Sonera PAX S80 User manual

USER GUIDE

Payment terminal PAX S80

USER GUIDE

Payment terminal PAX S80

1. GETTING STARTED

1.1 Important ...............................................................................4

1.2 Terminal structure ...................................................................4

1.3 Connecting the terminal ..........................................................5

1.4 Testing the connection ............................................................6

2. DAILY USE

2.1.1 Changing the paper roll .............................................7

2.1.2 Keypad ....................................................................7

2.1.3 Using the menus .......................................................7

2.2 TRANSACTIONS .....................................................................8

2.2.1 Chip card transactions ..............................................8

2.2.2 Swipe card transaction ..............................................8

2.2.3 Void .........................................................................9

2.2.4 Manual entry ............................................................9

2.2.5 Receipt copy .......................................................... 10

2.2.6 Return ................................................................... 10

2.3 REPORTS AND BATCH SENDING ........................................... 11

2.3.1 Batch report ........................................................... 11

2.3.2 Monthly report ........................................................ 11

2.3.3 Batch sending ........................................................ 11

2.3.4 Blacklist ................................................................. 12

2.3.5 Report explanations ................................................ 13

2.4 AUTHORIZATION CODES ...................................................... 14

3. SETTINGS

3.1 Terminal settings ................................................................... 17

3.2 Printing the parameters ......................................................... 17

3.3 Batch time ............................................................................ 18

3.4 Cashier number .................................................................... 18

3.5 Fixed IP-address ................................................................... 18

3.6 Connection type ................................................................... 19

3.7 Language ............................................................................. 19

3.8 Changing the time and date ................................................... 19

3.9 Sound .................................................................................. 19

4. DOWNLOADS

4.1 Downloading the parameters ................................................. 20

4.2 Downloading the certificate ...................................................20

5. SPECIAL FUNCTIONS

5.1 Cash receipt ......................................................................... 21

5.2 Cash withdraw ......................................................................22

5.3 Extra / Tip ............................................................................. 23

5.4 VAT ......................................................................................24

5.5 Mandatory authorization ........................................................ 24

5.6 Preauthorization....................................................................24

5.7 Invoice .................................................................................25

5.8 Multi cashier ........................................................................ 25

6. ADDITIONAL FUNCTIONS

6.1 Version for multiple users ...................................................... 26

7. TROUBLESHOOTING

7.1 Notifications on the screen .................................................... 27

7.2 Notifications on the receipt .................................................... 27

7.3 Other errors .......................................................................... 28

7.4 Maintenance ........................................................................29

8. TECHNICAL DATA...................................................................... 30

9. USEFUL CONTACT INFORMATION ................................................31

TABLE OF CONTENTS:

1. GETTING STARTED 1. GETTING STARTED

1.1 Important

NB: If the user fails to adhere to these instructions and the

terminal is damaged, the warranty on the terminal does not apply!

•Use the terminal only in an earthed socket connected to a fuse.

•Protect the power cord and the modem. If damaged, they must no longer be used.

•The voltage of the power supply must not differ from the voltage specified for the

terminal.

•The terminal must be firmly placed on a table. It must not be placed in direct

sunlight, a hot temperature or in a moist or dusty place.

•The terminal is not waterproof.

•The terminal must be used only indoors.

•Do not insert any foreign objects in the reader slots or cable ports of the terminal.

This might seriously damage the terminal.

•If the terminal is damaged, please contact Sonera’s Technical Corporate Customer

Service. You must not repair the terminal yourself.

•Only use appropriate paper in the terminal to avoid paper jams and damage to the

printer.

•Never use thinner, trichloroethylene, or ketone-based solvents for cleaning the

terminal. These substances may damage the terminal’s plastic or rubber parts.

•Never spray cleaners or other solutions directly onto the screen or keypad.

Instead, use a cleaning cloth or the like.

