TD Luxe 6200m User manual

TD Luxe 6200m

UnionPay Guide

TD Luxe 6200m Wired:

• Standalone

• Semi-Integrated

COPYRIGHT © 2021 by The Toronto-Dominion Bank

This publication is conidential and proprietary to The Toronto-Dominion Bank and is intended solely for the use of Merchant customers of

TD Merchant Solutions. This publication may not be reproduced or distributed, in whole or in part, for any other purpose without the written

permission of an authorized representative of The Toronto-Dominion Bank.

NOTICE

The Toronto-Dominion Bank reserves the right to make changes to speciications at any time and without notice. The Toronto-Dominion Bank

assumes no responsibility for the use by the Merchant customers of the information furnished in this publication, including without limitation

for infringements of intellectual property rights or other rights of third parties resulting from its use.

i

Contents

Who should use this guide?.....................................................1

What is UnionPay? .................................................................................. 1

How do I identify a UnionPay card?....................................................... 1

UnionPay card types............................................................................... 1

Financial Transactions............................................................ 2

Transaction requirements ......................................................................2

PIN entry............................................................................................................2

Customer signature.........................................................................................2

Transaction Restrictions .........................................................................2

Purchase (credit or debit card) ..............................................................2

Receipts ...................................................................................................3

Receipt codes...................................................................................................3

Troubleshooting ......................................................................4

ii

1

Who should use this guide?

You should use this guide if you are a client of TD Merchant Solutions and perform transactions involving

UnionPay credit or debit cards during the course of your daily business.

What is UnionPay?

Union Pay is an international payment brand that is becoming more commonly used worldwide. You will see

either single branded cards (UnionPay only) or dual branded cards (UnionPay and another payment brand).

How do I identify a UnionPay card?

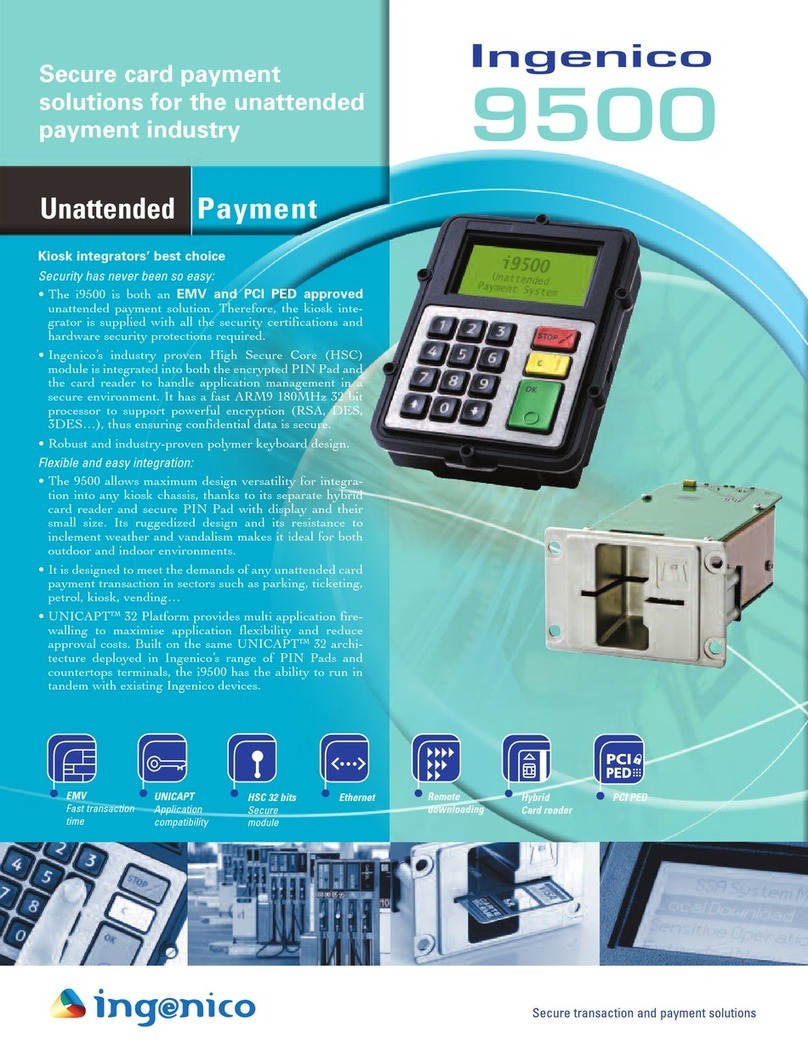

UnionPay cards are easy to identify by their logo shown below.

