TD TD Generation Portal 2 with PINpad User manual

For the TD Generation:

• Portal 2 with PINpad

TD Generation

Quick Start Guide

COPYRIGHT © 2016 by The Toronto-Dominion Bank

This publication is conidential and proprietary to The Toronto-Dominion Bank and is intended solely for the use of

Merchant customers of TD Merchant Solutions. This publication may not be reproduced or distributed, in whole or in part,

for any other purpose without the written permission of an authorized representative of The Toronto-Dominion Bank.

NOTICE

The Toronto-Dominion Bank reserves the right to make changes to speciications at any time and without notice.

The Toronto-Dominion Bank assumes no responsibility for the use by the Merchant customers of the information

furnished in this publication, including without limitation for infringements of intellectual property rights or other

rights of third parties resulting from its use.

MERCHANT INFORMATION

Merchant Name .................................................

Merchant Number ...............................................

i

Contents

About this Guide ......................................................................1

Welcome kit contents ............................................................................. 1

The Portal 2 with PINpad .........................................................1

The Terminal............................................................................................2

The PINpad ..............................................................................................2

Screens....................................................................................................3

Icons...................................................................................................................3

Idle screens.......................................................................................................4

Home screens...................................................................................................4

Navigation ........................................................................................................4

The Communications Hub......................................................................5

Cardholder Privacy and Security ...........................................5

Terminal security.....................................................................................5

Administering the terminal.............................................................................6

Terminal functionality and security ..............................................................7

Fraud prevention.....................................................................................9

Manually entered credit card transactions.................................................9

Call for authorization ......................................................................................9

Storing cardholder receipts .........................................................................10

Financial Transactions.......................................................... 10

Accepted card types.............................................................................. 11

Credit card purchase............................................................................. 11

Debit card purchase ............................................................................. 12

Void ........................................................................................................ 13

Refund ................................................................................................... 14

Transaction recall ................................................................................. 14

Phone or mail purchase........................................................................ 15

Force post purchase ............................................................................. 16

Force post phone / mail purchase ....................................................... 16

Receipts ..................................................................................................17

Receipt print options..................................................................................... 17

Reprinting receipts ........................................................................................ 17

Receipt examples .......................................................................................... 18

Business Day Functions ....................................................................... 20

Performing day close ................................................................................... 20

Reprinting the day close report.................................................................. 20

ii

Reporting ................................................................................21

Business day reports............................................................................. 21

Batch reports.........................................................................................22

Customized reports...............................................................................22

Coniguration ........................................................................ 22

Adjusting terminal volume ...................................................................22

Adjusting PINpad volume .....................................................................23

Troubleshooting ....................................................................23

What problems can I easily resolve?....................................................23

Why isn’t my terminal powering on? ....................................................24

Why do I see the Internet disconnected icon? ....................................24

Why do I see the PINpad disconnected icon? ....................................24

What do I do if the terminal displays a security alert? ............................24

Error codes ............................................................................................24

Reference............................................................................... 25

Storing the terminal and PINpad .........................................................25

Maintaining the terminal and PINpad..................................................25

Changing the paper..............................................................................25

1

About this Guide

This Guide provides an introduction to your TD Generation solution, hardware functionality,

performing inancial transactions, coniguration, and troubleshooting. For further information

regarding its use and available features, please review our online documentation at

www.tdmerchantsolutions.com/posresources.

Welcome kit contents

We are pleased to provide Merchants new to TD Merchant Solutions with the included

Welcome Kit from. The enclosed information was prepared with you in mind, and includes

the following:

• Paper rolls for the terminal

• Cleaning card and instructions

• Card acceptance decals (Visa®, MasterCard®, Discover®, American Express®,

Interac® Direct Payment, etc.)

