6

For transactions over the Authorised Floor Limit, you must phone the Authorisation Centre

using the phone numbers outlined in section 1.2 to verify if the account has sufficient funds

available to cover the transaction. If approval is not obtained for transactions above your

Authorised Floor Limit, you risk the transaction being charged back.

When you contact the Authorisation Centre, a transaction will be ‘approved’ or ‘declined’.

If declined, please advise the customer to contact the Card Issuer and seek an alternative

method of payment.

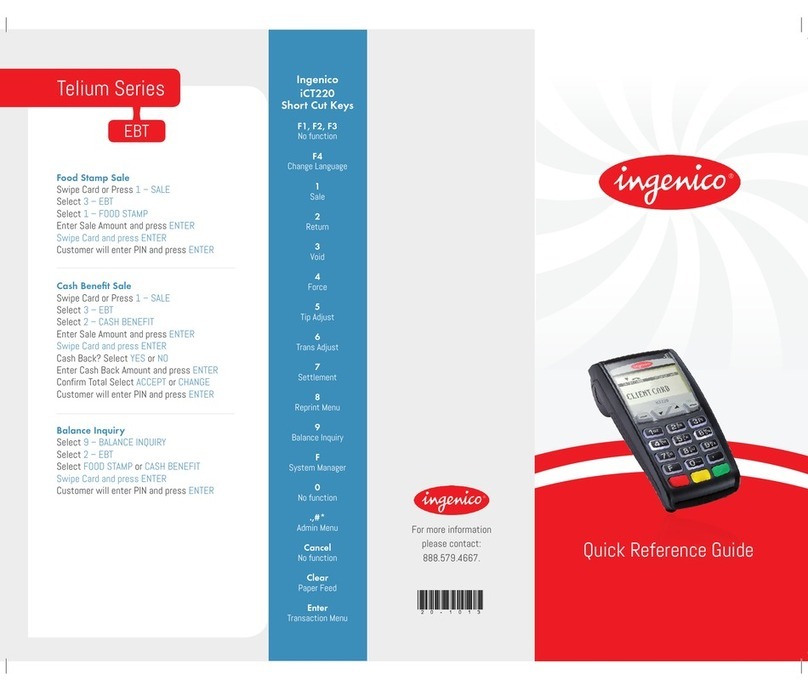

NOTE: An alpha character may be provided as part of the approval code. Select the numeric key

corresponding to the alpha character and press <▼> key to scroll through options. Example: If character

‘C’ is required, select number ‘2’ on the terminal and press the <▼>key until you scroll to character ‘C’,

then press ENTER.

NOTE: A transaction may still be charged back despite being authorised by the Authorisation Centre.

Retain Card

If the Card Issuer has cancelled the card, the Authorisation Centre may ask that you try to

retain the card.

1.5 Change of Business Details

General Conditions describes various situations in which you must notify us of a change to

your circumstances.

Please visit anz.com/merchantconnect to complete and submit the respective form or contact

ANZ Merchant Services on 1800 039 025 if there are any changes to your:

• Business name and/or address

• Business type or activities including changes in the nature or mode of operation of

your business

• Mailing address

• Ownership

• Bank/branch banking details

• Telephone or fax numbers

• Industry

• Email address.

Should your business be sold, cease to trade or no longer require an ANZ Merchant Facility,

please contact ANZ Merchant Services immediately on 1800 039 025.

The ANZ Merchant Services General Conditions sets out your obligations when your business

is sold, ceases to trade or no longer requires an ANZ Merchant Facility.

You must ensure that all stationery, promotional material, Transaction Vouchers, Card

Imprinters and equipment (including Electronic Terminals) is returned to ANZ, based on the

closure instructions provided by ANZ Merchant Services.

Please note: It is the authorised merchant’s responsibility to ensure that the Merchant Facility is returned.

Failure to do so, may result in the continual charge of Terminal Rental Fees until all equipment is returned in

accordance with condition 16(iv) of the ANZ Merchant Services General Conditions.