UnionPay card types

Currently they oer the following cards:

Card type Single branded Dual branded

Credit card UnionPay UnionPay co-branded with Visa,

Mastercard, American Express, JCB

or Diners Club

Debit card UnionPay UnionPay co-branded with Interac

Debit or Visa Debit

2

Financial Transactions

Transaction requirements

UnionPay sometime requires customers to verify their identity. The two most common customer veriication methods are:

PIN entry

The terminal may request the customer to enter their PIN for any transaction. For credit cards, the customer can

bypass this PIN request, but if they do and the PIN is requested again, they must enter their PIN. Debit cards

always require a PIN.

Customer signature

The customer may be required to sign the merchant receipt. This can occur for any transaction, even one where

the customer has already entered their PIN. If you see a signature line on the Merchant receipt, the customer

must sign the receipt. Failure to do say will prevent you from being paid for the transaction.

Transaction Restrictions

The following are not allowed for UnionPay cards:

• Account selection (chequing or savings) on debit card transactions - a default setting will be used

• No signature required (NSR) transactions

• Oline authorizations

• Partial sale approvals

• Transactions in foreign currencies

• Voice authorization / forced post transactions

• Cashback

Purchase (credit or debit card)

This transaction is used for purchases where the UnionPay credit or debit card is present.

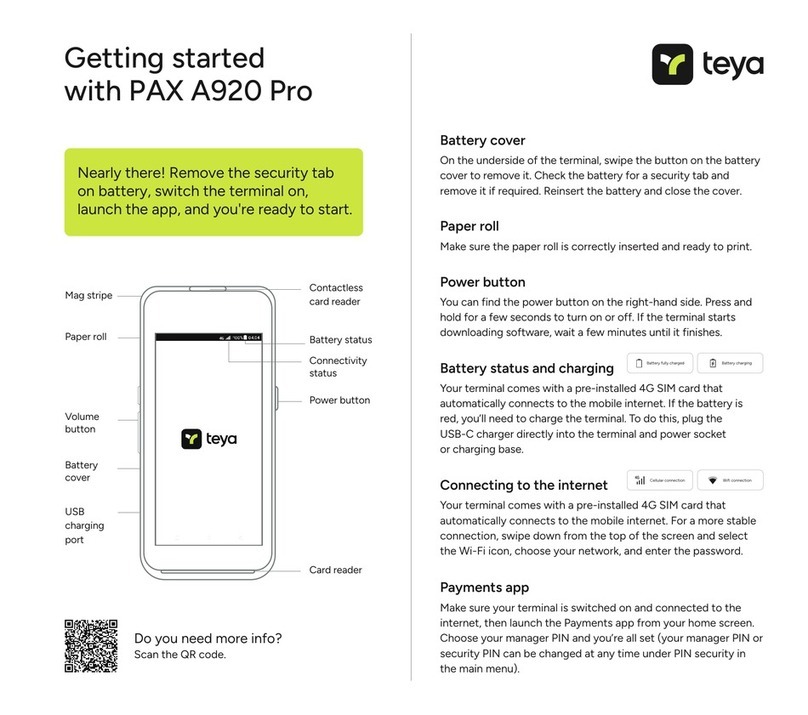

1. From the Desktop screen Purchase icon.

2. Enter the total dollar amount for the sale and press OK.

3. Customer conirms the dollar amount.

4. Perform one of the following payment methods.

a) The customer selects their contactless-enabled card on the contactless card reader. Go to

step 5. The customer may be required to swipe or insert their card in some cases.

OR

a) The customer inserts their card.

b) The customer enters their PIN and selects OK (credit card only). Go to step 5.

Depending how you have set up your terminal, you may be required to enter a supervisor ID and password to

proceed with any transaction.

3

OR

a) Merchant swipes the card. Interac debit cards cannot be swiped, but foreign debit cards can.

b) The customer selects their payment method: Co-brand or UnionPay.

c) The terminal may request the customer to enter their PIN for any transaction.

For credit cards, the customer can bypass this PIN request, but if they do and the PIN is

requested again, they must enter their PIN.

d) Verify the card info with what is on the terminal screen and select OK.

e) If the transaction is declined, please retry but select the brand option in step b. For example,

if you previously selected Co-brand for the declined transaction, select UnionPay this time.

5. The screen shows that the transaction is completed with an authorization number or approved

message. If the receipt requests the customer’s signature, they must sign the receipt. If you do not

receive their signature, you may be responsible for chargebacks.

6. You can REPRINT the receipt or FINISH the transaction.

Receipts

Each transaction has a dierent receipt and most of the information is purely for record keeping. There is important

information that you need to be aware of to ensure that your transactions have completed correctly.

Receipt codes

Card type

UP UnionPay

Important information

Trace # The trace number associated with the

transaction

Auth # The authorization number associated

with the transaction

Signature The card issuer determines when a

signatures is required for a transaction

so ensure that the client signs these

receipts.

Approved Always ensure that the transaction was

approved as it could be DECLINED.

The amount paid by the customer may only be partially authorized depending on the card company.

