TD iCT250 User manual

For the TD iCT250:

• with PINpad

• without PINpad

* PINpad not shown

TD iCT250

Quick Start Guide

COPYRIGHT ©2016 by The Toronto-Dominion Bank

This publication is conidential and proprietary to The Toronto-Dominion Bank and is intended solely for the use of

Merchant customers of TD Merchant Solutions. This publication may not be reproduced or distributed, in whole or in part,

for any other purpose without the written permission of an authorized representative of The Toronto-Dominion Bank.

NOTICE

The Toronto-Dominion Bank reserves the right to make changes to speciications at any time and without notice.

The Toronto-Dominion Bank assumes no responsibility for the use by the Merchant customers of the information

furnished in this publication, including without limitation for infringements of intellectual property rights or other

rights of third parties resulting from its use.

MERCHANT INFORMATION

Merchant Name ...........................................

Merchant Number ..........................................

i

Contents

About this Guide ......................................................................1

Welcome kit contents ............................................................................. 1

The TD iCT250 solution............................................................1

Functionality............................................................................................2

The Terminal ............................................................................ 2

Default shortcut keys ..............................................................................3

Screens....................................................................................................3

Idle screen and icons ......................................................................................3

Main menu screen ...........................................................................................4

Admin menu screen ........................................................................................4

Navigation ........................................................................................................4

The communications adapter................................................................5

Ports ...................................................................................................................5

The PINpad ..............................................................................................5

Navigation ........................................................................................................6

Cardholder Privacy and Security ...........................................6

Terminal security ....................................................................................6

Fraud prevention..................................................................................... 7

Manually entered credit card numbers ....................................................... 7

Call for authorization ......................................................................................7

Financial Transactions............................................................ 7

Accepted card types...............................................................................8

PINpad transactions ...............................................................................8

Special transactions ...............................................................................8

Cashback..........................................................................................................8

Partial authorizations......................................................................................8

Tip.......................................................................................................................8

Sale (credit card) ....................................................................................9

Sale (debit card).................................................................................... 10

Sale (phone or mail)............................................................................... 11

Force post (sale or phone / mail) .......................................................... 11

Transaction recall ................................................................................. 12

Void........................................................................................................ 13

Return .................................................................................................... 13

Receipts ................................................................................................. 14

Reprinting receipts ........................................................................................ 14

Receipt examples .......................................................................................... 14

Continued on next page

ii

Business Day Functions ........................................................ 16

Performing a day close......................................................................... 16

Reporting ................................................................................17

Business day reports..............................................................................17

Batch reports..........................................................................................17

Customized reports............................................................................... 18

EMV reports ........................................................................................... 18

Recent error report log ......................................................................... 19

Activity log............................................................................................. 19

Coniguration ........................................................................20

Changing the terminal communication method ............................... 20

More features and functionality.......................................................... 20

Troubleshooting .....................................................................21

What problems can I easily resolve?.................................................... 21

Why isn’t my terminal powering on? .................................................... 21

Why don’t I see a connection icon on the Idle screen?.......................22

Reference............................................................................... 22

Menu structure ......................................................................................22

Entering letters and special characters...............................................25

Maintaining the terminal and PINpad..................................................25

Storing the terminal and PINpad .........................................................26

Changing the paper roll .......................................................................26

1

About this Guide

This Guide provides an introduction to your TD iCT250 solution, hardware functionality,

performing inancial transactions, administration features and troubleshooting. For

further information regarding its use and available features, please review our online

documentation at www.tdmerchantsolutions.com/posresources.

Welcome kit contents

We are pleased to provide Merchants new to TD Merchant Solutions with the included

Welcome Kit from. The enclosed information was prepared with you in mind, and

includes the following:

• Paper rolls for the terminal

• Cleaning card and instructions

• Card acceptance decals (Visa®, MasterCard®, Discover®, American Express®,

Interac® Direct Payment, etc.)

• Information to help you protect your business and customers

The TD iCT250 solution

The terminal is solely for the you, the Merchant. You will use the terminal to initiate transactions

for customer’s using credit or debit cards. Depending on your settings, some card types

may not be accepted by your terminal. Please please go to our online documentation at

www.tdmerchantsolutions.com/posresources to learn how to use other cards.

There are two potential conigurations for the TD iCT250 solution. They are:

Terminal only

If you use this coniguration you must hand the terminal to the customer

whenever they must enter information.

Terminal and PINpad

If you use this coniguration you, the Merchant, will use the terminal to enter

your information and the customer uses the PINpad to enter their information.

1

9

F. , # *

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

S

W

YX

Z

0

MODEM

16:

20

05/04/2014

1

9

* . , #

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

S

W

YX

Z

0

F

CHQ SAV/ EP

iPP320

CANC

ANNUL CORR OK

F1 F2 F3 F4

1

9

F. , # *

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

S

W

YX

Z

0

MODEM

16:

