Casio PCR 262 - Personal Cash Reg 10DEPT/100 Price Look UPS/8CLERK Impact... User manual

Other Casio Cash Register manuals

Casio

Casio PCR-T276 User manual

Casio

Casio PCR-T500 User manual

Casio

Casio SE-C2000 User manual

Casio

Casio TE-900 User manual

Casio

Casio CE-T300 User manual

Casio

Casio 120CR User manual

Casio

Casio SE-C2000 User manual

Casio

Casio PCR-T2000 User manual

Casio

Casio TK-T200 User manual

Casio

Casio CE-6100 User manual

Casio

Casio TE-8000F Series User manual

Casio

Casio 130CR User manual

Casio

Casio CE-285 Assembly instructions

Casio

Casio PCR-T500 User manual

Casio

Casio TK-5100 User manual

Casio

Casio CE-6000 User manual

Casio

Casio CE-6100 User manual

Casio

Casio TE-2000 User manual

Casio

Casio TK-3200 User manual

Casio

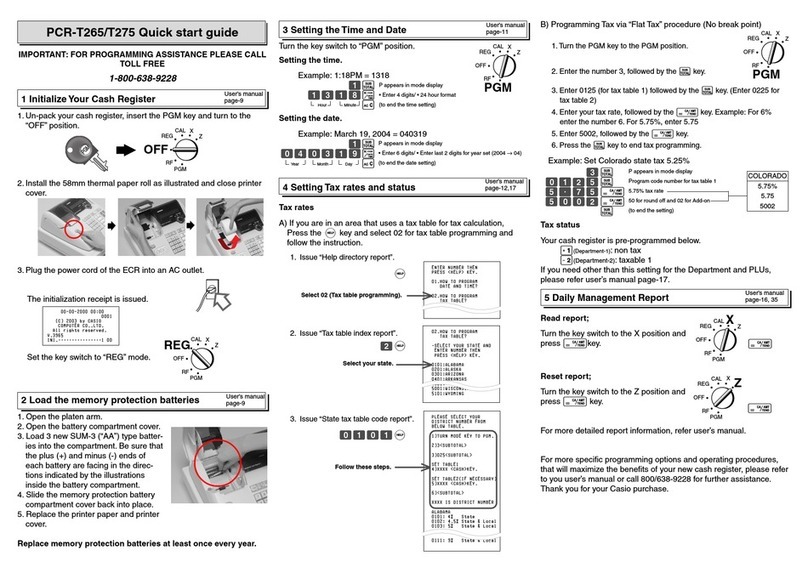

Casio PCR T265 - Electronic Cash Register User manual

Popular Cash Register manuals by other brands

Sharp

Sharp XE-A137-WH Operation Basic user manual

Sharp

Sharp XE-A203 - Cash Register Thermal Printing Graphic Logo... instruction manual

TEC

TEC TEC MA-1060 owner's manual

ELCOM

ELCOM Euro-2100TE user manual

American Changer

American Changer CLASSIC Series Operation manual

Sam4s

Sam4s ER-180 Operation manual