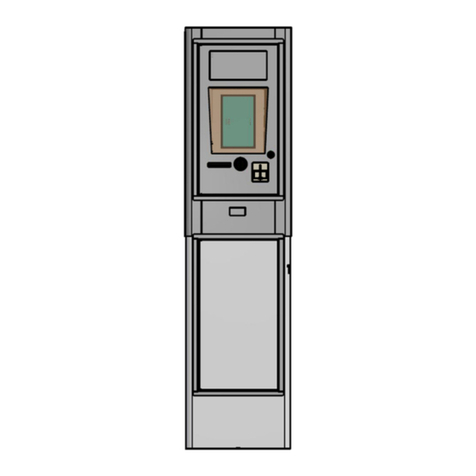

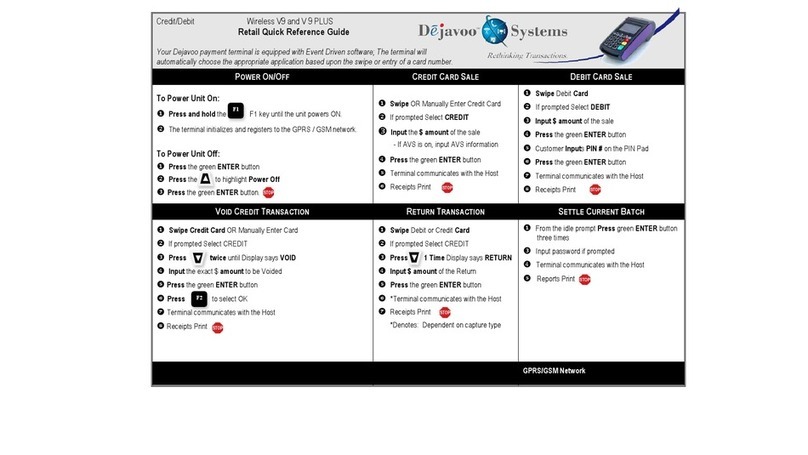

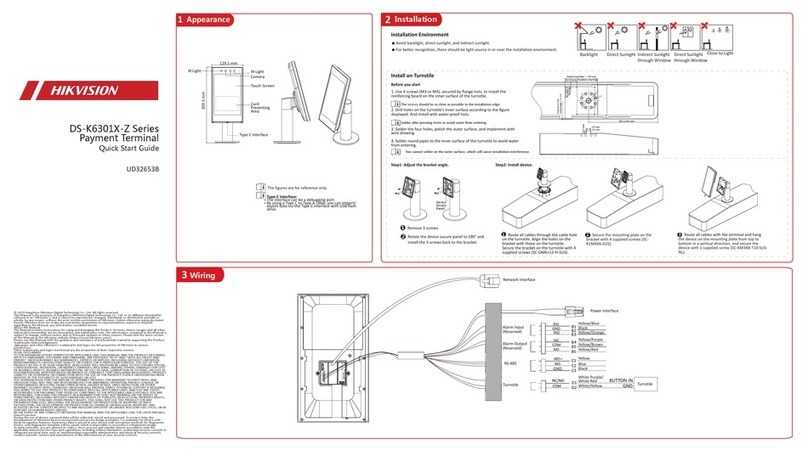

1.2 Terminal structure

1.3 Connecting the terminal

•Place the terminal on a table.

•Plug the power cord into the power cord.

•Detach the cord shield from the bottom of the terminal.

•Plug the necessary cords/cables into the correct sockets at the back panel.

•Put the cord shield back in its place.

•Insert the SIM card into the device (NB: This is necessary only when you take a

replacement device into use.)

•Switch the terminal on by pressing the on/off button

Plug the Ethernet cable into the socket

labelled: LAN. Plug the power cord into

the socket labelled: POWER.

Put the black connecting piece provided with the power

cord and the cord shield in their places.

A SIM card is ready-installed in Sonera Payment

Terminals but not in the replacement devices. If you take

a replacement device into use, remove the SIM card from

the payment terminal and insert it into the replacement

device. Unscrew the cover on the bottom of the terminal.

Place the SIM card in the SIM card holder, which is

located crosswise in the terminal, and slide the locking

mechanism in place. Screw the cover back on.

NB: The SIM card must NOT be used in any other

devices than Sonera Payment Terminals.

4 5

1. GETTING STARTED

2.1.1 Changing the paper roll

The terminal uses thermal paper. Width of the paper

roll: 58 mm, diameter: 50 mm. You can order the

paper rolls from us. See contact information on

section 9.

•Press the paper cover release button to unlock

the cover of the paper compartment.

•Place the paper roll in the compartment. Make

sure that the paper feeds from the underside of

the roll towards the front of the device.

•Pull the end of the paper out of the compartment

beyond the tear bar and close the paper

compartment cover.

2.1.2 Keypad

2.1.3 Using the menus

To browse through the menus, use the arrow keys. To confirm your selections, press

Enter. To go back to the previous menu, press Cancel. To return to the start view,

press Cancel repeatedly. In the menus, make your selections using the keys F1 to F4.

