CIMB Plug n Pay Bluetooth User manual

CARING FOR YOUR DEVICE

Your CIMB Plug n Pay device is battery operated. It is important to keep the

device constantly charged. Charge your device at least once every 14 days.

When the device displays a “BATTERY LOW” sign, it does not have enough

energy to continue operations, and must be charged immediately.

Energy is needed to protect the encryption keys in the device that keep your

transactions highly secure. Failure to maintain a charge in the device will cause

deletion of the keys, and the device to deactivate, and you will not be able to

perform any transactions. When this happens, you will need to contact the bank

immediately to reactivate the device.

Important Notice:

a)

CIMB Plug n Pay Web Portal and Mobile App

CIMB Plug n Pay Web portal needs minimal Google Chrome [Ver. 38+],

Mozilla Firefox [Ver. 33+], Internet Explorer [Ver. 8+] or Safari [Ver. 6+].

Mobile App can only support Mobile Phone for Android 5 and above &

IOS version 9 and above.

b)

Card Acceptance:

•

No multiple charge

•

No split sales

•

Match signature in signature screen with cards (for Non Chip & PIN card).

•

No surcharge to customer

•

No personal cash advance

•

DO NOT set minimal transaction amount to accept card payment

Bank will hold payment if there is any violation and/or customer’s dispute.

Cashiers shall refer to their Supervisor if there is any suspicious transaction or

call CIMB BANK Authorization at +603 6204 7000 for further advise.

2

CONTENTS

SECTION A:

Mobile Activation 4-5

Card Reader Bluetooth Connection 6-7

SECTION B:

Accepting Card Sales (One Time Payment) 8-10

Accepting Card Sales (Installment Payment Plan) 11-13

Accepting Card Sales (Recurring Payment) 14-17

Accepting QR Payment 18-20

Resend e-Receipt or Voiding Transaction 21-23

Credit Settlement 24

3

SECTION A: MOBILE ACTIVATION

Step 1:

Download the CIMB Plug n Pay app from App Store for

IOS or Google Play Store for Android.

Note: For iPad users, please search for ‘CIMB Plug n Pay App’ from iPhone Apps category.

Step 2:

Login with User ID and User PIN received via email

and tap ‘Login’.

4

Dear Bryan Cheong,

Thank you for subscribing to CIMB Plug n Pay.

Please use this login details to login to CIMB Plug n Pay:

User ID: bryancheong

User PIN: 130729

Activation code: Request in CIMB Plug nPay mobile app

Please insert Reader when login.

Please contact your Merchant System Administrator for enquiries relating to login

details –Merchant ID and/or Activation Code.

Please contact our Merchant Hotline at 03-6204 7733 or send an email to emerchant@cimb.com for

technical enquiries.

Best Regards,

CIMB Plug n Pay Team

SECTION A: MOBILE ACTIVATION

Step 3:

Key in preferred PIN twice and tap ‘Update’

Note: User PIN must contain a 6-digit numeric code only

.

5

SECTION A: CARD READER BLUETOOTH CONNECTION

Step 1:

Press “Power” button to turn on card reader.

Tap on “Reader” to connect card reader by scanning the barcode.

(Tips: Barcode is located at the back of your card reader)

Step 2:

Immediately press the “tick” button when instructed.

Note: Only applicable for the newer CIMB Plug n Pay Bluetooth model.

6

SECTION A: CARD READER BLUETOOTH CONNECTION

Alternative for Step 1:

Click on ‘Connect Manually’.

Next, tap on ‘Scan for devices’ if your card reader is not listed.

Tap on the serial number that matches your card reader,

immediately press “tick” button on your card reader when instructed.

7

Cx

SECTION B: ACCEPTING CARD SALES

(ONE TIME PAYMENT)

Step 1:

In ‘Card Payment’ menu, tap “>”for One Time Payment

(Tips: Tap on ‘More option’ to select other card payment method

such as Recurring Payment or Installment Payment Plan)

Step 2:

Enter payment value and sales description.