• Information to help you protect your business and customers from fraud

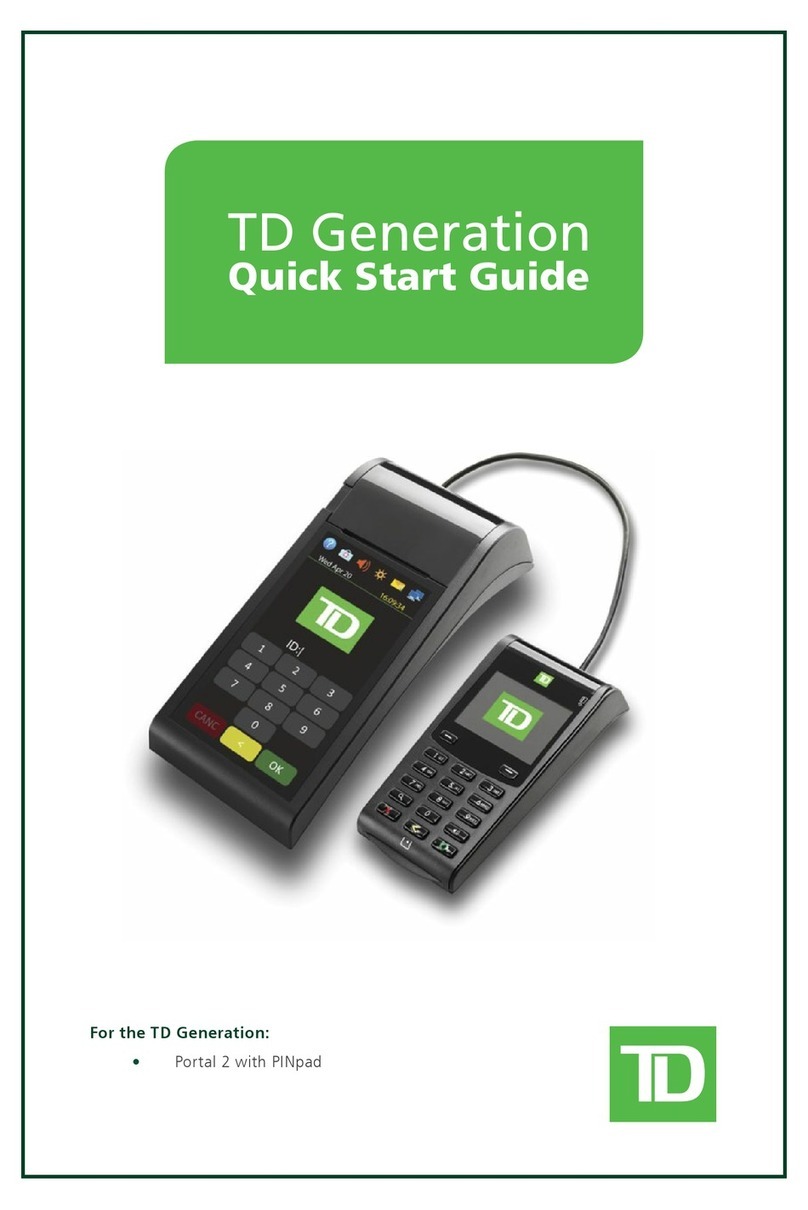

The Portal 2 with PINpad

The terminal is solely for you, our Merchant. You will use the terminal to initiate transactions

for customer’s using credit, debit, loyalty or gift cards. Depending on your settings, some

card types may not be accepted by your terminal. For loyalty and gift card information,

please review our online documentation at www.tdmerchantsolutions.com/posresources.

Please note, there are two versions of this terminal: the Portal with PINpad and Portal 2 with

PINpad. Below are examples of the terminal screens to help you determine which version

you use. This document covers the Portal 2. If you have the previous hardware version,

please ensure that you download the Portal with PINpad documentation.

Portal with PINpad Portal 2 with PINpad

16:20

?

Wed Apr 20 16:09:34

?

2

The Terminal

1. Paper chamber button

2. Touchscreen

All navigation and merchant

data entry is done through the

touchscreen.

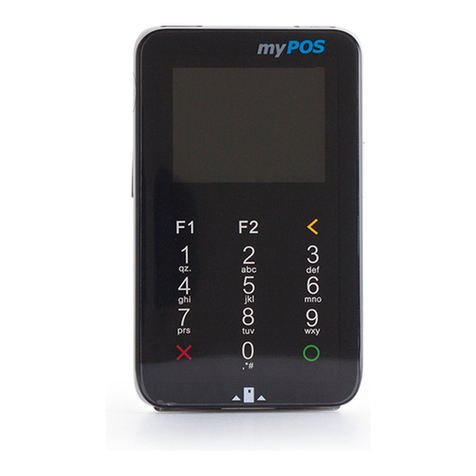

The PINpad

The PINpad is used by the customer to

make transaction selections and entries.

