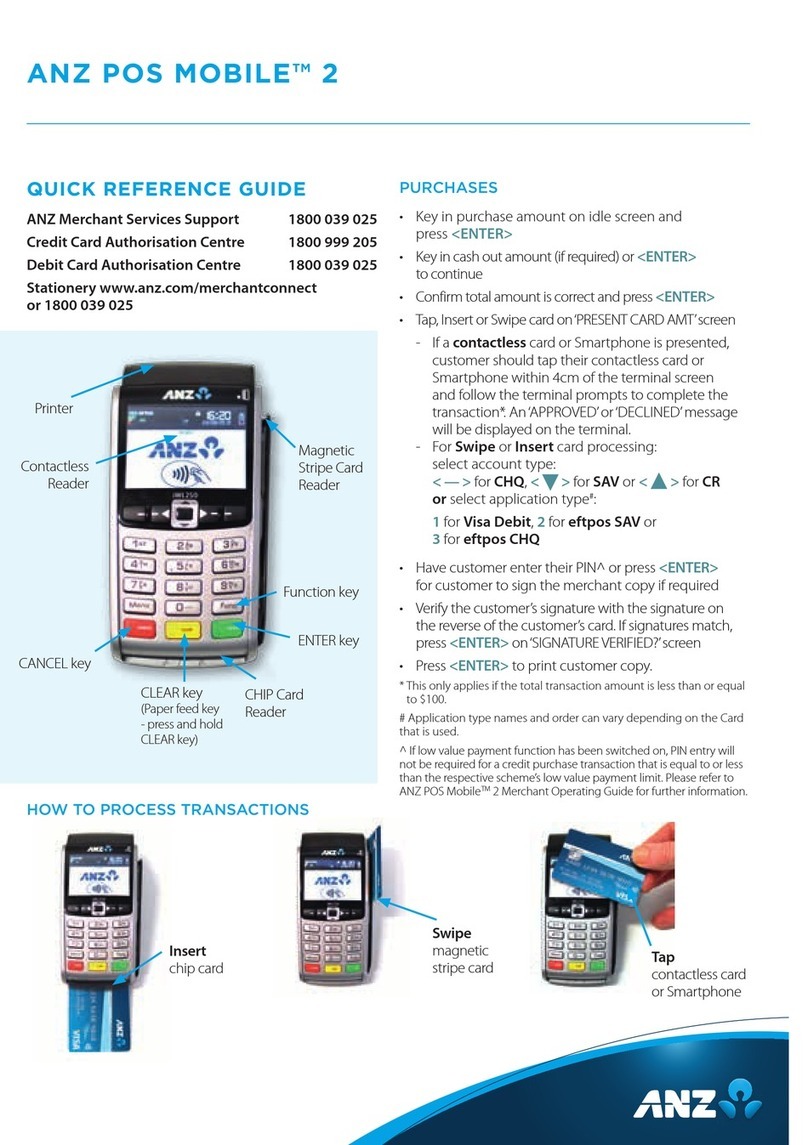

Card Validation Code (CVC2):

The Card Validation security feature is

activated in all ANZ POS Terminals

when processing Mail Order and

Telephone Order Transactions. To

activate the CVC2 for other

Transactions please contact ANZ

Merchant Services on 1800 039 025.

If activated, a new screen will appear

when processing nancial

Transactions.

Card Validation Code.

Turn the cardholder’s credit card over and locate the last 3-digits of the number printed on

the signature panel. If the Transaction is initiated via mail, telephone or Internet, instruct

the cardholder to locate and quote the 3-digits on the signature panel.