When you go to the Batch menu or to the Parameters menu, the terminal says Press

Enter.

1.4 Testing the connection

When the terminal is been switched on for the first time, a text appears on the screen:

BLACKLIST MISSING

UPDATE THE BLACKLIST?

YES = ENTER / NO = CANCEL

Press the Enter-button. The terminal sets up a connection to the bank. The word

CONNECTING is displayed on the screen. If the connection is successfully set up,

the word CONNECTED appears on the screen. The terminal retrieves the payment

terminal information, AID and BIN tables, EMV keys and the blacklist from the bank.

The words SENDING and RECEIVING alternate on the screen, and consecutive

numbers are displayed.

After this, the terminal is ready for use.

NB! If you use the terminal via broadband and there are fixed

IP-addresses on the network, please look for more information on

page 19.

If the connection does NOT work, see section 6, TROUBLESHOOTING, for further

guidance.

You can also test the connection by pressing MENU and Enter. Then choose

SEND BATCH.

2. DAILY USE

76

2. DAILY USE2. DAILY USE

2.2 TRANSACTIONS

2.2.1 Chip card transactions

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

PLEASE INSERT OR SWIPE CARD: Insert the card in the chip card reader slot, the chip

facing up.

CREDIT / DEBIT: The customer selects the payment method.

ENTER PIN: The customer enters the PIN code and presses Enter.

(To skip the PIN code, just press Enter. This means that the merchant takes full

responsibility.)

The terminal prints the receipts. The first receipt is for the merchant, the second one is

for the customer.

If the transaction has been confirmed with a PIN code, the customer need not sign the

receipt. The terminal reminds the salesperson to check the identity of anyone whose

receipt total exceeds €50.00, depending on card type. Press Enter and check the

customer’s identity. On the receipt, write the last four digits of the customer’s identity

number and indicate how you checked the identity.

REMOVE CARD: Remove the card from the reader. Make sure that the card remains in

the reader slot for the entire transaction, or the operation is aborted.

2.2.2 Swipe card transaction

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

PLEASE INSERT OR SWIPE CARD: Swipe the card through the reader.

CREDIT / DEBIT: Select the payment method.

The terminal prints the receipts. The first receipt is for the merchant, the second one

is for the customer. Ask the customer to sign the receipt. The terminal reminds the

salesperson to check the identity of anyone whose receipt total exceeds €50.00,

depending on card type. Press Enter and check the customer’s identity. On the

receipt, write the last four digits of the customer’s identity number and indicate how

you checked the identity.

2.2.3 Void

NB: You can only void transactions that are still in the device

memory and has not been sent to the bank.

Press MENU F1 and select VOID.

ENTER RECEIPT NUMBER: The terminal shows the number of the latest receipt as

default. Press Enter to accept it, or enter another receipt number and press Enter.

PLEASE INSERT/SWIPE CARD: Insert the card in the reader or swipe the card.

The terminal prints the receipts. The first receipt is for the merchant, the second one is

for the customer. If necessary, ask the customer to sign the receipt.

TRANSACTION NOT FOUND: If you see this text, you have either entered the receipt

number incorrectly or the transaction is no longer in the terminal memory.

2.2.4 Manual entry

Press MENU F1 and select MANUAL ENTRY.

ENTER CARD NUMBER: Enter the card number and press Enter.

ENTER EXPIRY DATE MMYY: Enter the expiry date of the card and press Enter.

DEBIT / CREDIT: Select the payment method.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

DIAL YES/NO: If you want the terminal to verify the transaction, select YES.

Manually entered transactions must always be verified. If you bypass the verification,

the terminal will ask you to enter a verification code. Call the verification centre, type

in the number they give you, and press Enter. You can also bypass this procedure by

entering 9999. In this case, the responsibility lies with your company.

The terminal prints the receipts. The first receipt is for the merchant, the second one

is for the customer. Ask the customer to sign the receipt. The terminal reminds the

salesperson to check the identity of anyone whose receipt total exceeds €50.00,

depending on card type. Press Enter and check the customer’s identity. On the

receipt, write the last four digits of the customer’s identity number and indicate how

you checked the identity.

NOT ALLOWED: The number of this card may not be entered manually.

8 9

2. DAILY USE2. DAILY USE

2.3 REPORTS AND BATCH SENDING

2.3.1 Batch report

Press MENU and Enter.

Select PRINT BATCH.