1. Dash keys

Use the

-

/ dash keys to navigate

the screens and menus.

2. Command keys

•

X

= Cancel

•

<

= Correction

•

O

= OK or activate

3. Volume key

Use this key to adjust the PINpad

volume.

4. Card readers

a) Insert chip cards

b) Contactless cards

c) Swipe cards

Wed Apr 20 16:09:34

?

ID:|

1

4

7

2

5

8

3

6

9

0

CANC <OK

1

2

- -

1 QZ 2 ABC 3 DEF

4 GHI 5 JKL 6 MNO

7 PRS 8 TUV 9 WXY

0

X<O

Welcome/Bonjour

4c

4b

4a

1

23

3

Screens

Icons

The icons on the terminal change from screen to screen. Below are the most common icons

that you will use in your day-to-day business and which screen(s) they are available on. The

PINpad has no interface icons.

Icon Name Description Idle

Screen

Home

Screen

Home Tap this to access the Home

screen(s).

Yes Yes

Control panel Tap this icon to access

coniguration settings. This

menu functionality is covered

in our online Coniguration and

Troubleshopoting Guide.

No Yes

?

Help Tap this to access the Help

screen.

Yes Yes

Lock / Log o Tap this to log out the current

user or, if you don’t use login

IDs, tap this icon to return to

the Idle screen.

No Yes

Internet status These icons indicates if your

terminal is connected to the

Internet or not.

Possible Possible

Dial-up status This icon indicates that your

terminal is connected via dial-up.

Possible Possible

PINpad

disconnected

This icon indicates your

PINpad is disconnected from

the terminal. Please verify the

PINpad is securely connected

to the terminal.

Possible Possible

Speaker volume Tap to access terminal’s

speaker volume.

Yes Yes

Screen

brightness

Tap this to change terminal’s

screen brightness.

Yes Yes

Paper Advance Tap this to advance the paper roll. No Yes

Service menu This icon is only used by TD

technicians.

Yes No

4

Idle screens

The default screen is called the Idle screen. It displays a lot of important information and

dierent ways to access your terminal’s functionality. If you require users to log on to use

the terminal, your Idle screen will be the one on the left. After the terminal is unlocked, or

if it doesn’t require a login, it will appear as the screen on the right.

Terminal (locked) Terminals (unlocked)

Wed Apr 20 16:09:34

?

ID:|

1

4

7

2

5

8

3

6

9

0

CANC <OK

Wed Apr 20 16:09:34

?

Home screens

The Home screen displays three or more

icons that always include: Purchase, Void

and Day Close.

• If your business requires more

than 10 transaction types, there

will be a second screen with the

remaining icons.

• The Service Menu icon is replaced

with the Control Panel icon.

Navigation

• The terminal uses a touchscreen

for navigation. You can navigate

screens by swiping left / right or

tapping an onscreen option.

• Only use your inger when using

the touchscreen as objects may

damage it.

?

Wed Apr 20 16:09:34

Purchase

Void

Force Post

Purchase

Day Close

Refund

X

Last

Receipt

CLOSED

$

RECEIPT

$

Tran. Recall

More

Debit/Credit

Ribequ

1234 5678 91

Alitem Ra

Ide

que

9101 121

amt

delk

Host Tran.

Financial

Reports

5

• If you have more than one Home screen you can tell which screen you’re on by

looking at the two dots at the top of the screen. The red dot indicates the active

screen. Place your inger on the touchscreen and swipe left or right to navigate to

the desired screen.

• If an icon has sub-menus, swipe up and down the screen to navigate.

The Communications Hub

The TD Generation terminal comes with an hub to allow for easy power and Internet

connectivity. It includes:

• A power cable

• A power port

• A dialup port

• An Ethernet port

• Dual connection

communications hubs are

available upon special request.

Cardholder Privacy and Security

Terminal security

It is the Merchant’s responsibility to secure the terminal, any user IDs or passwords to

prevent unauthorized use. In any event the Merchant will be liable for any unauthorized

use of the terminal or any user IDs or passwords. There are two user security settings:

No security (Default)

This setting does not use user IDs and passwords. Merchants that choose to use no security still

have the option to setup a store / manager override ID and password to access areas of

the terminal that have a mandatory requirement for supervisor password.

