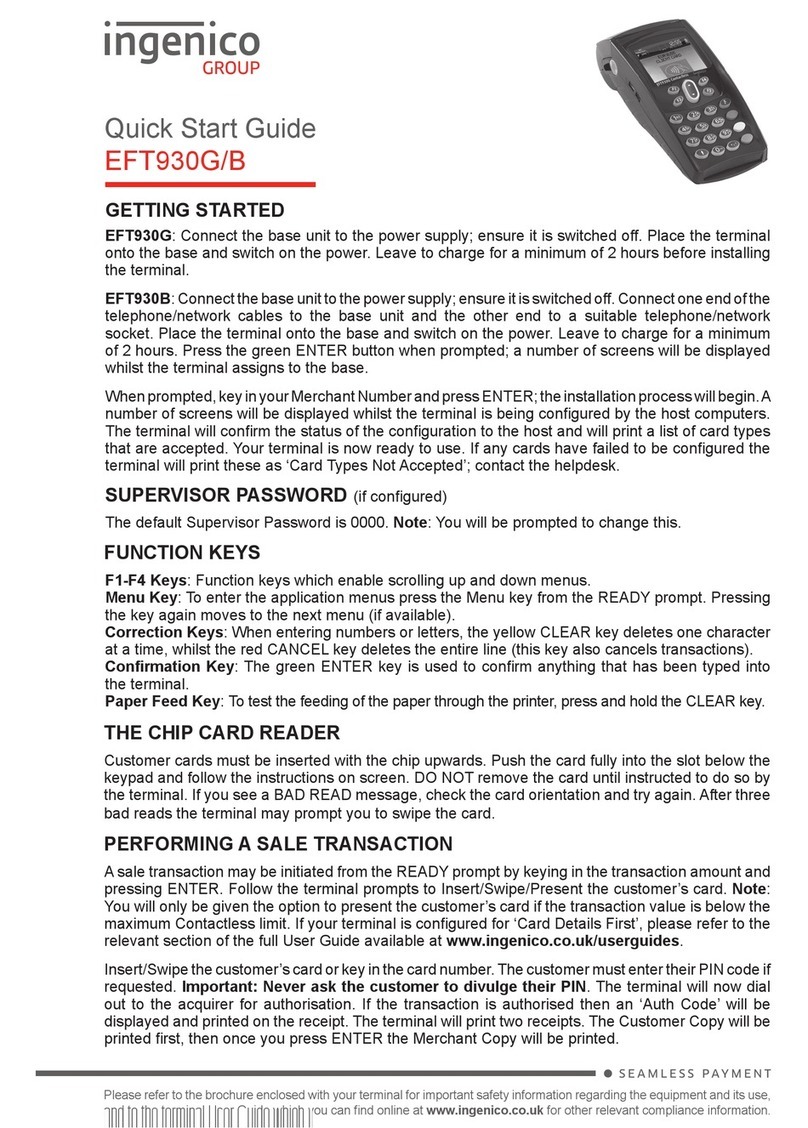

2.1 Customer terminal

Thermal printer (yomani COMPACT only)

Chip reader

For chip cards.

Magnetic strip reader

For cards with magnetic strips.

Display

The next step to be taken is always shown on

the display.

Navigation buttons

You can use these three buttons to navigate

throughthemenu(up/down/conrm).

<OK> button

Allentriesmustbeconrmedusingthe<OK>

button.

<CORR> button

Incorrect entries can be corrected using the

<CORR>button.

<STOP> button

Active procedures can be stopped using this

button.

Contactless reader (RFID)

For contactless paying.

6

2.2 Cash register terminal (yomani AUTONOM)

Thermal printer

Screen

The next step to be taken is always shown on

the screen.

Navigation buttons

You can use these buttons to move up and down

in the menu.

<STOP> button

Active procedures can be stopped using this

button.

<CORR> button

Incorrect entries can be corrected using the

<CORR>button.

<OK> button

Allentriesmustbeconrmedusingthe<OK>

button.

7

Cards with a chip Cards which store the information needed for electronic payment on a chip

must be inserted in a chip reader, depending on the terminal model. If the

terminal is equipped with a motor reader, then the card is automatically

drawn in and read.