The terminal prints a report on the day’s transactions, classified by card type.

Please note that the terminal automatically clears this report when the batch has been

successfully sent to the bank.

2.3.2 Monthly report

The monthly report can also be used, for example, as a shift report. The terminal

keeps adding transactions to the report until it is reset. You must always print the

report before resetting it.

To print a monthly report:

Press MENU and Enter.

Select MONTHLY REPORT. Choose MONTHLY REPORT again.

The terminal prints a report itemized by card.

To reset the monthly report:

Press MENU and Enter.

Select MONTHLY REPORT. Select RESET REPORT.

The terminal resets the report.

2.3.3 Batch sending

The terminal sends the batch automatically provided that a transmission time has

been specified in its settings. The batch can also be sent manually if, for example, the

automatic sending fails.

NB: The automatic batch sending does not work if the terminal is

switched off.

Press MENU and Enter.

Choose SEND BATCH.

2.2.5 Receipt copy

Press MENU F1 and select PRINT COPY from the menu.

RECEIPT NUMBER: The terminal shows the number of the latest receipt as default.

Press Enter to accept it, or enter another receipt number and press Enter.

The terminal prints a copy of the receipt.

2.2.6 Return

The RETURN function can be used at any time. However, you want to cancel a

transaction made on the same day, use the VOID function (page 10) instead.

NB: The RETURN function is NOT permitted for bankcard

purchases.

Press MENU F1 and choose RETURN.

TOTAL: Enter the amount in euros, including cents, and press Enter.

PLEASE INSERT OR SWIPE CARD: Insert the card to the chip slot or swipe the card

from the magnetic card reader.

CREDIT / DEBIT: Select the payment method.

ENTER PIN AND PRESS ENTER: If the card is a chip card, the customer enters the

PIN code and presses Enter.

The terminal prints the receipts. The first receipt is for the merchant, the second one is

for the customer. If the transaction has been confirmed with a PIN code, the customer

need not sign the receipt.

The terminal reminds the salesperson to check the identity of anyone whose receipt

total exceeds €50.00, depending on card type. Press Enter and check the customer’s

identity. On the receipt, write the last four digits of the customer’s identity number and

indicate how you checked the identity.

10 11

2. DAILY USE2. DAILY USE

2.3.5 Report explanations

Example of a batch report and the items printed on it

Items on the report:

BATCH SENDING OK:

This text indicates that

the batch was sent

successfully.

MAKSUPAATE PALAUTE:

information of the

previous batch sending.

This only comes if it

has been formed at the

bank. It never comes

on weekends and bank

holidays or if the terminal

has not been in use.

AID TABLE, BIN TABLE

and EMV KEYS: The

terminal updates this

information, if it can be

retrieved from the bank.

KIELTOLUETTELO

(BLACKLIST): This is the

number of cards on the

blacklist.

The terminal prints a batch report and sets up a connection to the bank. Then the

terminal sends the batch and retrieves the AID and BIN tables, EMV keys, and the

blacklist.

If the batch was sent successfully, the following text is printed on the report:

BATCH SENDING OK. If there are no transactions on the terminal, the text will not be

printed.

2.3.4 Blacklist

The terminal updates the blacklist automatically when sending the batch. The blacklist

can also be updated manually, if it is not on the terminal.

Press FUNC and Enter.

Choose DOWNLOAD F3.

Choose BLACKLIST F3 and FULL/UPDATE.

FULL = the terminal retrieves the entire blacklist database

UPDATE = the terminal updates the blacklist database.

The terminal sets up a connection to the bank and updates the blacklist. The number

of blacklisted items will be printed on the receipt.

12 13

2. DAILY USE2. DAILY USE

2.4 AUTHORIZATION CODES

If the transaction is declined by the authorization centre, a response code indicating

why the transaction was declined will be printed on the receipt. Transactions are

declined on the basis of notifications given by the bank or Credit Card Company.