Security

This option allows the user to enable a login for supervisors and operators with an ID and

password or just ID login. The supervisor setup requires you to create a password. You can

activate this by tapping the Home icon Control Panel icon Logon Method.

Override Passcode

This option allows the business owner to setup a passcode to bypass certain functionality.

See page 7 for the list of functionality that can be bypassed with this passcode.

6

The TD Generation oers you a variety of options to personalize the terminal while

helping you to administer your business. Some standard administration features are:

• User Management (creating, editing, deleting and unlocking locked user IDs)

• Parameter Updates (updating your settings on the terminal to relect new

information such as new accepted payment types)

• Communications (changes to your terminal’s communication method)

• Training Mode (enable/disable this setting to train new employees on how to

use the terminal)

• Receipts (changes to how and when they are printed)

Administering the terminal

By utilizing the user types, you can help secure your terminal by setting what terminal

functionality that each of your employees can access. Listed below are the user types

and their functionality.

Note: There is a user hierarchy that determines who can access certain functionality:

• Administrator (TD Technician only),

• Manager,

• Supervisor, and

• Operator.

TD Merchant Solutions strongly suggests that you create and use a manager ID for your

day-to-day business needs and only use the administrator ID when absolutely necessary.

Some functions that require an administrator ID are.

• Adding, editing, deleting or unlocking manager IDs

• Any functionality that you have protected with an administrator login

The TD Generation oers you a variety of options to personalize the terminal while

helping you to administer your business. Some standard administration features are:

• User Management (creating, editing, deleting and unlocking locked user IDs)

• Parameter Updates (updating your settings on the terminal to relect new

information such as new accepted payment types)

• Communications (changes to your terminal’s communication method)

• Training Mode (enable/disable this setting to train new employees on how to

use the terminal)

• Receipts (changes to how and when they are printed)

Any changes that you make on the terminal will be overwritten the next time that you

perform a Host 1 or Host download after a settlement request. Please contact the TD

Merchant Solutions Help Desk to make any permanent changes to your terminal.

TD Merchant Solutions strongly suggests that when you create your manager

IDs that you record and store them in a safe place for future reference.

Any changes that you make on the terminal will be overwritten the next time that you

perform a Host 1 or Host download after a settlement request. Please contact the TD

Merchant Solutions Help Desk to make any permanent changes to your terminal.

7

Terminal functionality and security

The following is a list of terminal funtions that can be enabled or disabled (on or o),

protected by supervisor ID or protected by an override passcode.

Functionality Enable/Disable Supervisor ID Override Passcode

Generic settings

Voice prompts Yes No No

Financial Transactions

Call for authorization Yes Yes Yes

Cash transaction Yes Yes Yes

Cashback prompt Yes No No

Force post Yes Yes Yes

Force post purchase Yes No No

Gift card balance Yes No No

Loyalty award Yes No No

Manual entry (credit card)Yes Yes No

Manual entry (gift card) Yes No No

Payment Yes No No

Phone/mail purchase Yes No No

Pre-auth (completion) Yes No No

Pre-auth (open) Yes No No

Purchase Yes No No

Purchase with tip Yes No No

Refund Yes No No

Split bill Yes No No

Transaction recall sub-menu Yes No No

Void Yes No No

Receipt settings

Cash transaction receipts Yes No No

Last receipt Yes No No

8

Functionality Enable/Disable Supervisor ID Override Passcode

Print operator name Yes No No

Day close

Access day close No Yes No

Close batch with open

pre-authorizations

Yes No No

Day close Yes No No

Terminal auto-close Yes No No

Reporting

Access batch reports No Yes No

Access business day reports No Yes No

Access customized reports No Yes No

Access gift card reports No Yes No

Access override passcode

menu

No Yes No

End of day reports

Cash back totals report No Yes No

Gift card host details report No Yes No

Gift card host totals report No Yes No

Host balancing report No Yes No

Open pre-auth report No Yes No

Operator balancing report No Yes No

Operator detail report No Yes No

Pre-auth status report No Yes No

TD discount report No Yes No

Terminal balancing report No Yes No

Terminal details report No Yes No

Tip totals report No Yes No

9

Fraud prevention

The following information will help you protect yourself from fraudulent transactions.

