Introduction

Global Payments offers your business a wide variety of leading payment

technology solutions, all from one reliable source. As one of the world’s

largest and most trusted payment technology solution providers,

Global Payments combines industry-leading expertise with over 50 years

of Canadian-specific experience. This powerful combination allows us to

deliver comprehensive solutions that are personalized to your needs.

This guide is your primary source of information for operating, setting up,

and installing the Global Payments Terminal. For terminal-related

questions or support, please contact Global Payments’ Customer Care.

General tips

To help ensure a smooth processing experience with Global Payments

Canada, please consider the following tips:

1. User guide: Make sure to keep this user guide in an easily accessible

location. It contains valuable information about your terminal's

features, functions, and basic troubleshooting techniques.

2. Daily settlement: It is recommended to perform a daily settlement.

This practice ensures that your funds are deposited into your bank

account on a regular basis, providing you with timely access to your

funds.

3. Password security: To protect yourself from unauthorized use of

your terminal, it is essential to change your passwords frequently.

Regularly updating your passwords enhances the security of your

terminal and helps safeguard your account information.

4. Troubleshooting: If you encounter any issues with your terminal, start

by checking the cabling connections and attempt to reboot the

device. Oftentimes, this simple troubleshooting step can resolve

common problems and restore normal functionality.

5. Communication problems: In case of communication issues with

your terminal, first verify that there are no reported outages from

your Internet or wireless service provider. This step helps rule out

external factors that may be causing the problem.

6. Customer service support: Remember that Global Payments

Canada offers a dedicated Customer Service line. Whenever you

need assistance or encounter difficulties, reach out to their support

team. They are available to provide prompt assistance and ensure

that you receive the help you need.