000 to 009 are codes of acceptance

000 Accepted

001 Check ID

002 Accepted for a partial amount

003 Accepted (VIP)

005 Accepted, account type defined by the card donor

006 Accepted for a partial amount, account type defined by the card do-

nor

007 Accepted, chip update

100–199 Declined, card removal not needed

100 Declined

101 Card is no longer valid

102 Suspected cards counterfeit

103 Cashier, call to recipient

104 Limited card

105 Cashier, call to the recipients’ security department

106 Exceeds PIN-code attempts

107 Cashier, call to the card donor

108 Cashier, check the card donors’ special terms, do a manual authori-

zation

109 False payment recipients’ identifier

110 False amount

111 False card number

112 PIN-code required

113 Commission not accepted

114 False account type

115 Required action not supported

116 Not accepted

117 False PIN

118 Unknown card

119 Transaction is not allowed for card holder

120 Transaction is not allowed for payment terminal

121 Exceeds withdrawals floor limit

122 Security violation

123 Exceeds withdrawals time limit (too often)

124 Crown violation

125 Card is not yet valid

126 False PIN block

127 False PIN length

128 False PIN key synchronization

129 Suspected abuse

200–299 Declined, card removal needed

200 Declined

201 Card expired

202 Suspected card counterfeit

203 Cashier, contact the recipient

204 Limited card

205 Cashier, contact recipients’ security department

206 Exceeds PIN-code attempts

207 Special situation

208 Extinct card

209 Stolen card

210 Suspected abuse

300 Successful

306 Unsuccessful

307 Unsuccessful, form fault

400 Declined. Accepted revocation of authorization, try again

14 15

3. SETTINGS2. DAILY USE

900–999 System error, authorization not successful

902 False transaction

903 Do the transaction again

904 Form fault, try again

905 Unable to route the transaction to recipient

906 Temporary usage brake in the card donors system

907 No connection to the card donor

908 Unable to route the message

909 System error

910 Unable to connect to the card donor

911 Unable to connect to the card donor

912 Card donor not available

913 Dual transaction sending

914 The original transaction can not be traced

915 Control error, card donors’ system temporarily unavailable

916 MAC-error

917 MAC-synchronization error

918 Data transfer keys not available

919 Encryption keys’ synchronization error

920 Security program error, try again

921 Security program error, no transaction

922 Unknown message number

923 Transaction is been processed

930 Payment terminal error, date error

1Z3 Unable to connect to authorization centre, try again

0Y1 Offline accepted, no authorization

0Y3 Offline accepted, unsuccessful

3.1 Terminal settings

The Settings menu items listed below are the ones that apply to the PAX S80 terminal.

Some of the settings are explained in greater detail further below (section number

given in brackets).

Press FUNC and Enter. Select SETTINGS.

BATCH TIME (3.3) Batch time of the terminal

CASHIER NUMBER (3.4) Cashier number of the terminal

TCP/IP PARAMETERS (3.5) DHCP / FIXED IP

CONNECTION TYPE (3.6) AUTO / LAN / GPRS

LANGUAGE FINNISH / SWEDISH / ENGLISH

EXTRA AMOUNT (5.3) Settings of the Extra/Tip function

CASH RECEIPT (5.1) YES / NO

POWER OPTIONS NOT IN USE

AUTH. MANDATORY (5.5) YES / NO

TIME SETTINGS (3.8) Time and date

VAT (5.4) YES / NO

PREAUTHORIZATION (5.6) YES / NO

MULTICASHIER VER (5.8) YES / NO

SOUND (5.9) ON / OFF

3.2 Printing the parameters

Press FUNC and Enter.

Select PRINT PARAMETERS F2.

Select PARAMETERS F2.

The terminal prints a list of parameters with the settings of the terminal.

You should keep the printed list for later use.

1716

3. SETTINGS3. SETTINGS

3.3 Batch time

The terminal will send the batch automatically if you set a certain time to its settings.

The terminal needs to be on during that time. We recommend that you set the time

after your closing time. You should avoid even hours.

If you do not want to use the automatic batch sending, set the time to be 9999. Note

that you need to send the batch by your self.

Go to the Edit-menu selection: BATCH TIME.

Enter here the batch time you want to use and press Enter. (E.g. 0315)

3.4 Cashier number

If you use more than one terminal, it is important to specify the terminals by using

different cashier numbers. The cashier number is printed on the receipts. Using the

cashier number it is possible to know by which terminal the transactions have been

made.

Go to the Edit-menu selection: CASHIER NUMBER.

Enter here the number you want to use and press Enter. The number has to be three

digits long e.g. 001.

3.5 Fixed IP-address

If the network you use has fixed IP-addresses you need to define them to the terminal

settings.

NB: Only when connecting via broadband.

Go to the Edit -menu selection: TCP/IP PRAMETERS and choose FIXED IP.

ACTIVE IP ADDRESS IP-address that the terminal uses

GATEWAY Gateway address

SUBNET MASK Subnet mask address

DNS1 Not needed (0.0.0.0)

DNS2 Not needed (0.0.0.0)

NB: You make the dot by pressing first 1 and then three times

ALPHA-button.