Cards with a

contactless chip

Cards that have a chip featuring a contactless function can be held up to

contactless readers to speed up the payment process.

Cards with a

magnetic stripe

Cards which store the information needed for electronic payment on a mag-

netic stripe must be pulled through the swipe reader, depending on the

terminal model. If the terminal is equipped with a motor reader, then the

card is automatically drawn in and read.

CC Computer center

CCC Credit card company

CLP Contactless payment

CrC Credit cards

CVC/CVV

CardVericationCode/CardVericationValuenumberusedtoidentifythecard.

DCC Dynamic Currency Conversion. Foreign cardholders can pay in their domestic

currency.

EFT/POS Electronic Funds Transfer at the Point Of Sale

EMV GlobalspecicationsfromEurocard,MasterCardandVisabasedonachip

card.

ep2 <EFT/POS2000>,SwissstandardbasedontheEMVstandardinelectronic

paymenttrafc.

GPRS

General Packet Radio Service (GPRS) is a packet-oriented transmission

servicethatisusedintheeldofmobiletelephonesystems.

GSM Global Standard for Mobile Communications

Online transaction An online transaction is always directly authorised at the CCC.

Ofinetransaction Anofinetransactionisauthorisedininterdependencewiththecardand

terminal risk management (e.g. if the amount of the previous transactions is

lessthanthecardlimitoriftheamountislessthantheterminaloorlimit

on the card, etc.).

PF PostFinance(Switzerland)

PIN PersonalIdenticationNumber

PIN-based

transaction

For a PIN-based transaction, the customer must enter his/her PIN at the

point of sale during the payment process.

PW Password

PUK PersonalUnblockingKey

RFID radio-frequencyidentication

SPS SIX Payment Services Ltd

TIP Tip

Trm Terminal

Trx Transaction

WLAN A Wireless Local Area Network is a “wireless” local radio network, which

generallyreferstoastandardwithintheIEEE802.11family.

2.3 Abbreviations/Information

8

The payment process at the point of sale is stan-

dardised for all cards with ep2. A variety of card

types are in circulation today.

Payment functions

ep2 offers a full range of transaction modes and

functions. The transactions activated on your

terminal are determined by the settings in the

service centre as global parameters and by the

individual card processors.

e.g. Tip:

This transaction type is often used in the hotel

and restaurant industry. In the retail business,

however, it is unnecessary.

– Depending on the payment function and

credit card processor, different minimum/

maximum amounts, day limits, etc. can be

dened.

– Functions are described in general in the

sections that follow. Please note that

some transaction modes and functions

may be inactive on your terminal.

Caution for ofine transactions!

Ofine transactions are stored in the security

section of your terminal and submitted to the

card processor by means of the daily closing.

This can be carried out manually by the terminal

operator or automatically.

Should the security section of the device be

defective, intentionally damaged or stolen,

the transactions that have not been stored

will be lost.

For this reason, we recommend that you:

– Meticulously retain all sales slips.

– Carry out a daily closing every day or more

often.

– Always carry out a daily closing before

making installation changes, etc.

– Always carry out a daily closing for antici-

pated longer absences from the business.

– A closing must be carried out for seasonal

operations, at the end of the season.

2.4 Payment procedure with ep2

Operating temperature

0°Cto50°C

Humidity (not condensing)

20%to85%

Power supply via power supply unit

100 –250VAC,47– 63Hz

Power supply through USB

(except for yomani XR)

