TD iCT250 User manual

TD iCT250 and TD iWL252/255

UnionPay Guide

For the:

• TD iCT250

• TD iCT250 with PINpad

• TD iWL252 (Bluetooth)

• TD iWL255 (3G Wireless)

COPYRIGHT ©2016 by The Toronto-Dominion Bank

This publication is conidential and proprietary to The Toronto-Dominion Bank and is intended solely for the use of Merchant customers of

TD Merchant Solutions. This publication may not be reproduced or distributed, in whole or in part, for any other purpose without the written

permission of an authorized representative of The Toronto-Dominion Bank.

NOTICE

The Toronto-Dominion Bank reserves the right to make changes to speciications at any time and without notice. The Toronto-Dominion Bank

assumes no responsibility for the use by the Merchant customers of the information furnished in this publication, including without limitation

for infringements of intellectual property rights or other rights of third parties resulting from its use.

i

Table of Contents

Who should use this guide?.....................................................1

What is UnionPay? .................................................................................. 1

How do I identify a UnionPay card?.............................................................. 1

UnionPay cards ....................................................................................... 1

Financial Transactions.............................................................1

Transaction requirements ...................................................................... 1

PIN entry............................................................................................................ 1

Customer signature.........................................................................................2

Restrictions..............................................................................................2

Sale (credit or debit card) ......................................................................2

Sale (phone or mail)................................................................................3

Void..........................................................................................................3

Return ......................................................................................................3

Pre-authorizations...................................................................................4

Open a pre-authorization...............................................................................4

Close a pre-authorization...............................................................................5

Receipts ...................................................................................................5

Receipt codes...................................................................................................5

ii

1

Who should use this guide?

You should use this guide if you are a client of TD Merchant Solutions and perform transactions involving

UnionPay credit or debit cards during the course of your daily business.

What is UnionPay?

Union Pay is an international payment brand that is becoming more commonly used worldwide. You will see

either single branded cards (UnionPay only) or dual branded cards (UnionPay and another payment brand).

* More brands may be added overtime.

How do I identify a UnionPay card?

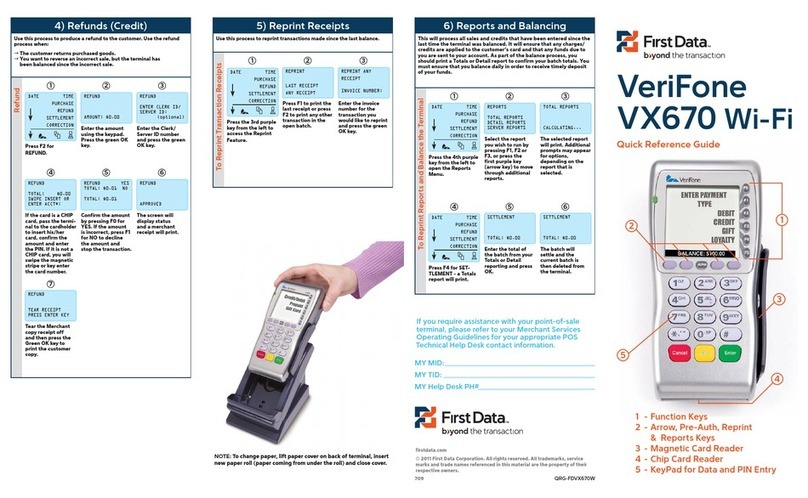

UnionPay cards are easy to identify by their logo shown below.

UnionPay cards

Currently they oer the following cards:

Single branded Co-branded

Credit card UnionPay UnionPay co-branded with Visa,

MasterCard, American Express,

JCB or Diners Club

Debit card UnionPay UnionPay co-branded with Interac

Debit or Visa Debit*

Financial Transactions

You can perform any inancial transactions with a UnionPay card that you would with another card.

Transaction requirements

UnionPay sometimes requires customers to verify their identity in dierent ways than what we are used to. The

two most common customer veriication methods are:

PIN entry

The terminal may request the customer to enter their PIN for any transaction. For credit cards, the customer

can bypass this PIN request, but if they do and the PIN is requested again, they must enter their PIN. Debit

cards always require a PIN.

2

Customer signature

The customer may be required to sign the merchant receipt. This can occur for any transaction, even one where

the customer has already entered their PIN. If you see a signature line on the Merchant receipt, the customer

must sign the receipt. Failure to do so may prevent you from being paid for the transaction.

Restrictions

The following are not allowed for UnionPay cards:

• Account selection (chequing or savings) on debit card transactions - a default setting will be used

• No signature required (NSR) transactions

• Oline authorizations

• Partial sale approvals

• Transactions in foreign currencies

• Voice authorization / forced post transactions

• Cashback

Sale (credit or debit card)

1. Press F1.

2. Enter the total dollar amount for the sale and press OK.

3. Customer conirms the dollar amount and presses Yes or No.

4. Perform one of the following payment methods: Contactless, Insert, or Swipe.

a) The customer taps their contactless-enabled credit card on the contactless card reader. Go

to step 5.

Insert card

a) The customer inserts their credit card.

b) The customer enters their PIN and presses OK (credit card only). Go to step 5.

Swipe card

a) Merchant swipes the card.

b) The customer selects their payment method: Co-brand or UnionPay.

c) Verify the card info with what is on the terminal screen and press OK.

d) If the transaction is declined, please retry but select the other brand option in step b. For

example, if you previously selected Co-brand for the declined transaction, select UnionPay

this time. Go to step 5.

5. The screen shows that the transaction is completed with an authorization number or approved

message. If the receipt requests the customer’s signature, they must sign the receipt. If you do not

receive their signature, you may be responsible for chargebacks.

