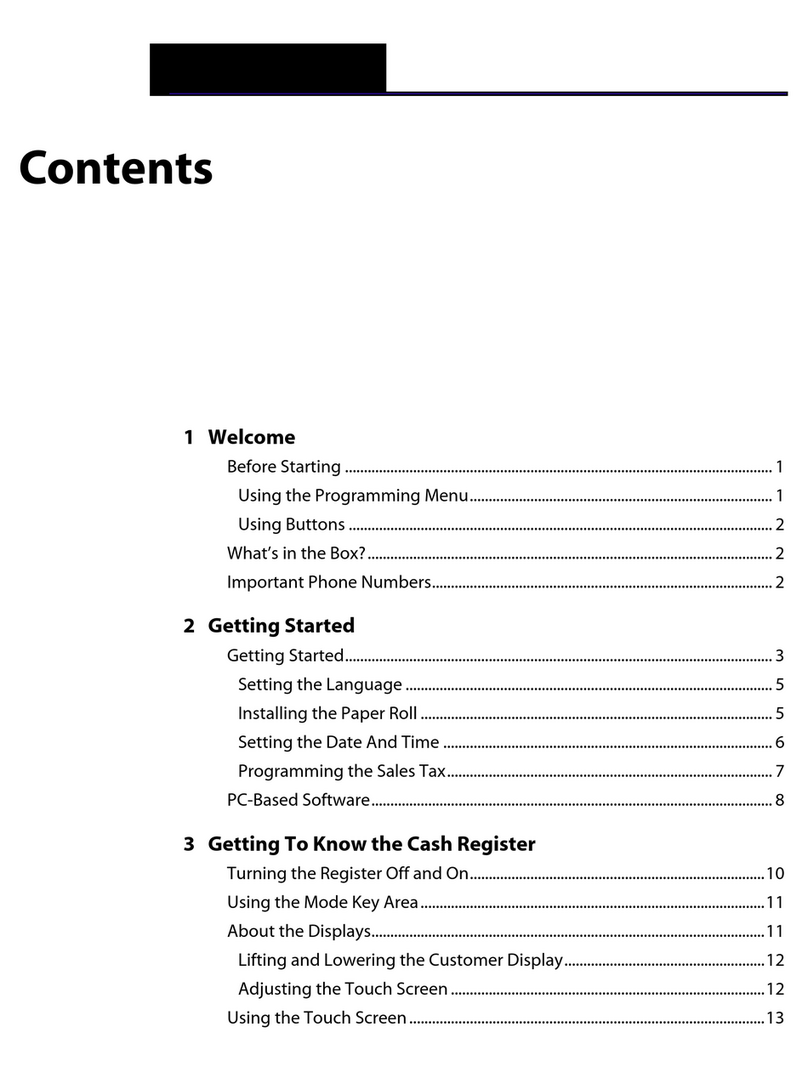

TABLE OF CONTENTS

TRANSACTION EXAMPLES FOR OPERATING THE CASH REGISTER ................................................... 28

SAMPLE RECEIPT ................................................................................................................................. 28

TRANSACTION SYMBOLS .................................................................................................................... 28

STANDARD TRANSACTIONS ............................................................................................................... 29

Registering a Single Item Sale and Tendering Change ...................................................................... 29

Registering a Sale to Multiple Items ................................................................................................... 29

Registering a Charge Transaction ..................................................................................................... 29

Using Split Tendering ......................................................................................................................... 30

MINUS (-) KEY TRANSACTIONS ........................................................................................................... 30

Registering a (-) Reduction (Coupon) ................................................................................................ 30

PERCENT DISCOUNT (-%) TRANSACTIONS ....................................................................................... 30

Discounting (-%) Indi idual Items ....................................................................................................... 30

Using a Preset Discount (-%) on the Total Sale ................................................................................. 30

Using a Preset Discount (-%) on Indi idual Items .............................................................................. 30

O erriding the Preset Discount (-%) .................................................................................................. 31

PLU CODES ........................................................................................................................................... 32

Using Fixed PLU Price ....................................................................................................................... 32

Using Open PLU Price ....................................................................................................................... 32

O erriding Open PLU Price ............................................................................................................... 32

VOID AND REFUNDS ............................................................................................................................ 33

Voiding the Pre ious Entry in the Middle of a Sale ............................................................................. 33

Voiding a Single Item ......................................................................................................................... 33

Voiding Multiple Items ........................................................................................................................ 33

Refunding a Single Item ..................................................................................................................... 34

Refunding Multiple Items ................................................................................................................... 34

TAX OVERRIDE TRANSACTIONS ........................................................................................................ 35

Exempting Tax on an Item ................................................................................................................. 35

Exempting Tax on an Entire Sale ....................................................................................................... 35

Adding Tax to a Non-Taxed Department............................................................................................ 35

OTHER TRANSACTIONS ...................................................................................................................... 36

Registering Money Recei ed on Account........................................................................................... 36

Paying Money Out ............................................................................................................................. 36

Registering an Identification Number ................................................................................................. 36

Registering a No Sale ........................................................................................................................ 36

MANAGEMENT REPORTS ......................................................................................................................... 37

"X" POSITION REPORT ......................................................................................................................... 37

"Z" POSITION REPORT AND RESET .................................................................................................... 37

PRINTING THE SALES REPORT .......................................................................................................... 37

CLEARING THE GRAND TOTAL ........................................................................................................... 37

SAMPLE MANAGEMENT REPORT ....................................................................................................... 38

BALANCING FORMULAS ...................................................................................................................... 39

PLU REPORT ......................................................................................................................................... 40

TROUBLESHOOTING (FULL SYSTEM CLEAR PROCEDURE) ................................................................ 41

TAX SYSTEM PRESET ............................................................................................................................... 42

VAT TAX SYSTEM ....................................................................................................................................... 43

CANADIAN TAX SYSTEM ...................................................................................................................... 44-45

ACCESSORIES ORDER FORM ................................................................................................................. 46

EXTENDED WARRANTY ............................................................................................................................ 47

LIMITED WARRANTY ................................................................................................................................. 48