5V,500mA

Storage

–20°Cto70°C

2.5 Technical information

9

3 Start-up

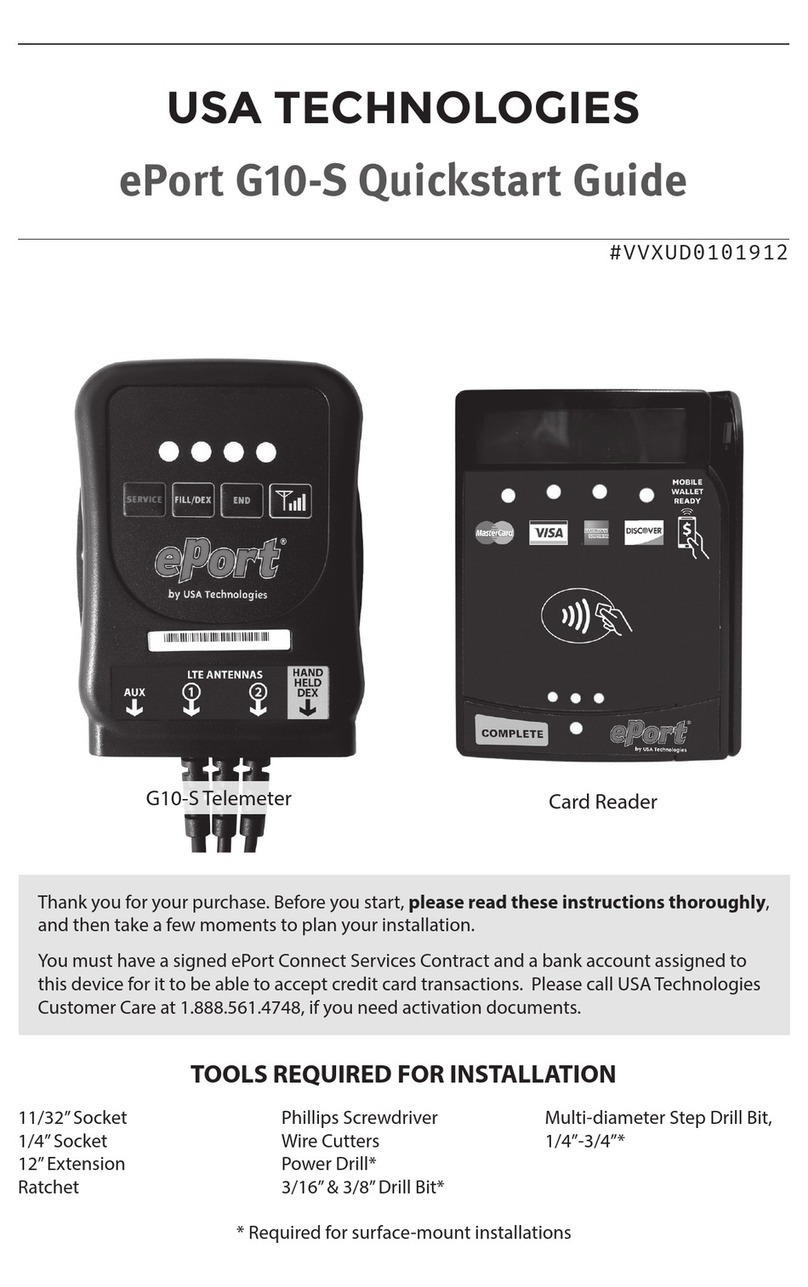

3.1 Installation

– Position the device at its intended location

– Connect the device.

Always plug in the power supply last!

– Cable:

!Only the original cables delivered with the

product should be used.

The terminal starts up und reports with an acous-

tic signal when it is ready to operate.

Customer terminal

Cash register terminal (yomani AUTONOM)

Completed installation

Port for NFC antenna

(for contactless paying)

Serial RS-232 port

USB port

yomani XR PINPAD and COMPACT only

Ethernet/LAN port

Cable guides

Power supply port

Customer terminal port

10

First initialisation

The yomani will generally already have been

commissioned by the SIX production facility.

Additional instructions are provided to you in the

“Congurationinstructionsforyomani”delivered

along with the terminal.

Subsequent initialisation

Should it be necessary to re-initialise a device

for any reason, proceed as outlined on page 24.

3.2 Conguration/Initialization

Key

The following symbols are used in the descrip-

tions in this document.

..............

Function selection by choosing the corresponding number or using the

cursorandthe<OK>button.

Insert card.

Depending on the card type, it must be inserted in the chip card reader,

held up to the contactless reader or pulled through the magnetic swipe

reader.

Remove card.

Sales slip printout.

Request the customer’s signature.

Processing and/or communication.

Manual entry of the card data.

Press function button.

11

Main menu

Toenterthemenutreebelow,pressthe<STOP>button.

▲ Access only with your password. You can nd this on the

conguration sheet delivered with your terminal.

4 Menu tree (illustration)

4.1 Main menu

■Access only for service technicians.

* This function may not be activated depending on the CCC.