Manually entered credit card transactions

There is an inherent risk associated with these transactions as they have an increased rate

of fraud. If you do manually enter a credit card transaction which is deemed fraudulent,

you will be held responsible for any chargebacks associated with it. Manually entered

credit card transactions include mail order and telephone order transactions.

Transaction type Default Setting

Manually entering a credit card number on the terminal

This is the ability to manually enter a credit card number

into the terminal for a purchase transaction when a

customer is performing a card-present purchase.

Disabled and, if enabled,

protected with supervisor

ID and password.

Mail order / Telephone order purchase

This is the ability to manually enter a credit card number

into the terminal for a purchase transaction when a

customer is performing a card-not-present purchase.

Disabled

Force post purchase

This is the ability to perform a transaction with a manually

entered authorization number versus the transaction being

authorized automatically through the terminal.

Disabled and, if enabled,

protected with supervisor

ID and password.

Call for authorization

Sometimes, due to a communication or a security issue, a transaction cannot or

should not be completed. See the list of messages and events below that will cause

you to call for authorization.

Note: You must call for authorization for every force post transaction performed on

your terminal.

If you are uncomfortable manually entering credit card information, as a business owner,

you can request another form of payment (another credit card, debit, cash, etc.).

We understand that the default settings that come with this terminal may not fully meet

your businesses’ needs. Should you wish to amend these default settings, please contact

the TD Merchant Solutions Help Desk at 18003631163 to learn about your options.

10

Whenever Action

…the card number on the screen does not

match the number embossed on the

card.

OR

…the cardholder signature on the receipt

does not match the signature on the

reverse of the card.

OR

…you have any doubts about the validity

of a card or a transaction.

1. Call for a voice authorization

immediately.

2. Request a CODE 10 authorization.

In this situation, you may be dealing

with a fraudulent card and CODE

10 will alert the inancial institution

to this possibility.

Storing cardholder receipts

Merchants are responsible for retaining all receipts to respond to cardholder inquiries.

The following are guidelines you should use when storing them. Store receipts:

• ...in a dark, secure area with limited access for at least 18 months

• ...in envelopes arranged by date in a secured iling cabinet works well. If you

have several terminals use a separate envelope(s) for each terminal.

• ...as long as you retain cash register tapes for direct payment transactions

Your receipts could become unreadable if you store receipts in plastic coated containers

or expose them to direct heat or cold sources.

• If TD needs a receipt copy, please send it within eight days and retain a copy

for your records.

• The required storage and response times are for TD Merchant Solutions only

and may vary by inancial institution.

Financial Transactions

The TD Generation terminal can perform the following transactions:

• Purchase

• Purchase (Phone / Mail)

• Force post

• Refund

• Void

• Pre-authorizations*

• Gift card*

• Loyalty card / More Rewards® / Air Miles®*

• UnionPay*

* These optional transactions are covered in our online documentation at

www.tdmerchantsolutions.com/posresources.

11

Accepted card types

The terminal will accept whatever cards you indicated when you signed up. If you wish to

adjust your accepted card list, please contact the TD Merchant Solutions Help Desk at

18003631163.

Credit card purchase

This transaction low is used for credit card purchases where the credit card is present. If

the purchase is via phone or mail, use the Phone or mail purchase instructions. If you use

the incorrect purchase transaction you could incur extra charges.

1. Tap the Home icon Purchase.

2. Enter the dollar amount on the terminal and press OK.

3. Select SPLIT or PAY. If the customer is paying the entire amount with one

payment select PAY. Otherwise, select SPLIT.

Split payment (optional)

a) Enter the payment amount and press OK. Enter the partial payment amount.

b) Select the back arrow or OK. If correct, select OK. Otherwise, select

the back arrow.

c) Select the payment method and press OK. The customer selects how

they are paying for the partial amount. Gift card appears only if you

accept them.

d) Select the back arrow or YES. If the amount and payment type are

correct select YES. Otherwise, select the back arrow. Go to step 4.