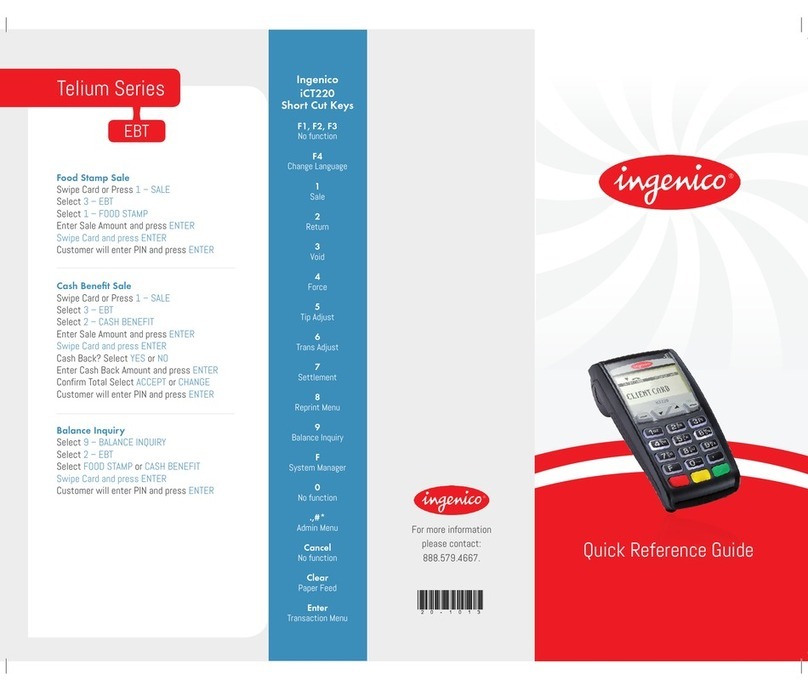

Terminal Display

At this display screen, key in the Card Validation Code

then press ENTER.

NOTE: American Express cards have a four digit code located on the front of the card. Diners Club

cards have a three digit code on the reverse of the signature panel.

After Processing the Transaction:

• Check the card number details against those printed on the Transaction Record

• Ensure that ‘Approved’ or an approval number/code is printed on the Transaction

Record.

Fraud Minimisation for Debit Cards

The following procedures are vital in helping you identify and minimise fraudulent debit

card Transactions via your Merchant Facility.

Debit Transactions are to be processed by swiping the presented card and having the

customer enter their PIN or signature depending on the debit card type.

Cards Left at Premises

From time to time customers may accidentally leave their debit or credit cards behind at

your premises. To ensure any potential fraud is minimised and to better align with broader

industry practices, a change to existing handling process is required.

Upon discovering a card left at your premises, you are to perform the following tasks:

- Retain the card in a safe place for a period of up to two business days;

- Hand the card to the customer claiming the card only after having established the

claimant’s identity by comparing signatures; and

14–15

- If the requisite two business days have passed, destroy the card

Should the cardholder enquire about their missing card, instruct them to contact their

issuing institution.

PCI DSS and Data Storage

What is the Payment Card Industry Data Security Standard (PCI DSS)?

PCI DSS is a set of standards implemented by the Card Schemes, MasterCard – Site Data

Protection (SDP), and Visa – Account Information Security (AIS), to manage the risk to

merchants of data breaches or hacker access. The standards apply to all merchants who

store credit card data in any formation, have access to credit card details, or have systems

which enable internet access to their company by the public.

Benets to your business

• Ensuring the security of cardholder data can lessen the likelihood of a data breach

being traced back to your business

• Your business will experience continued patronage due to customers’ condence in the

secure storage of vital information

• Helps to identify potential vulnerabilities in your business and may reduce the

signicant penalties and costs that result from a data breach.

Failure to take appropriate steps to protect your customer’s payment card details means

you risk both nancial penalties and cancellation of your merchant facility in the event of a

data compromise.

Key areas of focus

PCI DSS covers the following six key principles:

• Build and maintain a secure network

• Protect cardholder data

• Maintain a vulnerability management program

• Implement strong access control measures

• Regularly monitor and test networks

• Maintain an information security policy

What you need to do

MasterCard and Visa have created a set of tools and resources to assist you to implement

the PCI DSS. Visa’s program is called Account Information Security (AIS). MasterCard’s

program is called Site Data Protection (SDP).

For more information on working towards PCI DSS compliance, visit the PCI Security

Standards Council website at: pcisecuritystandards.org/index.shtml

Storage of prohibited cardholder data

As a merchant, it is vital to protect your customers as well as your business against misuse

of credit & debit account information. It is essential that you do not store prohibited

cardholder data after a transaction is completed.

VERIFICATION NO?