Tap on ‘Continue’and confirm the payment amount.

8

SECTION B: ACCEPTING CARD SALES

(ONE TIME PAYMENT)

Step 3:

To charge, insert card into the bottom of the reader / swipe the card at the

top of the reader / tap the card on the reader.

Step 4:

Customer keys in PIN on card reader and press ‘tick’ button.

(Tips: Foreign cards might require cardholder’s signature,

obtain customer’s signature and tap ‘Confirm Payment’)

Or

9

or

SECTION B: ACCEPTING CARD SALES

(ONE TIME PAYMENT)

Step 5:

Key in customer's mobile number and/or email address to

send e-receipt.

Tap ‘Skip it’if customer does not wish to

receive e-receipt.

Step 6:

An e-Receipt will be sent to the customer via email or SMS.

Transaction completed.

10

Dear Andrew Lee,

Greetings from CIMB Plug n Pay.

RM899.99 was charged to your card ending 2912 at ABC Sdn Bhd

on 30/11/2019.

Please find the e-Receipt attached:

RECEIPT_70003041180615600261_20191130.pdf

Best Regards,

CIMB Plug n Pay Team

RM0.00 CIMB: Plug n

Pay e-receipt:

RM899.99 was charged

to your car ending 2912

at ABC Sdn Bhd on

30/11/2019

Cx

SECTION B: ACCEPTING CARD SALES

(INSTALLMENT PAYMENT PLAN)

Step 1:

In ‘Card Payment’ menu, tap on ‘More option’,

then select ‘Installment Payment Plan’

Step 2:

Enter payment value and sales description.

Tap on ‘Continue’ and confirm the payment amount.

11

Cx

To charge, insert card into the bottom of the reader

Select the IPP Plan

SECTION B: ACCEPTING CARD SALES

(INSTALLMENT PAYMENT PLAN)

Step 3:

Step 4:

12

Cx

13

SECTION B: ACCEPTING CARD SALES

(INSTALLMENT PAYMENT PLAN)

Step 5:

Customer keys in PIN on card reader and press ‘tick’ button.

Step 6:

Key in customer's mobile number and/or email address to send e-receipt.

Tap ‘Skip it’ if customer does not wish to receive e-receipt.

Transaction completed

Cx

SECTION B: ACCEPTING CARD SALES

(RECURRING PAYMENT)

Step 1:

In ‘Card Payment’ menu, tap on ‘More option’,

then select ‘Recurring Payment’

Step 2:

Enter payment value and sales description.

Tap on ‘Continue’ and confirm the payment amount.

14

Cx

SECTION B: ACCEPTING CARD SALES

(RECURRING PAYMENT)

Step 3:

Enter recurring plan details. Tap on ‘Continue’.

Step 4:

To charge, insert card to the bottom of reader.

15

Cx

SECTION B: ACCEPTING CARD SALES

(RECURRING PAYMENT)

Step 5:

Customer keys in PIN on card reader and press ‘tick’ button.

(Tips: Foreign cards might require cardholder’s signature,

obtain customer’s signature and tap ‘Confirm Payment’)

Or

Step 6:

Allow customer to read and accept

the recurring payment terms and conditions.

16

or

Cx

SECTION B: ACCEPTING CARD SALES

(RECURRING PAYMENT)

Step 7:

Obtain customer’s signature for the recurring payment.

Step 8:

Key in customer's mobile number and/or email address to send e-receipt.

Tap ‘Skip it’ if customer does not wish to receive e-receipt.

Transaction completed.