4. The customer conirms the amount: back arrow or OK.

Tip (optional)

If you have tips enabled on your terminal you will follow these steps:

a) The customer selects / enters one of the tip options oered on screen.

b) The customer conirms the amount: NO or YES.

5. Perform one of the following payment methods: Insert, Swipe,Contactless or

Manual Entry.

Insert

a) The customer enters their PIN and presses OK. Go to step 6.

• Depending how you have set up your terminal, you may be required to enter a

supervisor ID and password to proceed with any transaction.

• If the customer’s receipt has a signature line on it, the customer must sign it.

12

Swipe

a) Verify the card info with what is on the screen and press OK. Go to step 6.

Contactless

a) The customer taps their contactless-enabled credit card on the

contactless card reader. In some cases the customer may be required

to swipe or insert their card. Go to step 6.

Manual entry

a) Enter the account number and press OK.

b) Enter the expiry date and press OK.

c) A manual imprint of the credit card is required. Make the imprint and

press OK.

d) Enter the CVD number and press OK. This number is generally located

on the back of the credit card. Go to step 6.

6. The screen shows that the transaction is completed with an authorization

number or approved message. The receipts will print. If the customer’s copy

has a signature line on it, the customer must sign the receipt. You can REPRINT

the receipt or FINISH the transaction.

7. If there is a balance left owing, go to the Split Payment instructions in step 3.

Debit card purchase

1. Tap the Home icon Purchase.

2. Enter the dollar amount and press OK.

3. Select SPLIT or PAY. If the customer is paying the entire amount with one

payment select PAY. Otherwise, select SPLIT.

Split payment (optional)

a) Enter the payment amount and press OK. Enter the partial payment

amount.

b) Select the back arrow or OK. If correct, select OK. Otherwise, select

the back arrow.

c) Select the payment method and press OK. The customer selects how

they are paying for the partial amount. Gift card appears only if you

accept them.

d) Select the back arrow or YES. If the amount and payment type are

correct select YES. Otherwise, select the back arrow. Go to step 4.

Tip (optional)

If you have tips enabled on your terminal you will follow these steps:

a) The customer selects / enters one of the tip options oered on screen.

13

b) The customer conirms the amount: NO or YES.

Cashback (optional)

You will only see these steps if you have cashback enabled on your terminal.

a) The customer indicates whether they want cashback (NO or YES).

b) The customer enters or selects the cashback amount and presses OK.

c) Customer conirms that the amount is correct (NO or YES).

Payment method

4. Perform one of the following payment methods: Insert or Tap.

Insert

a) The customer inserts their debit card.

b) The customer selects the account to use: CHEQUING or SAVINGS.

c) The customer enters their PIN and presses OK. Go to step 5.

Contactless

a) The customer taps their contactless-enabled debit card on the screen. In

some cases the customer may be required to enter their PIN. Go to step 5.

5. The screen shows that the transaction is completed with an authorization

number or approved message and the receipts print. You can REPRINT the

receipt or FINISH the transaction.

6. If there is a balance left owing, go to the Split Payment instructions in step 3.

Void

This option recalls a transaction so that you can void it. The following instructions can

access any transactions that were performed in the current open batch. If a day close

has been completed you cannot recall transactions made prior to the day close and you

must do a refund, not a void.

1. Tap the Home icon Void.

2. Enter the trace # from the receipt of the transaction to be voided and tap OK.

3. Conirm that the transaction is to be canceled (NO or YES).

4. If this is a debit card, the customer inserts their card, enters their PIN and

presses OK.

5. The screen shows that the transaction is completed with an approved message

and the receipts print. Go to step 2.

6. You can REPRINT the receipt or FINISH the transaction.

14

Refund

You can only perform a refund on a transaction that has already been submitted for reimbursement.

1. Tap the Home icon Refund.

2. If refunds have been password protected on your device, or this is a debit card

refund, you must:

a) Enter a Supervisor ID and press OK.

b) Enter the Supervisor Password and press OK.

3. Enter the dollar amount and press OK.

4. Select one of the following payment methods: Insert,Swipe,Contactless or Manual Entry.

Insert credit or debit card / swipe credit card

a) The customer enters their PIN and presses OK. Go to step 5.

Contactless credit or debit card

a) The customer taps their contactless-enabled card on the screen. Go to step 5.