Balances

<1> Begin shift

<2> End user shift

<3> Daily closing

<4> Transmit. trx data

Queries

<1> Shift counter

<2> Daily counter

<3> Trx log info

<4> Print DCC rates*

<5> Print last ticket

Settings

<1> Trm lanuage

▲ <4> Service PW

<7> Keypad tones

Setup

<1> Conguration

<2> Initialisation

<3> SW Update

■ <4> Trm reset

<5> Info

<6> Print. cong.

■ <8> Print HW Info

<9> System

<1> Transactions

<2> Balances

<3> Queries

<4> Settings

▲ <5> Setup

12

4.2 Transactions

▲ Access only with your password. You can nd this on the

conguration sheet delivered with your terminal.

Transactions <1> Purchase

<2> Purch. phone auth.

▲<3> Reversal

▲<4> Credit

<5> Reservation

<6> Purchase reserv.

<7> Purchase w. Cashback

<8> Cash advance

<9> Purch. mail order

<10> Other transact. Other transactions

<1> Phone ordered

<2> Purch. forced acc.

<3> Reserv. adjustm.

<4> Conf. Phone auth.

<5> Mobile Voucher

<6> Mobile Coupon

<7> GiftCard/VM

<8> Cancel Reserv.

13

Cashier handling

1. Press “1”. “Purchase” will be activated. 1: Purchase

2.* If the “foreign currency” function is activated on your terminal,

you must select the desired currency.

* Menu only appears if 2 or more currencies are activated.

<Currency>

3. Enter the amount and confirm with <OK>.

The amount must be separated with a decimal point. For amounts below

CHF/EUR 1.00, a zero “0” must be entered first (e.g., CHF/EUR 0.55).

Amount

3a

(DCC)1

If the cardholder prefers to make a transaction in CHF/EUR,

this can be selected with the “CHF/EUR” function button.

4. Proceed with card processing as detailed on pages 16 and 17,

or enter manually as detailed on page 14.

5 Transactions

5.1 Purchase

<1> Purchase

The purchase is the most common transaction

typeinelectronicpaymenttrafc.

– Depending on the CCC, minimum/maximum

amounts, day limits, etc. may vary.

– The “manual recording of card data” and “sub-

sequent cancellation” functions are either acti-

vated or deactivated, depending on the CCC.

– yomani COMPACT: If a transaction is not suc-

cessful, then you will hear three short, acous-

tic signals that repeat every 2 seconds. This

prompts the customer to give the terminal to

the cashier. The reason for the problem is

displayed by pressing on the special signals

function button.

1 This menu item is only shown if DCC is activated. The terminal automatically recognizes if the card is one that is in a DCC-capa-

ble foreign currency and automatically chooses DCC. Otherwise, the transaction will be processed in CHF/EUR. If the cardholder

prefers to make a transaction in CHF/EUR, this can be selected with the “CHF/EUR” function button. As soon as the card has

been read in, CHF/EUR can no longer be selected!

Sample sales slip: Certaineldsmaydifferaccordingtothepurchasetype.

COMPANY EXAMPLE

EXAMPLE STREET 88

1234 EXAMPLE

Purchase

Processing company

XXXX 123456 1234

DD.MM.YYYY HH.MM.SS

Trm-Id: 12345678

Akt-Id: 00000001

AID: A99999999999

Trx. Seq-Nr.: 12345

Trx. Ref-No: 99999999999

Aut. Code: 123456

EPF: ABC123ABC123ABC

Total-EFT CHF: 123.45

Your company data, which will be printed out on

the sales slip.

Transaction date.

Transaction time.

Transaction information for unambiguous identi-

cationofthetransaction.

Amount

14

yomani AUTONOM/yomani COMPACT

1.* If the “foreign currency” function is activated on your terminal, you must

select the desired currency.

* Menu appears only if two or more currencies are activated.

<Currency>

2. Enter the amount and confirm with <OK>.

The amount must be separated with a decimal point.

For amounts below CHF/EUR 1.00, a zero “0.” must be entered first.

Amount

3. Press the “Manual” button for manual recording.

4. Enter the card number and press <OK>. Card number

5. Enter the card expiry date and confirm with <OK>. Expiry date

6. Enter the CVC2 respectively CVV2 and confirm with <OK>.

Tip! For cards without a CVC, press <OK> without entering the CVC.

