Introduction

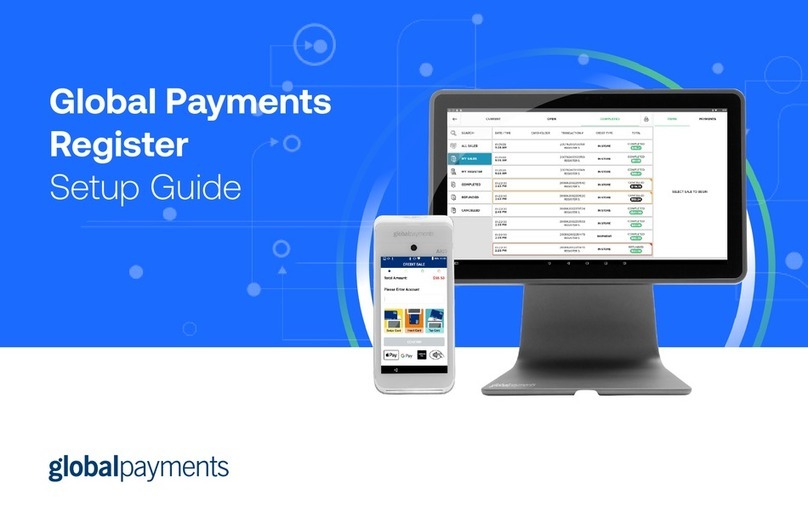

Global Payments offers merchants a wide variety of leading payment

technology solutions, all from one reliable source. As one of the world’s

largest and most trusted payment technology solution providers, Global

Payments combines industry-leading expertise with over 50 years of

Canadian-specific experience. This powerful combination allows us to

deliver comprehensive solutions that are personalized to your needs.

This guide is your primary source of information for operating, setting up,

and installing the Global Payments’ Wireless - Move/5000 and

Move/5000 Multi-Merchant terminal.

For questions or support, please contact Global Payments Customer

Care.

General Tips

The following tips will help ensure you continue to process smoothly with

Global Payments Canada:

1. This reference guide contains information on the features and

functions capable of your terminal, as well as basic troubleshooting

techniques. Keep this guide in an easy-to-find location.

2. Perform a settlement daily; this ensures that your funds are

constantly deposited into your bank account regularly.

3. Change your passwords frequently. Changing passwords frequently

ensure you protect yourself from unauthorized use of your terminal.

4. If you have a problem with your terminal, check cabling and attempt

a reset by unplugging and re-plugging the power supply.

5. If you have a communication problem with your terminal, verify that

there are currently no outages reported by your telephone company

or your Internet service provider.

6. The Global Payments Canada Customer Service line is open 24

hours a day, 7 days a week, to ensure there is always someone

available to assist you.

Basic Terminal

Operations

Before You Begin

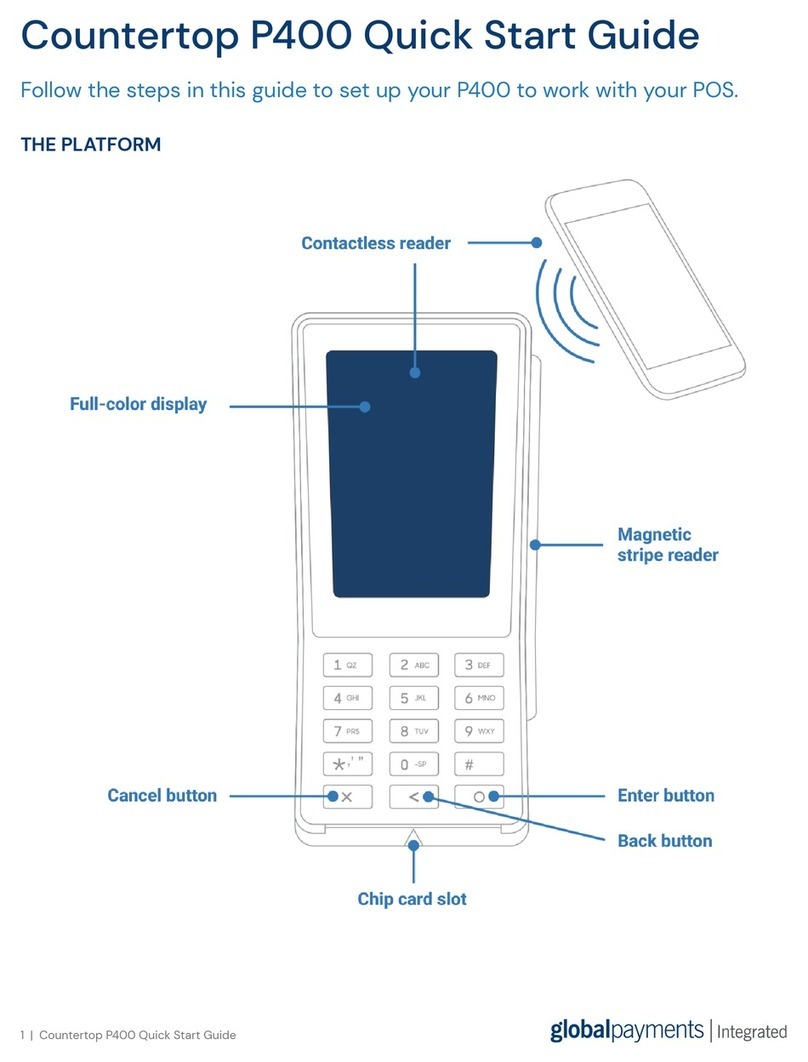

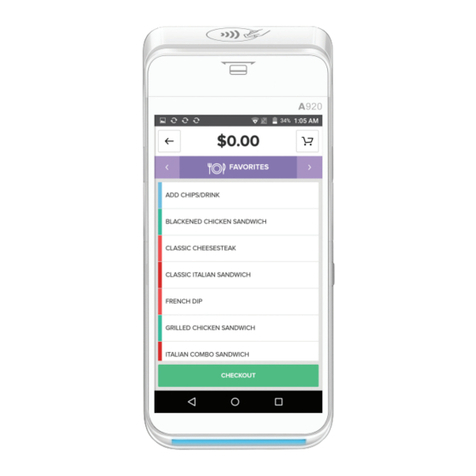

The terminal (“Desk/5000”) is a point-of-sale electronic payment

terminal designed to process debit and credit card transactions via

an Internet or standard dial connection. For terminal set-up

instructions, refer to Section 18.

Due to risk of shock or terminal damage, do

not use the terminal near water, in a wet

basement, bathtub, washbowl, kitchen sink,

laundry tub, or near a swimming pool. Do not

use in flammable environments.

Unpacking the Shipping Carton

Carefully inspect the shipping carton and its contents for shipping

damage. If the content is damaged, file a claim immediately with the

shipping company and notify Global Payments. Do not try to use

damaged equipment.

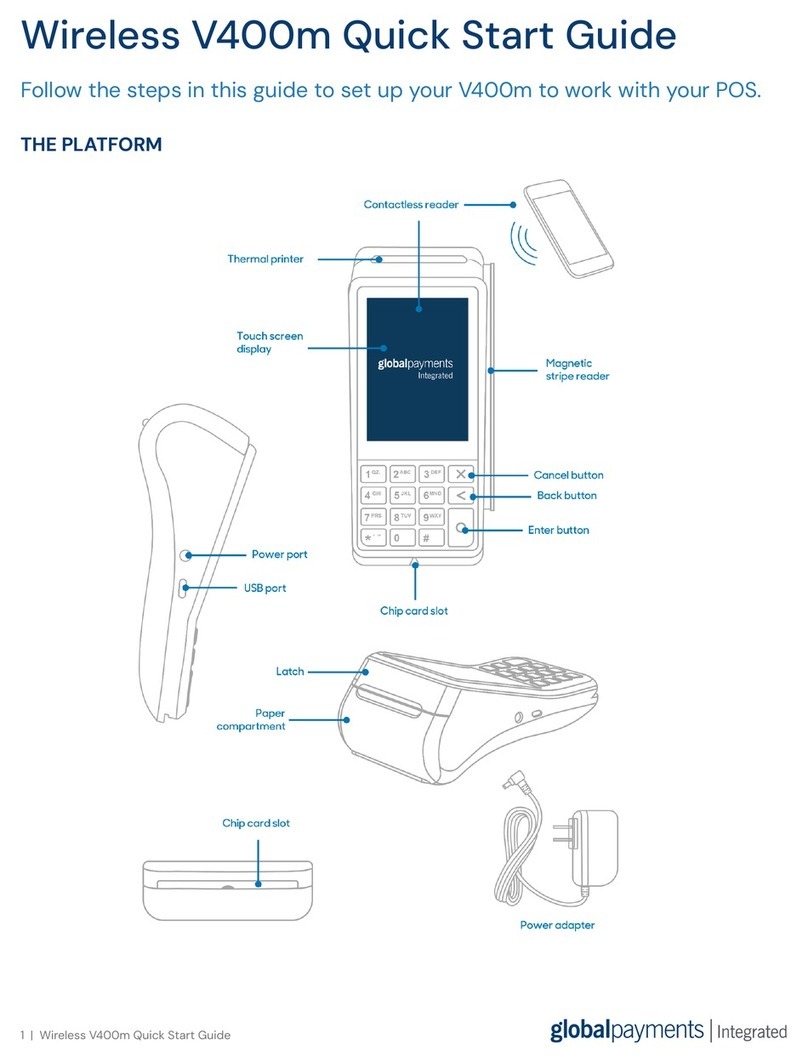

Remove the items from the carton. You should have the following

items, according to what was ordered:

●A Global Payments Countertop -Desk/5000 terminal with paper

roll installed

●An external power supply

●Roll of thermal printer paper

●Quick Start Instructions

●Ethernet cable and/or telephone cord