Manual credit card

a) Enter the account number and press OK.

b) Enter the expiry date and press OK. This is four digits in length.

c) Is a manual imprint required (NO or YES)? If you select NO, the transaction

will be canceled.

d) Enter the CVD number and press OK. This can be up to four digits in length.

Go to step 5.

5. You can REPRINT the receipt or FINISH to complete the refund and the receipts print.

Transaction recall

This option recalls a transaction so that you can view, void or complete / close it if it is

a pre-authorization or tab. The following instructions access any transactions that were

performed in the current open batch. If a day close has been completed you cannot recall

transactions prior to the day close. Pre-authorization and tab transactions are covered in

our online documentation at www.tdmerchantsolutions.com/posresources.

1. Tap the Home icon Transaction Recall.

2. Select one of the following:

Recall all

This recalls the details all of transactions in the open batch.

a) A list of all transactions currently available on the terminal appear. Go to step 2.

Debit refunds are disabled by default. If you wish to activate debit refunds on your

terminal please call the TD Merchant Solutions Help Desk at 18003631163.

15

Recall by trace #

This only recalls the transaction connected to the trace # in the open batch.

a) Enter the trace number that you want to recall and tap OK. Go to step 4.

Recall by amount

This recalls any transaction for the entered dollar amount in the open batch.

a) Enter the dollar amount and tap OK. Go to step 3.

Recall by account #

This recalls any transaction for the entered card account number in the open batch.

a) Swipe or Manually enter the card. Go to step 3.

Recall by invoice #

This recalls the transaction for the entered invoice number.

a) Enter the invoice number that you want to recall and tap OK. Go to step 4.

3. If there are multiple transactions, scroll to the desired one and tap OK.

4. Select Void to cancel the transaction. Tap cancel to leave this screen without

making a selection.

Phone or mail purchase

These instructions are used for purchases where the card is not present. If the card is present

at purchase, see Credit card purchase. If you use the incorrect purchase transaction you

could incur extra charges.

1. Tap the Home icon Phone / Mail Purchase.

If you have both Phone Orders and Mail Orders enabled, you will have the option to

select which one you want to use: PHONE or MAIL.

2. Enter the invoice number (if enabled).

3. Enter the dollar amount and press OK.

4. Enter the account number and press OK.

5. Enter the expiry date and press OK.

6. If this is a phone order, enter the CVD and press OK.

7. Enter customer’s house number and press OK (if enabled).

8. Enter the customer’s postal code and press OK (if enabled).

• There are risks performing transactions when the credit card is not present. Ensure

that you perform all of the available security checks for phone / mail purchases.

• These transactions can be password protected.

16

9. The screen shows that the transaction is completed with an authorization number

and the receipts print.

10. You can REPRINT the receipt or FINISH the transaction.

Force post purchase

This option is only used due to communication problem or that the force post is requested

via the terminal.

1. Tap the Home icon Force Post Purchase.

2. Enter the dollar amount and tap OK.

3. Then enter the authorization number and tap OK. Please note, authorization

numbers can include letters.

4. Select one of the following payment methods: Insert, Swipe, or Manual Entry.

Insert credit or debit card / swipe credit card

a) Insert the card into the PINpad. Go to step 5.

Manual credit card

a) Enter the account number and tap OK.

b) Enter the expiry date and tap OK.

c) Enter the CVD number and tap OK. Go to step 5.

5. The screen shows that the transaction is approved and the receipts print.

6. You can REPRINT the receipt or FINISH the transaction.

Force post phone / mail purchase

This option is only used when you can’t process a credit card purchase normally through

the network whether due to communication problem or that the force post is requested

via the terminal.

1. Tap the Home icon Force Phone / Mail Purchase.

2. Enter the dollar amount and press OK.

a) Enter the account number and press OK.

b) Enter the expiry date and press OK.

c) If this is a phone order, enter the CVD and press OK. This can be up to

four digits in length.

Before you perform this transaction you must call the TD Merchant Solutions Help Desk

at 18003631163 and receive an authorization number.

Before you perform this transaction you must call the TD Merchant Solutions Help Desk

at 18003631163 and receive an authorization number.

Table of contents

Other TD Payment Terminal manuals