17

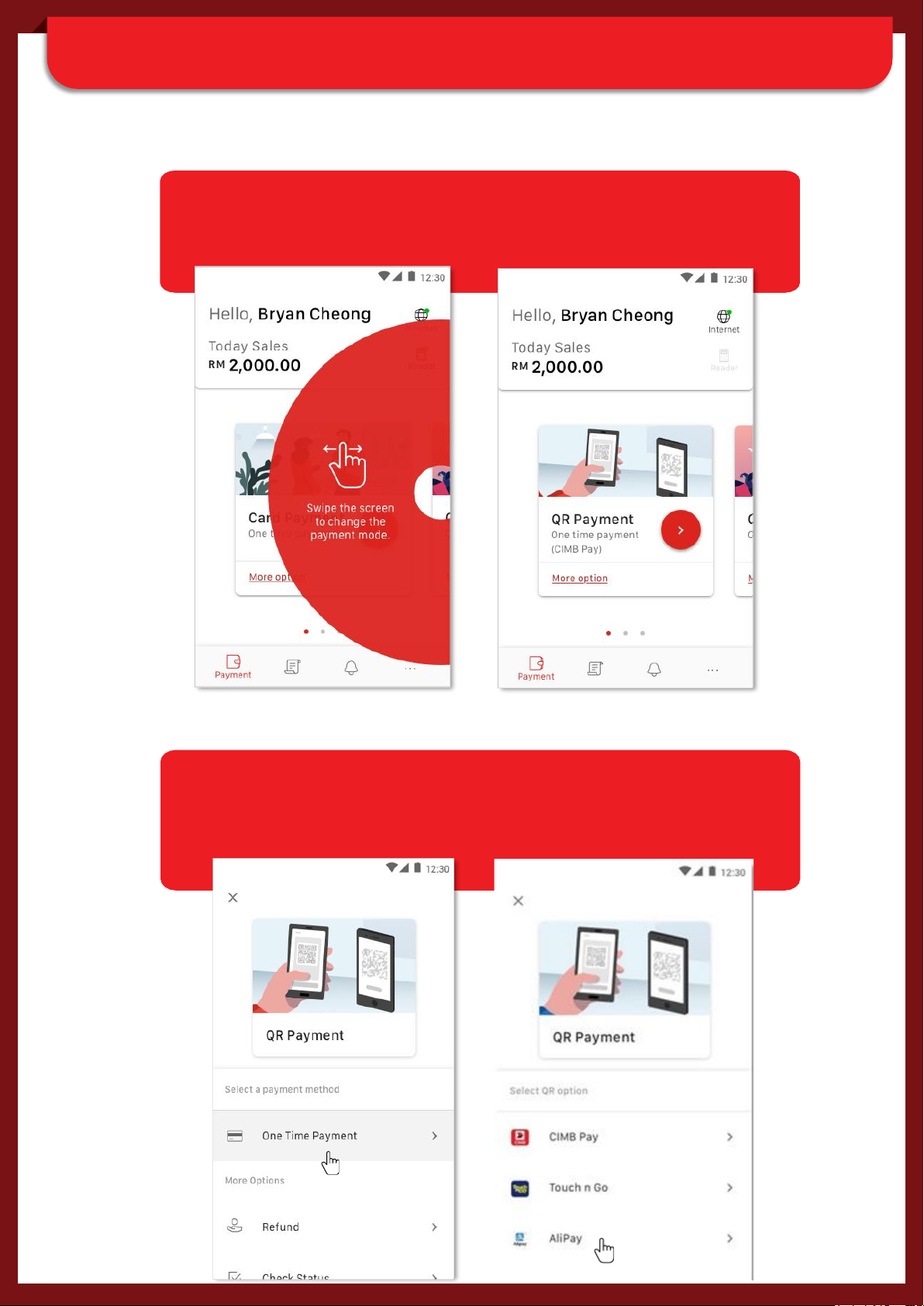

SECTION B: ACCEPTING QR PAYMENT

Step 1:

Swipe the screen to change to QR payment mode.

Tap “>” for default One Time Payment (CIMB Pay).

Step 1A:

In ‘QR Payment’ screen, tap on ‘More option’ to select other

payment method (eg. One Time Payment, Refund, etc) and

QR Option (eg. CIMB Pay, Touch n Go, Alipay)

18

SECTION B: ACCEPTING QR PAYMENT

Step 2:

Enter payment value and sales description.