3.6 Connection type

Go to the Edit-menu selection: CONNECTION TYPE.

AUTO Terminal uses both broadband and GPRS connection

TCP/IP SSL Terminal uses broadband connection

GPRS SSL Terminal uses GPRS connection

3.7 Language

Go to the Edit-menu selection: CONNECTION TYPE.

Select the language you want to use Finnish, Swedish or English.

3.8 Changing the time and date

Go to the Edit-menu selection: TIME SETTINGS.

Choose ADJUST CLOCK.

Choose the item you want to change using the F keys and change it.

3.9 Sound

Go to the Edit-menu selection: SOUND.

Choose on or off to set the key sound on or off.

18 19

5. SPECIAL FUNCTIONS4. DOWNLOADS

4.1 Downloading the parameters

NB: You only need to download the parameters on the equipment

suppliers demand.

Press FUNC and Enter.

Select DOWNLOAD.

Select FROM LOADPOINT and PHONE.

The terminal starts to download the parameters. A dash line appears on the screen,

and as the download proceeds, it is replaced by stars. The terminal will print the text

“SUCCESSFUL PARAMETERS DOWNLOAD” on the receipt.

NB: After the parameters have been downloaded, you must set up

a connection to the bank with the terminal.

Press MENU and Enter.

Select SEND BATCH.

4.2 Downloading the certificate

NB: The certificate is already downloaded on to the terminal when

you receive it.

Press FUNC and Enter.

Choose DOWNLOAD.

Go to menu selection DOWNLOAD SERTIFICA.

The terminal downloads the certificate and prints out: “SUCCESSFUL CERTIFICATE

DOWNLOAD“.

5.1 Cash receipt

You can use the cash receipt when the customer pays with cash and you want to print

a receipt with the terminal. Cash receipts are also listed on the reports.

To activate the cash receipt, go to the Settings menu (page 18).

To make a cash receipt:

Press MENU F1.

Choose CASH RECEIPT.

Choose CASH RECEIPT SALE.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

VAT %: Enter the VAT percentage and press Enter.

The terminal prints the receipts.

To void a cash receipt sale:

Press MENU F1.

Select CASH RECEIPT.

Select CASH RECEIPT VOID.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

VAT %: Select the VAT percentage.

The terminal prints the receipts.

2120

5. SPECIAL FUNCTIONS

5.2 Cash withdraw

Cash withdraw is used when the customer wants to withdraw cash from your cash

register. You make a transaction with the terminal and give the customer cash.

Merchant gets 50 cents of the transaction.

E.G. The customer wants to withdraw €10,00. You make a transaction with sum €10,50

and give the customer €10,00.

NB: You are only allowed to withdraw cash with a bank card. To be

able to withdraw cash, you must conclude an agreement with your

bank.

Press MENU F1.

Select CASH WITHDRAW.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

PLEASE INSERT OR SWIPE CARD: Insert the card in the reader or swipe the card.

VISA / BANK: Select BANK.

ENTER PIN AND PRESS ENTER: If the card is a chip card, the customer enters the PIN

code and presses Enter.

The terminal prints the receipts. The first receipt is for the merchant, the second one is

for the customer. If the transaction has been confirmed with a PIN code, the customer

need not sign the receipt.

The terminal reminds the salesperson to check the identity of anyone whose receipt

total exceeds €50.00, depending on card type. Press Enter and check the customer’s

identity. On the receipt, write the last four digits of the customer’s identity number and

indicate how you checked the identity.

5.3 Extra / Tip

Extra is used e.g. in restaurants so that the customer can leave a tip for the waiter.

The Extra function is activated in the Settings menu (page 18).

Options:

NO = Extra function not activated

ONLY BEFORE = The extra amount is given during the transaction.

ONLY AFTER = A line labelled Extra is printed on the receipt, and the extra amount is

entered separately in the terminal.

UNRESTRICTED = The terminal asks for Extra during the transaction, and an Extra line

is also printed on the receipt.

NB: If the customer pays with a chip card, Extra can only be given

during the transaction.

To enter extra in the terminal separately:

An amount has been written on the receipt on the Extra line. The amount must be

entered in the terminal separately during the same day.

Press MENU F1.

Select EXTRA AMOUNT.