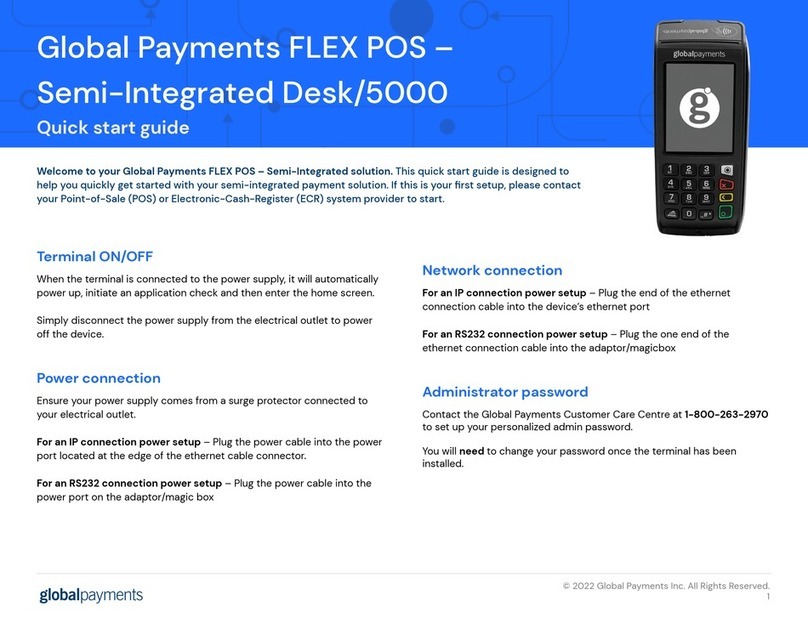

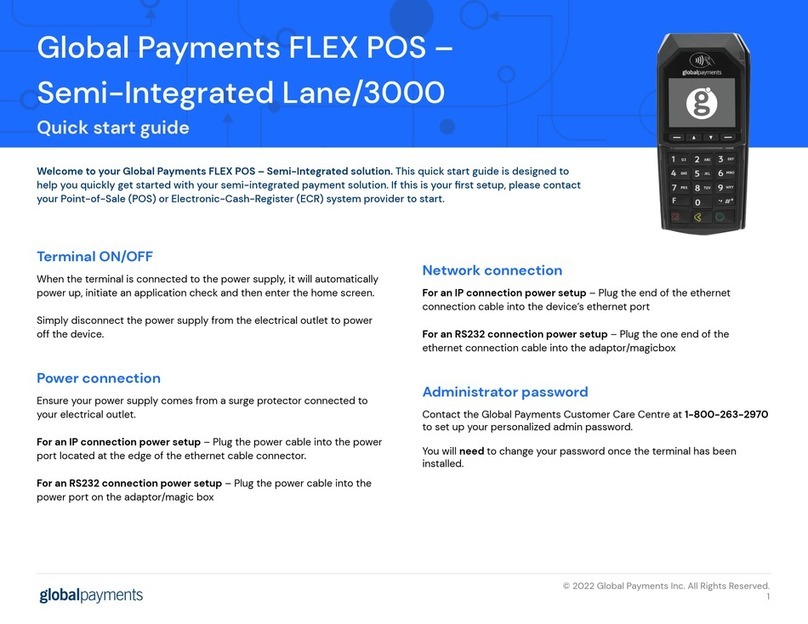

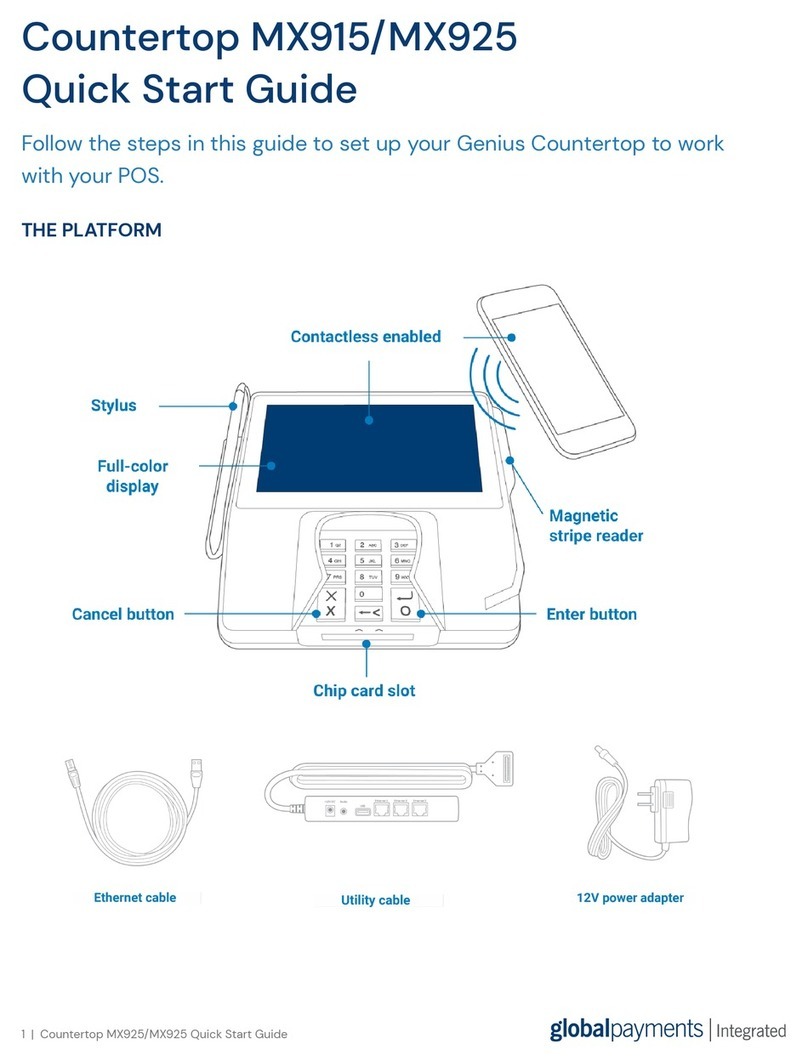

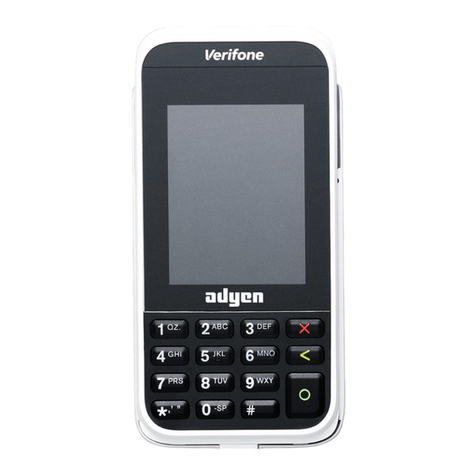

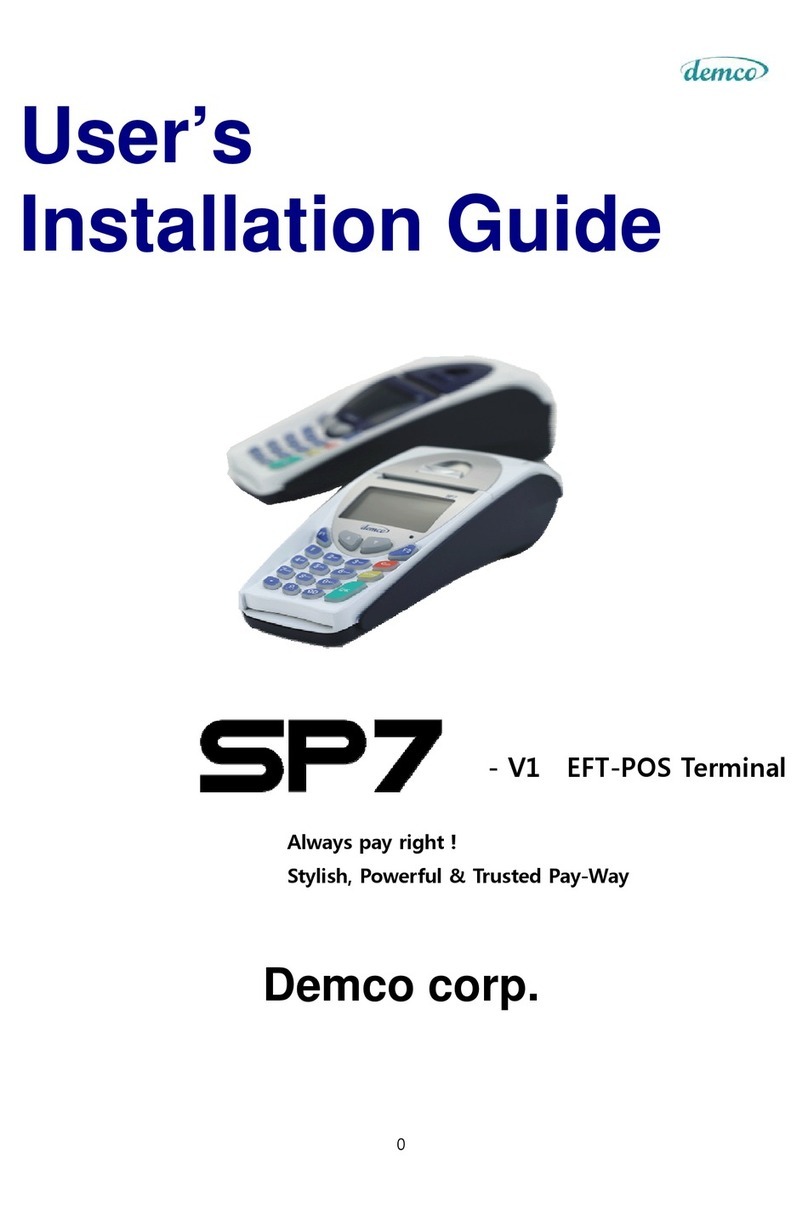

Available hardware

Global Payments offers a variety of terminal options to cater to different

needs. This guide is tailored specifically for the Verifone T650C

countertop and T650P wireless devices. To determine which device you

are using, please refer to the images provided below: