3. Credit/Refund Transactions are performed when you

make a mistake or need to facilitate a refund and the

transaction has already been settled. Credits may only be

processed to the card used for the original transaction.

Do not issue a credit by giving the cardholder cash (or a

check) if the original purchase was made with a card.

Also, do not credit a card for purchases originally made

by cash or check. If you have a special policy regarding

returns or refunds, make sure you clearly post it at the

point of sale and print it on the transaction receipt close to

the cardholder’s signature.

TRANSACTION RESPONSES

When you process a card, the four most common

responses received are Approved, Decline, Pick Up Card, and

Referral or Call Authorization. Descriptions of these responses

are below:

1. Approved – Good news! Complete the transaction.

2. Decline – You will need to ask for an alternative form of

payment.

3. Pick Up Card – This one is tricky. The Card Issuer is

asking you to decline the transaction and not to return

the card to the cardholder. We have tips to help you

manage this and encourage you to read them by visiting

www.paymentsinsider.com. You can learn about manag-

ing Code 10 Security Alerts and what to do with an

unauthorized card.

4. Referral or Call Authorization – This means the Card

Issuer wants you to call the Voice Authorization Center to

provide additional information or obtain an approval code.

Once you make the call, you will receive an approval or

decline.

TIPS & HINTS

Can I Void a Transaction? Yes! A void can be performed if

you ran the transaction incorrectly or a customer changes

his mind after the transaction is complete but not yet settled.

Voiding a transaction makes it appear to the cardholder as if

the transaction never happened. To learn how to void a

transaction on your point-of-sale solution, please reference

the flip side of this guide or visit www.paymentsinsider.com.

How Do I Settle Daily Transactions? Great question! You

need to settle transactions every day! Settling transactions is

required in order for us to fund your account. Higher rates

may apply if transactions are not settled daily. To learn

how to settle transactions on your point-of-sale solution,

please reference the next page of this guide or visit

www.paymentsinsider.com.

What is EMV? EMV, or chip cards, may be new to the US

but are in wide use globally. There are over 2 billion chip

cards in circulation world-wide, which have become popular

due to the increased security protection they offer com-

pared to the traditional magnetic stripe card. Elavon offers

EMV-capable equipment, so you can process both card

types quickly and easily.