If a partial authorization occurs, the screen will display the amount still outstanding. The transaction

will then request another payment method for the balance.

Merchant Name

Address, Postal Code

City, Province

2000000

N10000000205

**** PURCHASE ****

12-21-2015

Acct # 452001****5097

Exp Date 10/19

A00000000003101001

Trace # 6

Inv. # 5

Auth # 75612

RRN 001006006

TVR 000000000000TST F800

TC 0E19785C8DAA97AC

Total $50.00

(00) APPROVEDTHANK YOU

Retain this copy for your records

Merchant Copy

Receipt Banner

Receipt Banner

12:29:12

C

CardType UP

Contact Information

Please call the TD Merchant Solutions Help Desk at 18003631163. We would be happy to answer any questions

you may have.

Authorization:

24 hours a day, seven days a week

Terminal Inquiries:

24 hours a day, seven days a week

General Merchant Inquiries:

Monday – Friday, 8 a.m. – 8 p.m. ET

Printer / Stationery Supplies:

Monday – Friday, 8 a.m. – 5 p.m. ET

Documentation Portal

This guide covers the most commonly used information in order to get you started. Your terminal has more

features and functionality to explore on our documentation portal which you can ind at www.tdmerchantsolu-

tions.com/posresources.

Below is a list of the available Luxe 6200m documentation:

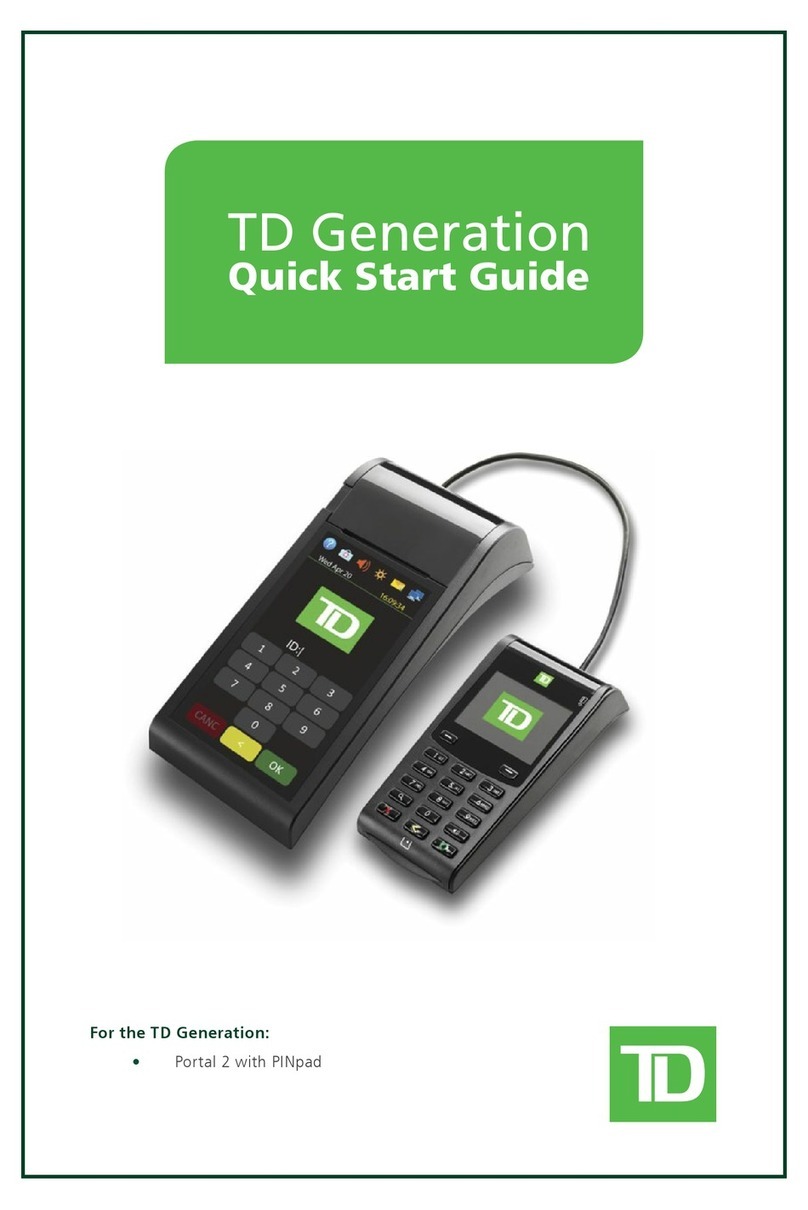

• Quick Start Guide

• Coniguration and Troubleshooting Guide

• Pre-authorization Guide

• Givex Gift Card Guide

• More Rewards Guide

• UnionPay Guide

• and more

(0321)

Other manuals for Luxe 6200m

3

Table of contents

Other TD Payment Terminal manuals