Tap on ‘Continue’.

Step 3:

Confirm payment amount and Present the QR code to customer for

scanning

19

SECTION B: ACCEPTING QR PAYMENT

Step 4:

Key in customer's mobile number and/or email address to send e-receipt.

Tap ‘Skip it’ if customer does not wish to receive e-receipt.

Transaction completed.

20

Table of contents

Other CIMB Payment Terminal manuals

Popular Payment Terminal manuals by other brands

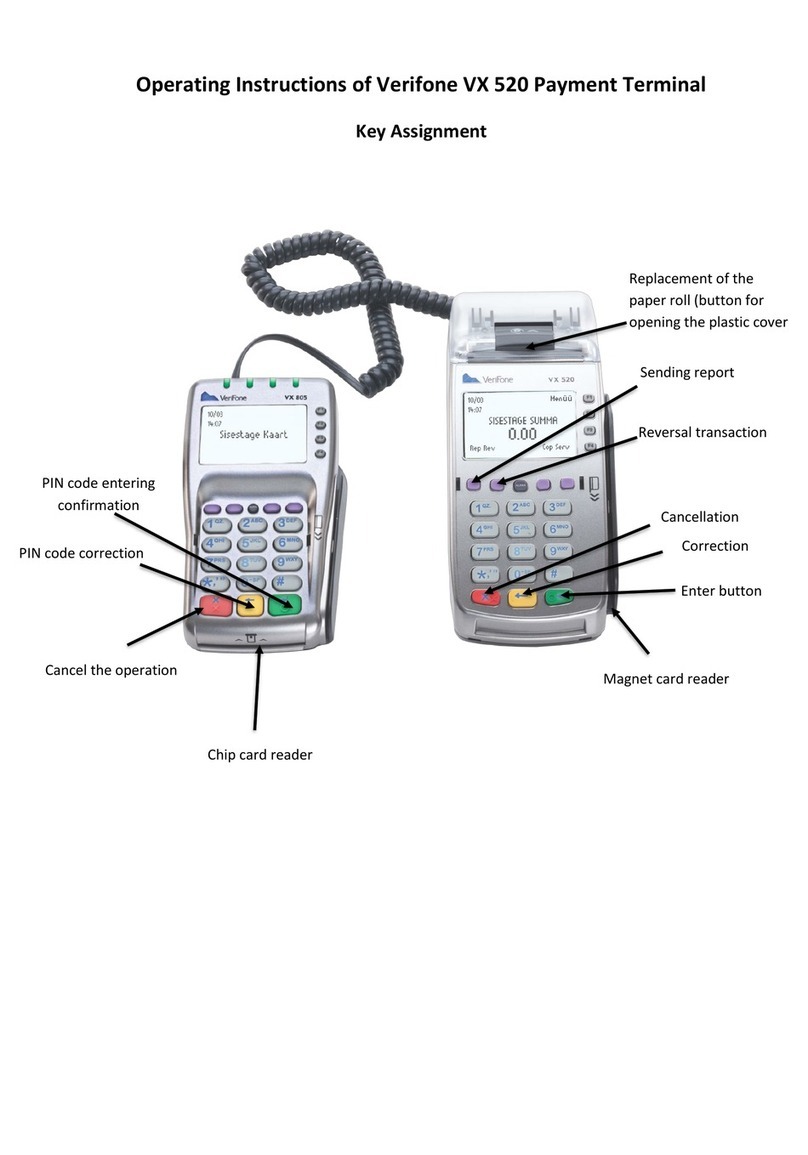

VeriFone

VeriFone Vx-520 Series APACS 40 manual

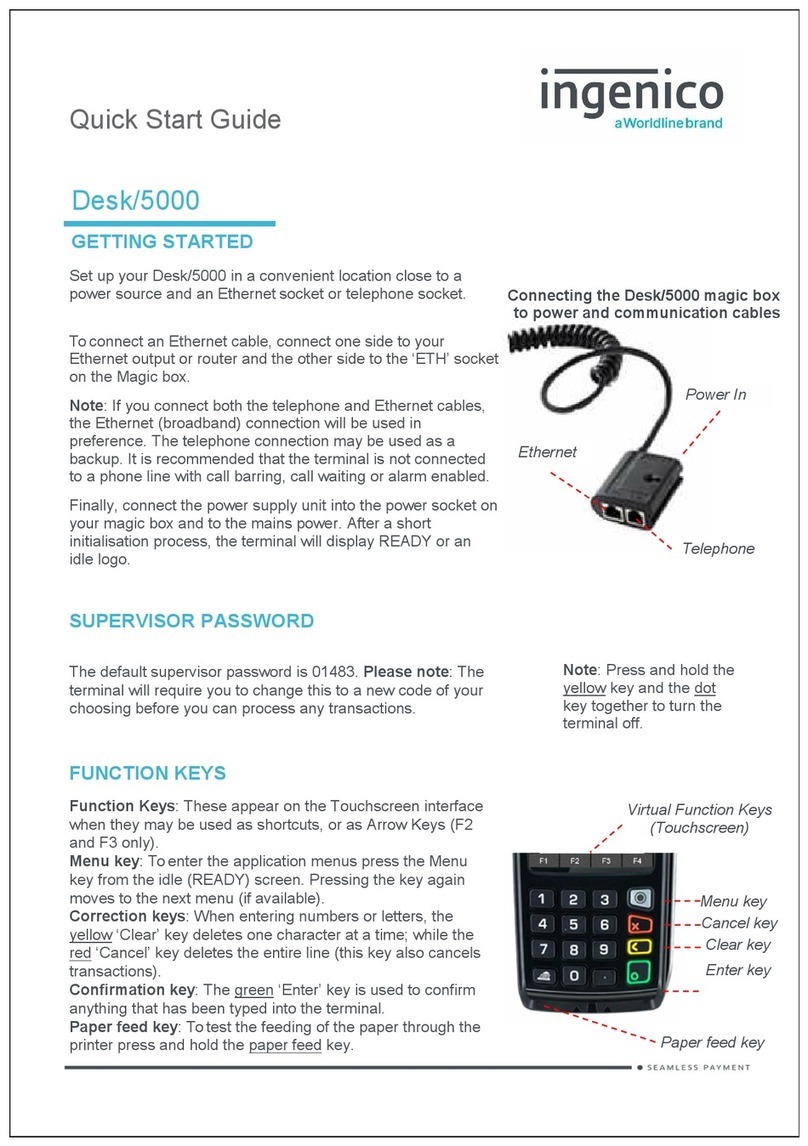

Ingenico

Ingenico iSC250 installation instructions

Worldline