TIPS FOR PROCESSING

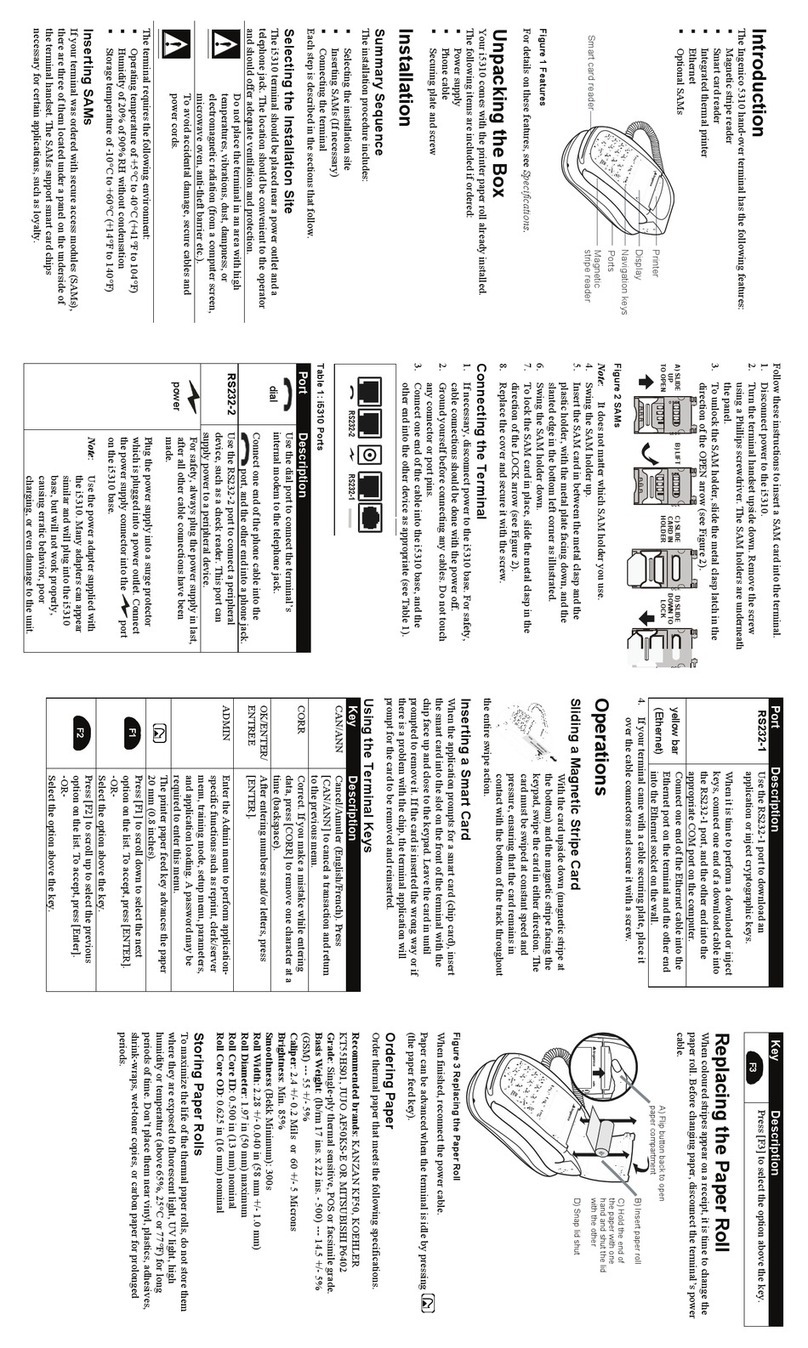

• To scroll through the menu, press MORE

• Press 3 multiple times until the paper advances to

desired length

CREDIT/DEBIT SALE

• Select SALE

•Input amount and press ENTER

•If prompted, select YES to confirm amount or NO to

cancel transaction

•If NO is selected, press CANCEL to end transaction

•Swipe, insert, or tap card, or manually enter the account

# and press ENTER

•If prompted, select CREDIT or DEBIT

• If prompted “Enter PIN or press Enter”, cardholder

enters PIN or presses ENTER to bypass

Restaurant Prompts

• If prompted, select Tip % or select OTHER AMOUNT to

key amount

• If OTHER AMOUNT is selected, enter the Tip Amount

and press ENTER

Manually-Keyed Security Prompts

• Input expiration date and press ENTER

• Select YES or NO to indicate card presence

• If YES is selected, imprint card and press ENTER

• Input V-Code and press ENTER

• If prompted, input Street Address and press ENTER

• If prompted, input Zip Code and press ENTER

(The transaction processes and a Merchant Copy of the

receipt prints)

• Select YES to print Customer Copy

• If prompted “Amt Exceeds Bal – Amt Authorized $00.00,

Balance Due $00.00, Continue?” select YES and collect

remaining amount due with another form of payment or

NO to reverse the authorization and cancel the

transaction

REPRINT

• Press REPRINT

• Select LAST RECEIPT, or select ANY RECEIPT and

follow prompts

• Requested Merchant Copy of the receipt prints

• Select YES to print Customer Copy

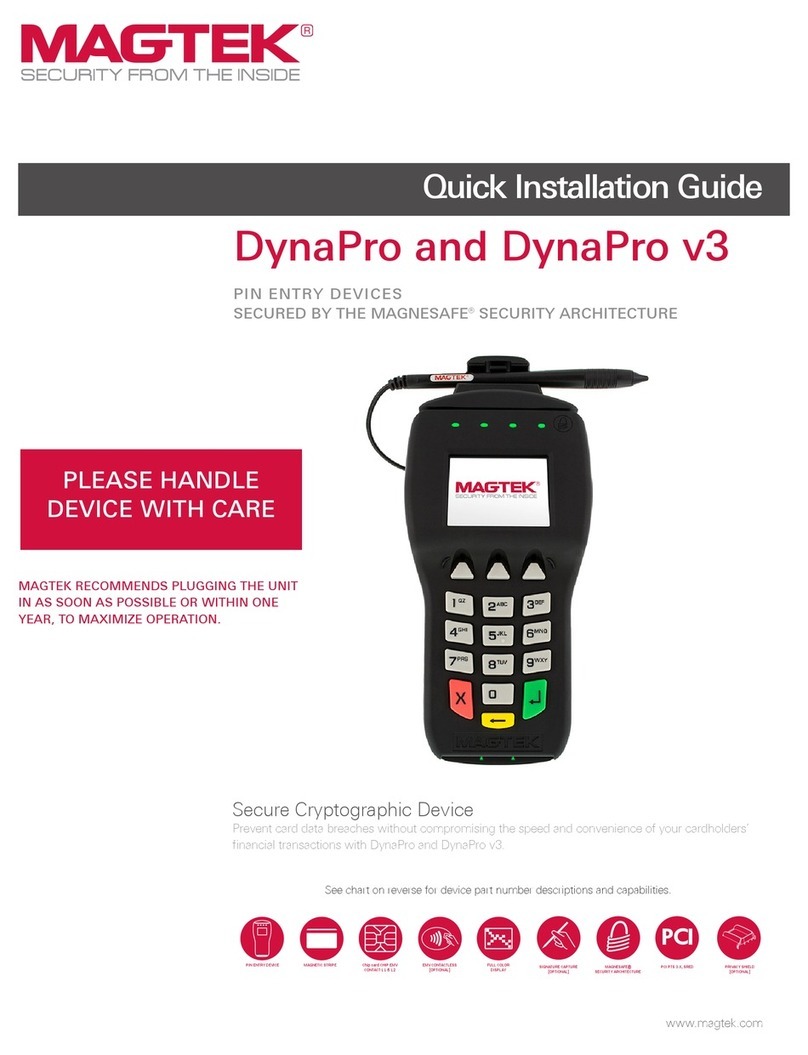

= Cancel/No

= Backspace

= Enter/Yes