6. You can REPRINT the receipt or FINISH the transaction.

The customer may be required to swipe or insert their card in some cases.

3

Sale (phone or mail)

1. Press F4 Phone / Mail Sale.

2. Enter the dollar amount and press OK.

3. Enter the account number and press OK.

4. Enter the expiry date and press OK.

5. Enter the CVD number and press OK. This is an optional step and is dependent upon your settings

and the card requirements.

6. The screen shows that authorization number, the transaction total and the receipts print.

Void

This transaction is used to correct a previously entered transaction from the terminal in the current, open

business day. You can also use Transaction Recall to recall and cancel/void a transaction based on

information other than the trace #.

1. Press OK Void.

2. Enter the trace # for the transaction to be voided and press OK.

3. Verify that this is the correct transaction: Void or Back. If you select back, you can enter a new trace #

to void.

4. The voided transaction receipts print.

Return

You can only perform a return on a transaction that has already been submitted for reimbursement.

1. Press OK Return.

2. Enter the dollar amount and press OK.

3. Customer conirms the dollar amount and presses Yes or No.

4. Perform one of the following: Insert ,Swipe or Manual entry the card in question.

Insert card

a) Verify the card info with what is on the screen and press OK.

b) The customer may be required to enter their PIN. Go to step 5.

• These instructions are used for sales where the card is not present. If the card is present at sale, see Sale

(credit card). If you use the incorrect sale transaction you could incur extra charges.

• There are risks performing transactions when the credit card is not present. Ensure that you perform all of

the available security checks for phone / mail sale.

If you have closed the business day that the transaction was performed in, you can only perform a return. The

option to void the transaction is no longer available.

Debit returns are disabled by default. If you wish to activate debit returns on your terminal please call the TD

Merchant Solutions Help Desk at 18003631163.

4

Swipe card

a) Verify the card info with what is on the screen and press OK. Go to step 5.

Manually enter card

a) Enter the account number and press OK.

b) Enter the expiry date and press OK. This is four digits in length.

c) Indicate if the return is for a phone / mail sale: Yes or No. Go to step 5.

5. The screen shows that authorization number, the transaction total and the receipts print. The

customer must sign the signature ield on the merchant copy.

Pre-authorizations

This transaction is generally used by hotels, restaurants that deliver food and car rental agencies. By running a

pre-authorization the merchant veriies that the customer’s credit card currently has the available funds for the

purchase. The pre-authorized amount is charged upon completion of the transaction at a later time or date.

Restrictions

• Activate on terminal(s) - If you wish to use pre-authoriizations in your business, you must contact TD

Merchant Solutions Help Desk to activate it.

• Pre-authorizations can be left open for 10 days maximum.

Steps

The pre-authorization option has two steps:

• Open

• Close

Open a pre-authorization

Perform this transaction if you wish to create a new pre-authorization.

1. Press F3 key.

2. Enter the total dollar amount for the pre-authorization and press OK.

3. Customer selects one of the following payment methods: Insert,Swipe or Contactless.

Contactless

a) The customer taps their contactless-enabled credit card on the contactless card reader. Go to step 4.

Insert card

a) The customer inserts their credit card.

b) The customer enters their PIN and presses OK. Go to step 4.

Swipe card

a) The customer swipes their credit card.

b) Verify the card info with what is on the terminal screen and press OK.

c) If the transaction is declined, please retry but select the other brand option in step b. For

example, if you previously selected Co-brand for the declined transaction, select UnionPay

this time. Go to step 4.

4. The screen shows the transaction total and the receipts print. The customer must sign the signature

ield on the merchant copy.

5

Close a pre-authorization

Perform this transaction if you need to close an existing pre-authorization.

1. Press F2 key.

2. Enter the trace number from the initial pre-authorization receipt and press OK.

3. Close the pre-authorization: Comp or Back.

4. Enter the tip amount signed for by the client on the original receipt and press OK.

5. Conirm the dollar amount and press: Accept or Change.

6. If the amount exceeds the allowable limit either conirm or cancel the transaction: OK or Cancel.

If you press OK you will be prompted for a supervisor ID and password to continue with the higher

amount. Go to step 7.

If you press Cancel process will be cancelled and you will return to the Idle screen.

7. The screen indicates that the transaction is approved and the receipts print.

8. If there are other pre-authorizations open you will be prompted with the option to close another: Yes

or No.

Receipts

Each transaction has a dierent receipt and most of the information is purely for record keeping. There is

important information that you need to be aware of to ensure that your transactions have completed correctly.

Receipt codes

Card type

UP UnionPay

Important information

Trace # The trace number associated with the transaction

Inv # The invoice number associated with the transaction.

Auth # The authorization number associated with the transaction

Signature The card issuer determines when a signatures is required for a transaction so ensure that the

client signs these receipts.

Approved Always ensure that the transaction was approved as it could be DECLINED.

6

Contact Information

Please call the TD Merchant Solutions Help Desk at 18003631163. We would be happy to answer any questions

you may have.

Authorization:

24 hours a day, seven days a week

Terminal Inquiries:

24 hours a day, seven days a week

General Merchant Inquiries:

Monday – Friday, 8 a.m. – 8 p.m. ET

Printer / Stationery Supplies:

Monday – Friday, 8 a.m. – 5 p.m. ET

Documentation Portal

This guide covers the most commonly used information in order to get you started. Your terminal has more

features and functionality to explore on our documentation portal which you can ind at

www.tdmerchantsolutions.com/posresources.

535398 (0620)

Other manuals for iCT250

1

This manual suits for next models

2

Table of contents

Other TD Touch Terminal manuals