12 –Demo Mode..........................................................................18

13 –Employee Setup ...................................................................18

Default Employee ID Table ............................................. 19

14 –Reports.................................................................................19

15 –Handshake............................................................................20

16 –Terminal Set-up....................................................................20

Select a Location for the Terminal................................... 21

Unpack the Shipping Carton ........................................... 22

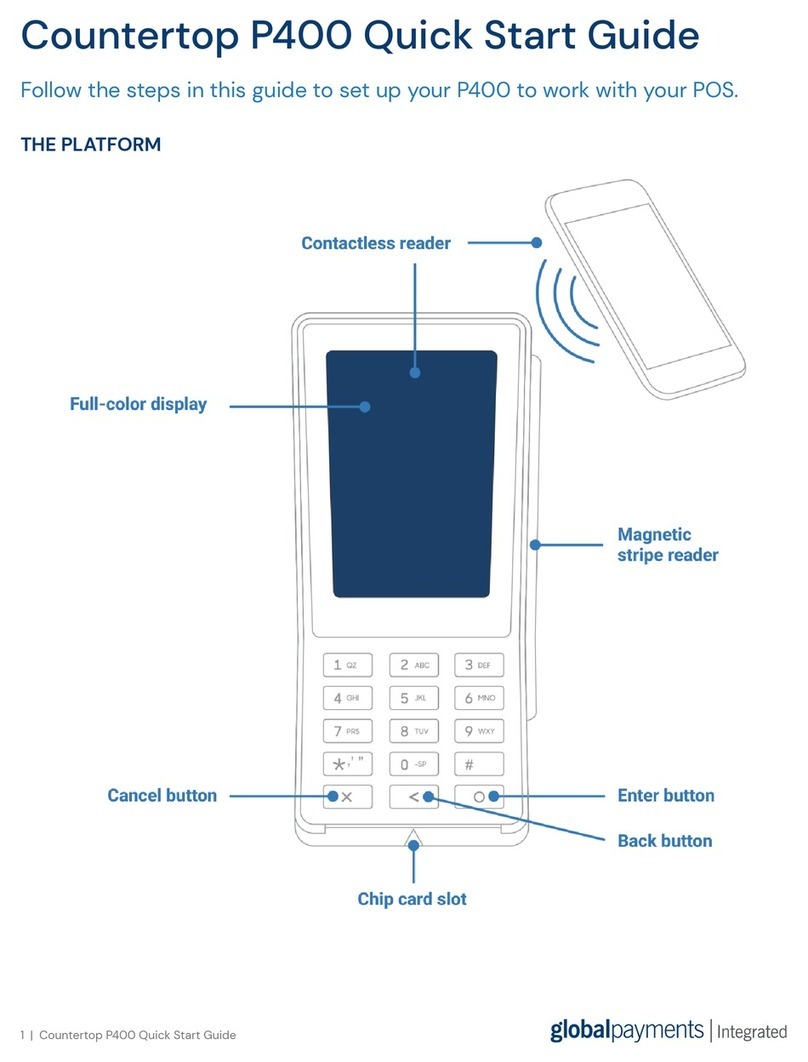

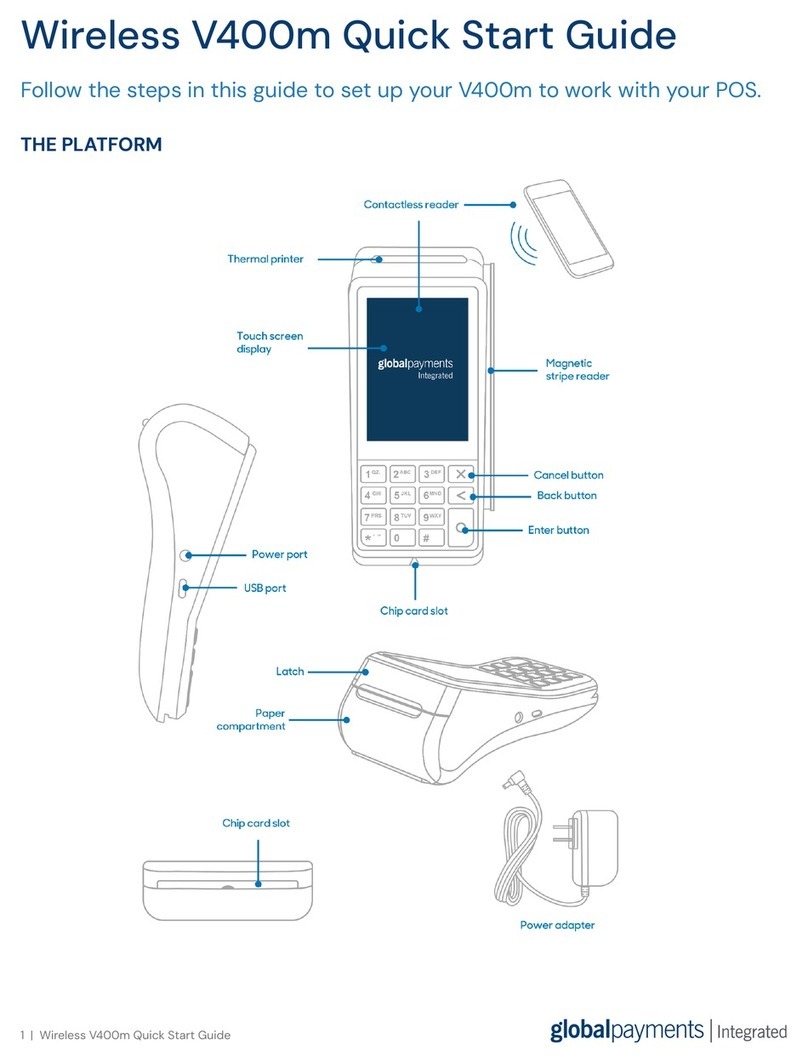

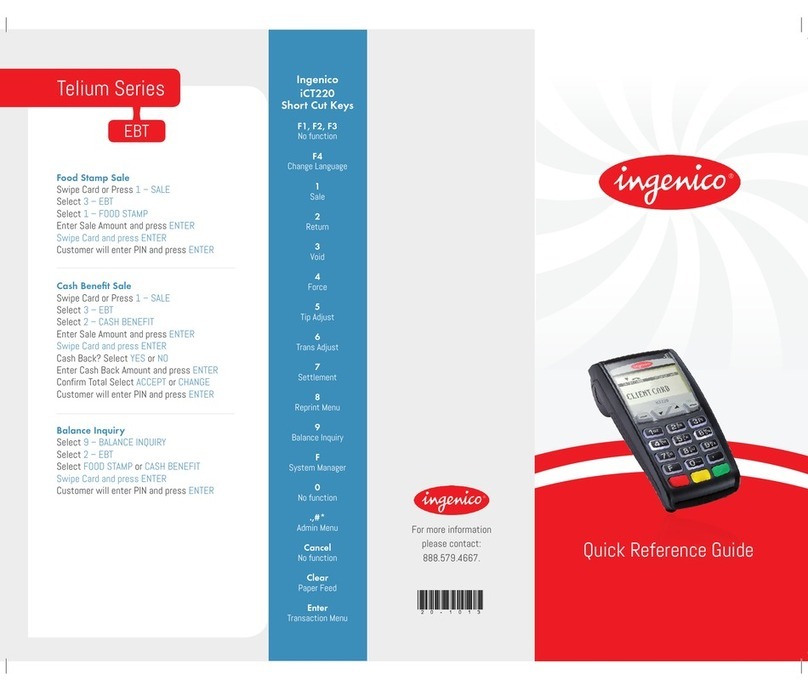

Examine Terminal Features ............................................ 22

General Features ............................................................ 23

Connection Ports on the Back Panel .............................. 24

Connecting the External PIN Pad.................................... 25

Installing the Paper Roll .................................................. 26

Cleaning the Terminal and Printer................................... 27

17 –Troubleshooting....................................................................28

Blank Display................................................................... 28

Terminal Does Not Connect to Global Payments ........... 28

Printer Does Not Print ..................................................... 28

Printer Paper Jam ........................................................... 29

Other Common Messages .............................................. 29

18 –Response Codes..................................................................29

19 –Abbreviations........................................................................31

20 –Other Features......................................................................32

21 –Service and Support.............................................................32

22 –Terminal Specifications ........................................................33

23 –Notes ....................................................................................34