CVC2/CVV2

if present

7. Payment is recorded and authorised online, if this function is activated.

8. A sales slip is printed out.

The sales slip must be signed by the customer.

9. If a copy is desired →press 1.

If no copy is desired →press 2.

If no button is pressed, the copy will be automatically printed out after

10seconds.

1 : Copy

or

2 : No copy

Cashier: Manual card data entry

Should a credit card be unreadable, the card

data can be entered manually.

To do so, you need the card number, the expiry

date, and for newer cards, the CVC/CVV (Card

VericationCode/CardVericationValue).This

3-digit code is printed on the reverse side of the

card (the last three numbers).

After you have chosen the transaction mode and

conrmedthisbypressing<OK>,manualentry

can be activated using the corresponding func-

tion button.

15

Example:

Credit card

5404 3521 4589 5038

09-09

John Example

Reverse side of card

1234 567

Card number

Expiry date

CVC2/CVV2

yomani PINPAD

1. Enter the transaction on the cash register as usual.

2. On the customer terminal, press the <Corr> and <Menu> buttons in quick succession within half

a second.

3. A request to enter the card details manually will be shown on the yomani screen.

16

Customer handling: Card without PIN

1. The amount is shown.

2. Depending on the card type, it must be inserted in the chip card reader,

held up to the contactless reader or pulled through the magnetic swipe

reader. If the customer uses the wrong reader for his or her card, that

person is instructed to use the proper reader.

2a

(TIP)1

If the TIP function is activated, after the original amount is confirmed,

the option of entering a tip is also offered and confirmed by pressing <OK>.

If the guest does not wish to give a tip, he/she can continue without

entering an amount by pressing <OK>.

Tip:

2b

(DCC)2

The customer chooses whether he or she wants to pay with DCC or in the

local currency.

1. CHF 100.00

33.66RUE.2

Choice?

ex. rate

:1

.463486

3. The amount is shown. Confirm the amount with <OK>.

4. Payment is recorded and authorized online if necessary.

5. Remove the card.

6. The sales slip is printed out.

The sales slip must be signed by the customer.

7. If a copy is desired →press 1.

If no copy is desired →press 2.

If no button is pressed, the copy will be automatically printed out

after 10 seconds.

1 : Copy

or

2 : No copy

1 This menu item is only shown if TIP is activated. This function is only activated for hotels and restaurants by the card organiza-

tions. In addition to the adjustments in the payment procedure, this modification also has an impact upon the payment receipt

and the daily closing printout.

2 This menu item is only shown if DCC is activated. The terminal automatically recognizes if the card is one that is in a DCC-capa-

ble foreign currency and automatically chooses DCC. Otherwise, the transaction will be processed in CHF/EUR. If the cardholder

prefers to make a transaction in CHF/EUR, this can be selected with the “CHF/EUR” function button. As soon as the card has

been read in, CHF/EUR can no longer be selected!

After the cashier enters the amount, the cus-

tomer is prompted by the terminal to use his or

her card.

Depending on the card type, the two following

procedures are possible:

– Customer handling: card without PIN.

– Customer handling: card with PIN (see p. 17).

17

1This menu item is only shown if TIP is activated. This function is only activated for hotels and restaurants by the card organi-

zations. In addition to the adjustments in the payment procedure, this modification also has an impact upon the payment receipt

and the daily closing printout.

2 This menu item is only shown if DCC is activated. The terminal automatically recognizes if the card is one that is in a DCC-capa-

ble foreign currency and automatically chooses DCC. Otherwise, the transaction will be processed in CHF/EUR. If the cardholder

prefers to make a transaction in CHF/EUR, this can be selected with the “CHF/EUR” function button. As soon as the card has

been read in, CHF/EUR can no longer be selected!

3Generally, customers need do nothing further for a contactless payment below CHF 40 (~ EUR 35).

Customer handling: Card with PIN

1. The amount is shown.

2. Depending on the card type, it must be inserted in the chip card reader,

held up to the contactless reader or pulled through the magnetic swipe

reader. If the customer uses the wrong reader for his or her card, that

person is instructed to use the proper reader.

2a

(TIP)1

If the TIP function is activated, after the original amount is confirmed,

the option of entering a tip is also offered and confirmed by pressing <OK>.

