Please note that it is the authorised merchant’s responsibility to ensure that the Merchant

Facility is returned. Failure to do so, may result in the continual charge of Terminal Rental

Fees until all equipment is returned in accordance with condition 16(iv) of the ANZ Mer-

chant Services General Conditions.

2. Cards You Can Accept

Credit Cards

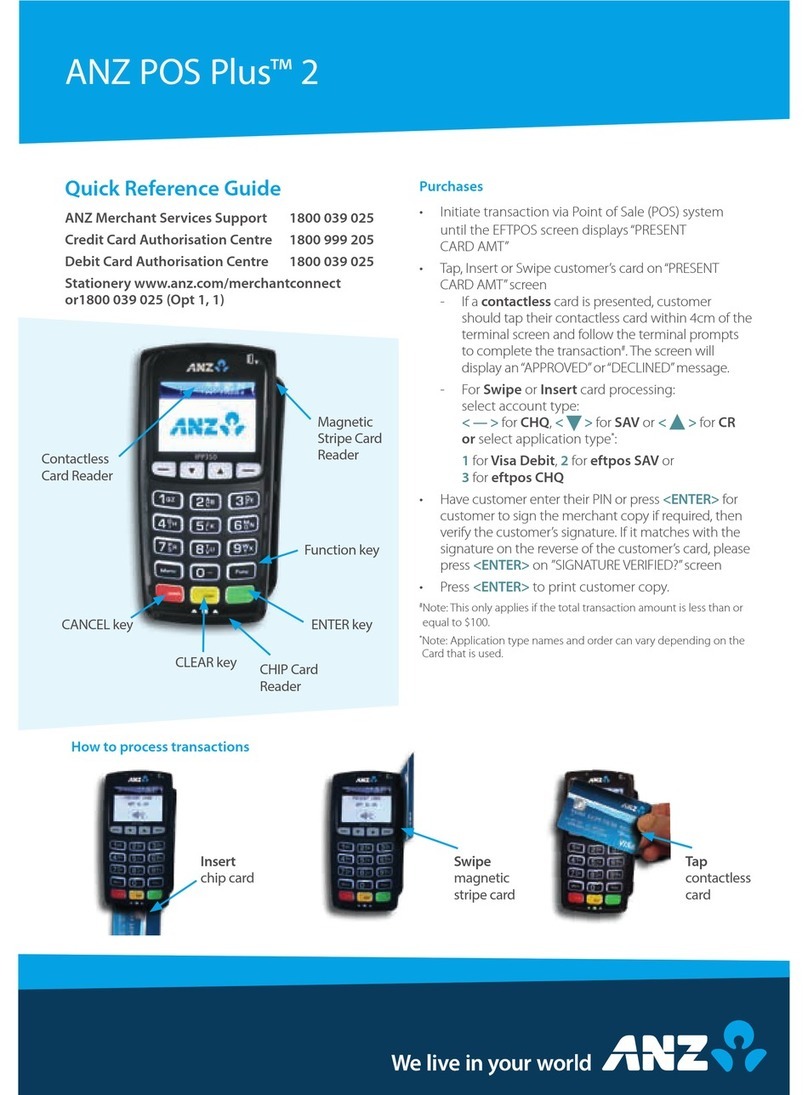

Cardholders can use credit cards (MasterCard®, Visa and UnionPay) to perform transactions

through the ANZ terminal on their credit card accounts. Cardholders can also access

cheque and savings accounts where those accounts are linked to the credit card.

Cardholders can access these accounts through the ANZ terminal using their PIN (Personal

Identification Number) and in some circumstances, their signature. Cardholders can also

use contactless cards to make the purchase by tapping their contactless card on the

terminal’s contactless reader. For contactless transactions under the certain purchase

value (AUD $100.00), PIN or signature may not be required to verify a transaction.

Debit Cards

Cardholders possessing a debit card will use a PIN for verification in most circumstances.

Cardholders can also use contactless cards by tapping the cards on the terminal’s

contactless reader. For contactless transactions under or equal to the certain purchase

value (AUD $100.00), PIN or signature may not be required to verify a transaction.

NOTE: The Electronic fallback, paper voucher and manual transaction are not allowed to process for

debit cards unless the Authorisation has been obtained (refer to section 1.4 Floor Limits).

Charge Cards

Processing charge cards is essentially the same as processing credit card transactions. To

accept charge cards, you must have an agreement with the charge card Issuer (eg. Diners

Club, American Express and JCB).

NOTE: Pre-authorisation transactions still require you to swipe or insert the customer’s debit cards

and credit cards in order to complete the transaction. You are unable to tap the customer’s

contactless card to complete these transactions.

3. Merchant Cards

You have been provided with two different types of Merchant Cards - EFTPOS Merchant

Card (Terminal ID card) and Merchant Summary Card (Merchant ID Card). These are

designed to use for with different purposes, including processing Refund Transactions and

Manual Paper Voucher Transactions.

It is your responsibility to always keep your Merchant Cards - EFTPOS Merchant Card

(Terminal ID card) and Merchant Summary Card (Merchant ID Card) in a safe place, and

ensure only authorised staff have access to these cards. Unauthorised access to these

cardscan result in unauthorised refunds via your merchant facility resulting in theft from

your business.

It is important that the correct cards are used at all times.