ENTER RECEIPT NUMBER: The terminal shows the number of the latest receipt as

default. Press Enter to accept it, or enter another receipt number and press Enter.

EXTRA: Enter the amount and press Enter.

The terminal prints a receipt.

5. SPECIAL FUNCTIONS

22 23

5. SPECIAL FUNCTIONS5. SPECIAL FUNCTIONS

5.4 VAT

When you are making a transaction, the terminal asks you for the VAT rate. The vat

percentage is calculated on the receipt.

The VAT function is activated in the Settings menu (page 18).

5.5 Mandatory authorization

If mandatory authorization has been activated, the terminal verifies all transactions

automatically irrespective of the amount or card type.

Mandatory authorization is activated in the Settings menu (page 18)

5.6 Preauthorization

Preauthorization is a function that can be used to make sure the card is valid.

Preauthorization is activated in the Settings menu (page 18).

Press MENU F1.

Select PREAUTHORIZATION.

PLEASE INSERT OR SWIPE CARD: Insert the card in the reader or swipe the card.

VISA / BANK: Select BANK.

ENTER AMOUNT: The terminal suggests EUR 1. Press Enter.

ENTER PIN AND PRESS ENTER: If the card is a chip card, the customer enters the PIN

code and presses Enter.

The terminal contacts the authorization centre, makes a cover reservation, and

cancels it.

5.7 Invoice

The invoice works the same way as cash receipt. The only difference is that text

Invoice is printed on the receipt.

To issue an invoice:

Press MENU F1.

Select INVOICE.

Select INVOICE.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

The terminal prints the receipts.

To void an invoice:

Press MENU F1.

Select INVOICE.

Select VOID INVOICE.

ENTER AMOUNT: Enter the amount in euros, including cents, and press Enter.

The terminal prints the receipts.

5.8 Multi cashier

When you use multi cashier the terminal asks for CASHIER NUMBER. You can enter

here any value from between 1–99. This is printed on the receipt. You can use the

multi cashier version for example in a restaurant to separate servers.

Multi cashier has to be activated from the SETTINGS menu (page 18).

24 25

7. TROUBLESHOOTING6. ADDITIONAL FUNCTIONS

6.1 Version for multiple users

Sonera Payment Terminal Service also includes a function for multiple users. This

function is useful when many entrepreneurs have to use the same payment terminal or

when payment transactions must be directed to different accounts.

To print the list of users:

Press FUNC.

Select PRINT PARAMETERS and MULTIPLE USERS.

The terminal prints a list of the terminal users. The list shows their user numbers,

receipt texts, and member shop numbers.

To make a payment transaction:

Enter amount: Enter the amount in euros, including cents, and press Enter. PLEASE

INSERT OR SWIPE CARD: Insert the card in the chip card reader or swipe the

magnetic stripe.

USER: Enter the user number and press Enter.

DEBIT / CREDIT: Select the payment method.

ENTER PIN AND PRESS ENTER: The customer enters the PIN code and presses

Enter.

The terminal prints the receipts. The first receipt is for the merchant, the second one is

for the customer.

If the transaction has been confirmed with a PIN code, the customer need not sign the

receipt. The terminal reminds the salesperson to check the identity of anyone whose

receipt total exceeds €50.00, depending on card type. Press Enter and check the

customer’s identity. On the receipt, write the last four digits of the customer’s identity

number and indicate how you checked the identity.

REMOVE CARD: Remove the card from the reader. Make sure that the card remains in

the reader slot for the entire transaction, or the operation is aborted.

Reports:

Reports are printed just like in the basic version, but the batch report is printed

separately for each user.

The monthly report is not available in the multiple-user version.

7.1 Notifications on the screen

BLACKLIST MISSING A blacklist is missing from the terminal. For

instructions on how to download the blacklist, see

section 2.3.4.

USE MAG CARD The terminal cannot read the chip. Use the

magnetic stripe.

USE CHIP The card has an EMV chip. Use the chip card

reader.

PIN LOCKED The pin code of the card in use has been locked.

It can be unlocked by contacting the card donor or

by using the card on an atm.

APPLICATION LOCKED The application on the card has been locked.

The card holder must contact the card donor.

“JÄSENLIIKENUMERO

PUUTTUU”

Card is not included in the terminals card selection.

It can not be used.

SERVICE NOT ALLOWED FOR

THIS CARD PRODUCT

Card is not included in the terminals card selection.

It can not be used.

7.2 Notifications on the receipt

CONNECTION ERROR The terminal is unable to connect. See section 7.3.