If the guest does not wish to give a tip, he/she can continue without

entering an amount by pressing <OK>.

Tip:

2b

(DCC)2

The customer chooses whether he or she wants to pay with DCC or in the

local currency.

1. CHF 100.00

33.66RUE.2

Choice?

ex. rate

:1

.463486

3.

(CLP)3

The total is displayed and the customer is requested to enter the PIN code

(4- to 6-digit) and to confirm with <OK>. If the amount is incorrect, the

transaction can be aborted using <STOP>. Timeout: The process will be

aborted if the processing does not occur within 30 seconds.

<PIN>

4. Payment is recorded and authorized online if necessary.

5. Remove the card.

6. The sales slip is printed out.

The sales slip must be signed by the customer.

7. If a copy is desired →press 1.

If no copy is desired →press 2.

If no button is pressed, the copy will be automatically printed out

after 10 seconds.

1 : Copy

or

2 : No copy

18

Cashier handling

1. Press “2”. The “Phone authorized” function is activated. 2: Phone authorized

2.* If the “foreign currency” function is activated on this terminal, then the

desired currency must be select.

* Menu only appears if 2 or more currencies are activated.

<Currency>

3. Enter the amount and confirm with <OK>. The amount must

be separated with a decimal point. For amounts below CHF/EUR 1.00,

a zero “0” must be entered first (e.g., CHF/EUR 0.55).

Amount

3a

(DCC)1

If the cardholder prefers to make a transaction in CHF/EUR,

this can be selected with the “CHF/EUR” function button.

4. Enter the authorization code and confirm with <OK>. Authorization code

5. Card handling according to pages 16 and 17, or page 14 for manual entry.

1 This menu item is only shown if DCC is activated. The terminal automatically recognizes if the card is one that is in a DCC-capa-

ble foreign currency and automatically chooses DCC. Otherwise, the transaction will be processed in CHF/EUR. If the cardholder

prefers to make a transaction in CHF/EUR, this can be selected with the “CHF/EUR” function button. As soon as the card has

been read in, CHF/EUR can no longer be selected!

5.2 Purchase authorized per phone

<2> Phone authorised

This purchase mode is used when the authorisa-

tion cannot be made automatically. The authori-

sation code is issued by a CCC representative by

telephone. With the function “Phone authorised”,

the transaction will be recorded later.

19

<3> Cancellation

The purchase which has just been made can be

cancelled using the “Cancellation” function.

– With some CCC’s this function may not be

activated.

– If a daily closing or shift-end has been carried

out in the meantime, or if the data has been

transmitted, then cancellation is no longer

possible.

5.3 Cancellation

Cashier handling

1. Press “3” to activate the “Cancellation” function. 3: Cancellation

2. Enter the terminal’s password and confirm with <OK>.

(See configuration sheet for the password.)

Password

3. The amount of the last transaction is shown. If the amount of the last

transaction is correct, then confirm this by pressing the <OK> button.

4. Cancellation is recorded and, if necessary, authorised online.

5. A sales slip is printed out.

6. If a copy is desired →press 1.

If no copy is desired →press 2.

If no button is pressed, the copy will be automatically printed out after

10seconds.

1 : Copy

or

2 : No copy

20

Cashier handling

1. Press “4”. “Credit” will be activated. 4 : Credit

2. Enter the password and confirm with <OK>.

(See the configuration sheet for the password)

Password

3.* If the “foreign currency” function is activated on this terminal, then the

desired currency must be selected.

* Menu only appears if 2 or more currencies are activated.

<Currency>

4. Enter the amount and confirm with <OK>. The amount must be separated

with a decimal point. For amounts below CHF/EUR 1.00, a zero “0” must

be entered first (e.g., CHF/EUR 0.55).

Amount

4a

(DCC)

If DCC is activated, then the date of the original transaction must also

be entered.

Orig. Trx date

(YYYYMMDD)

5. The amount is shown and the card requested.

6. Card handling according to pages 16 and 17, or page 14 for

manual entry.

The cashier signs the sales slip!

5.4 Credit

<4> Credit

A purchase that has been made can be corrected

using the “Credit” function. This is used if a can-

cellation is no longer possible.

This manual suits for next models

2

Table of contents

Other SIX Payment Terminal manuals