Worldline Ingenico Telium TETRA Desk/3500 quick start guide

VeriFone

VeriFone VX 805 installation guide

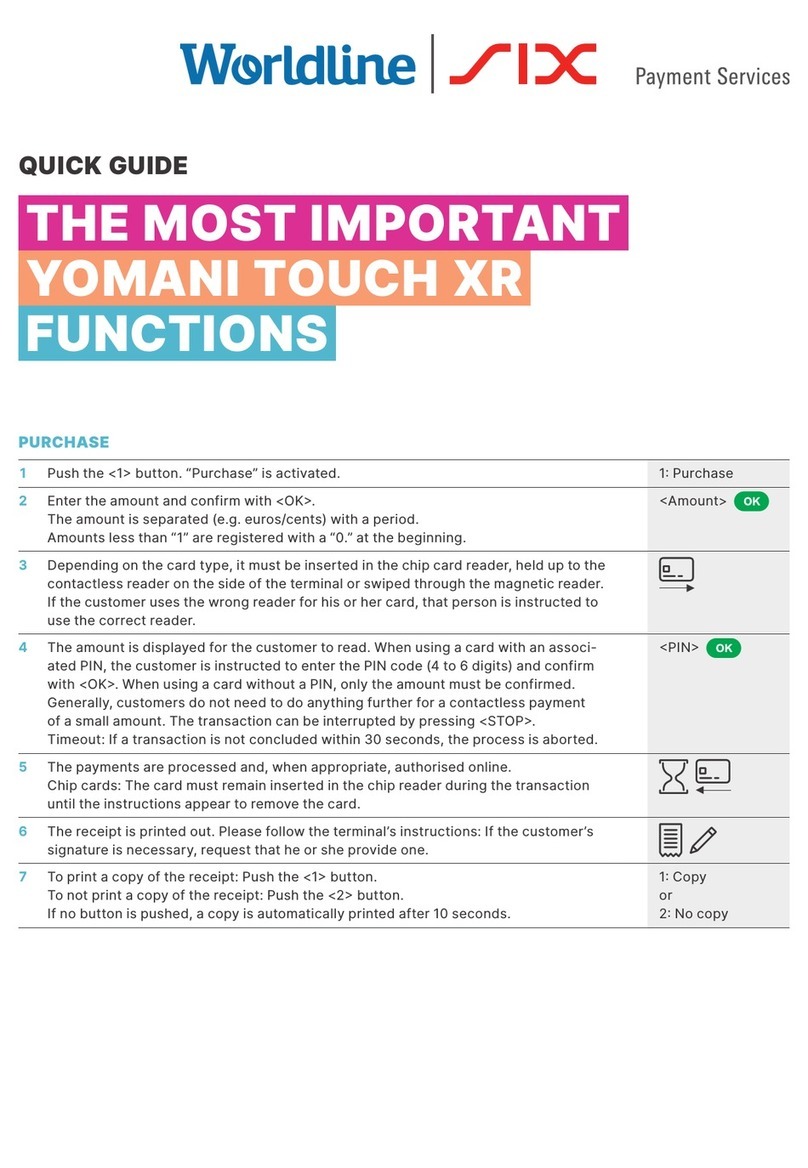

Worldline

Worldline SIX Payment Services YOMANI TOUCH XR quick guide

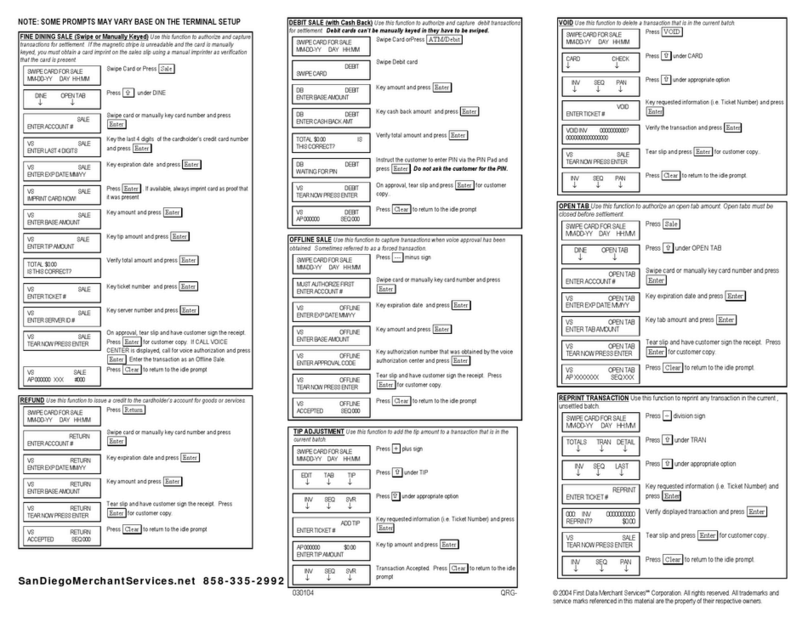

First Data

First Data nashville linkpoint 3000/aio Quick reference guide