BATCH SENDING ERROR The terminal is unable to connect. See section 7.3.

“PYYTÄMÄÄNNE AINEISTOA EI

OLE”

Is printed on the “Maksupäätepalaute” -section.

The bank does not have information of the previous

batch sending ready. This is normal after weekend

or bank holiday.

“TAPAHTUMATIEDOSTO

PUUTTUU”

Is printed on the “Maksupäätepalaute” -section.

The bank does not have information of the previous

batch sending ready. This is normal after weekend

or bank holiday.

“ERROR FILE NOT EXISTENT” Is printed on the “Maksupäätepalaute” -section.

The bank does not have information of the previous

batch sending ready. This is normal after weekend

or bank holiday.

“OTA YHTEYS NEUVONTAAN” Is printed on the “Maksupäätepalaute” -section.

The request for the return report differs with the

bank. Please, contact your bank.

2726

7.3 Other errors

CONNECTION PROBLEM There is a problem with the connection. Switch

the terminal off and on and try again. If this does

not help, there may be a problem with the ADSL

modem. Switch the modem off and on and try

again. Check whether the Internet connection

is working. If the connection does not work,

contact your broadband service provider. There

may also be a problem with the SIM card or the

GPRS subscription. Contact Sonera’s Technical

Corporate Customer Service.

TERMINAL DOES NOT READ

CARDS

The reader may be stuck. Switch the terminal off

and on and try again. The reader may also be dirty.

Clean it and try again.

POWER IS OFF Check the cables and switch the terminal on by

pressing the power key.

7.4 Maintenance

NB: If you use the terminal via GPRS, take off the SIM card before

you send it to maintenance. The SIM card needs to be transferred

to the new terminal.

You must not repair the terminal yourself. If you suspect or know that the terminal is

broken or damaged, contact Sonera’s Technical Corporate Customer Service.

If Sonera’s Technical Corporate Customer Service asks you to take the device to a

repair shop, do as follows:

1. Send the batch to the bank, see 2.3.3 Batch sending.

2. Pack the terminal so that it is well protected during the transport.

3. Enclose a note explaining what the suspected fault is and whether there are any

payment transactions in the terminal memory, and also give your contact details.

4. You need not send any cables with the terminal unless you want them to be

checked as well.

5. Send the terminal to the repair shop by post. The postage is always paid by the

sender.

Sonera Payment Terminal equipment is maintained by Point Transaction Systems Oy.

Repair shop address:

Point Transaction Systems Oy /

Huolto

Vanha Nurmijärventie 62 D

01670 Vantaa

7. TROUBLESHOOTING 7. TROUBLESHOOTING

28 29

8. TECHNICAL DATA 9. USEFUL CONTACT INFORMATION

Processor: 32-bit, ARM9

Memory: 8MB FLASH, 16MB SDRAM

Display: 128x64 pixel LCD display with LED backlight

Keypad: 10 numerical keys with letters, 8 function keys, 4 display selection keys and 1

on/off key

Reader: Magnetic stripe, 3 tracks, 2-way. Chip cards EMV compatible.

SAM card slots: 3, ISO7816

Connections: Built-in Ethernet and GPRS as a standard feature

Printer: Thermal printer, speed: 20 lines/second.

Width of the paper roll: 58 mm, diameter: 50 mm

Dimensions: Length: 216 mm, Width: 95 mm, Height: 86 mm (including shield)

Weight: 525 g

Sonera Corporate Customer Service

(dial 2) 0200 18818

(Mon–Fri 8:00am–4:30pm)

Sonera’s Technical Customer Service 0206 90801

•technical problems (dial 2)

About Sonera Payment Terminal Service www.sonera.fi/maksupaate

Orders for accessories:

•on the web: www.sonera.fi/maksupaate/hallinta

or

•Point Transaction Systems 09 477 433 43

Authorization centres:

Bank cards 0100 3100

Luottokunta 09 696 4646

American Express 0800 114 646

Diners Club 0800 955 55

Banks:

Handelsbanken 010 444 2545

Nordea 0200 672 10

OP-Pohjola Group 0100 051 51

Sampo 0600 125 25

Savings Banks / Aktia /

Local Cooperative Banks 0100 4050

Ålandsbanken 020 429 2910

3130

Sonera Corporate Customer Service

0200 18818

(mobile call charge / local network charge)

Sonera’s Technical Customer Service

0206 90801 (dial 2)

Table of contents