20

05/04/2014

1

9

* . , #

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

SW

YX

Z

0

F

CHQ SAV/ EP

iPP320

CANC

ANNUL CORR OK

F1 F2 F3 F4

Welcome / Bonjour

2

Functionality

Name Terminal PINpad

Paper chamber button Yes No

Function keys Yes Yes

Navigation keys Yes Yes

Paper advance key No

Command keys

CANC

ANNUL

CORR

OK

F key

F

Present but not used

Chip card reader Yes Yes

Magnetic stripe reader Yes Yes

Contactless reader Yes Yes

Communications Via dial-up or DSL connection Connected to the terminal

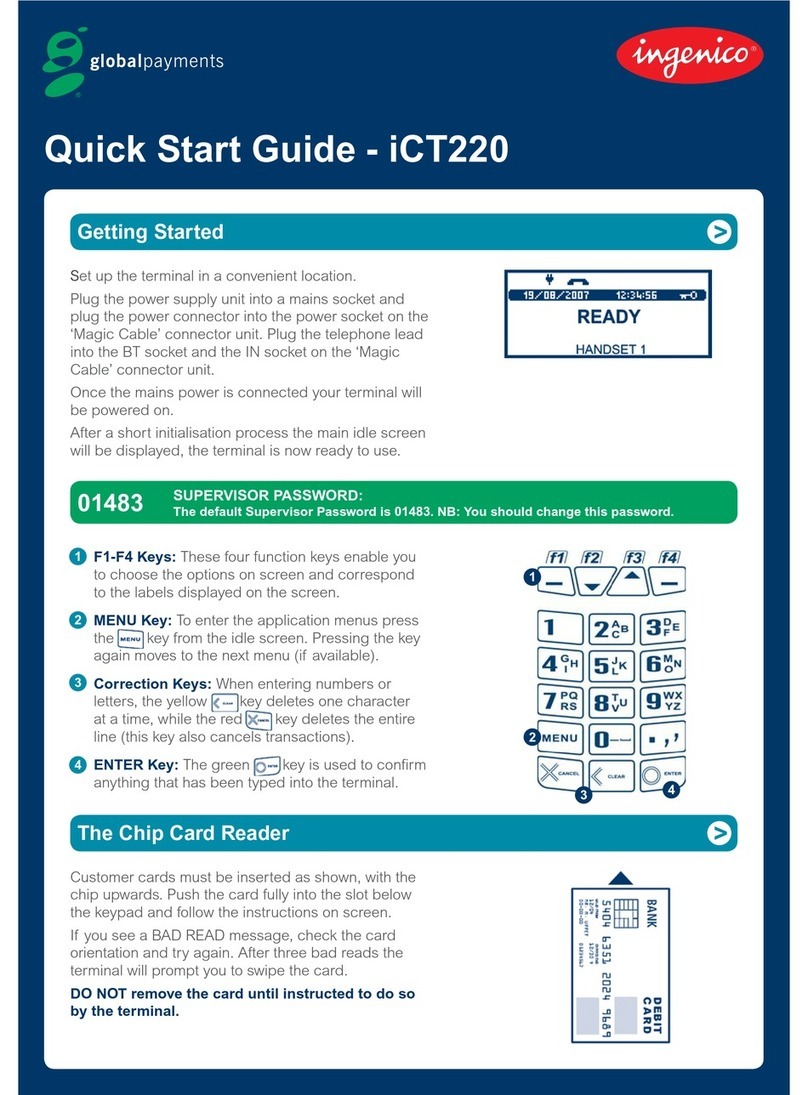

The Terminal

1. Paper chamber lap

2. Function keys

The / F1 and / F4 keys

can be used as shortcuts and to

select onscreen options. See

page 3 for more information.

3. Navigation keys

Use the F2 and F3 arrow keys to

navigate the screens and menus.

4. Command keys

/ Cancel

/ Correction or Paper

advance

/ OK and shortcut to the

Transactions screen.

5. Card readers

a) Insert chipped cards

b) Swipe cards

c) Contactless cards

1

9

F. , # *

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

S

W

YX

Z

0

MODEM

16:

20

05/04/2014

1

5a

3

22

4

5b

5c

3

Default shortcut keys

To access a speciic menu or function, use the following shortcuts:

Transaction Key

Sale (default) / F1

Pre-Auth Initiation (default) / F2

Pre-Auth Completion (default) / F3

Phone/Mail Sale (default) / F4

Main Menu / OK

Admin Menu

. , # *

Reprint last receipt

0

Advance paper / Correction

Screens

Idle screen and icons

The default screen is called the Idle screen. On it are a number of important icons. They

are, left to right:

1. Communication icon

The icon indicates whether the

terminal is connected to the

network. It will be one of two colours:

• green (connected) or

• white (disconnected).

2. Lock (security)

The lock icon will be closed or

open. If you don’t see the closed

lock, do not use this terminal and

contact the TD Merchant

Solutions Help Desk to report it

as a tampered device.

3. Power

The plug icon in the top-right

corner indicates that the

terminal is powered.

MODEM

16:

20

05/04/2014

1 2 3

4

Main menu screen

From the Idle screen, press the OK key and

the Main Menu screen appears. The Main

Menu screen displays the following

transactions:

• Return

• Void

• Force Post

• Balance Inquiry

Admin menu screen

From the Idle screen, press the Admin key

and the Admin Menu screen appears. It

displays the following options:

• Logon / Logo

• Business Day Menu

• Trans Recall Menu

• Setup Menu

• Reprint Menu

• Maintenance

• Other Functions

For a list of all the admin functions on

available on the terminal, refer to page

22 for a complete menu breakdown.

Navigation

Once you get to the desired screen, use the following keys to navigate it:

• Press the F2 or F3 arrow keys to scroll down or up one menu selection

• Press the F1 or F4 keys to select an on screen option

• Press Cancel to go back one screen

• Press Correction to change an entry

• Press OK to conirm your menu selection or entry

• Press the number associated with the desired menu item

MAIN MENU

1 - Return

2 - Void

3 - Force Post

4 - Balance Inquiry

MODEM 16:20

05/04/2014

ADMIN MENU

1 - Logon/Logo

2 - Business Day Menu

3 - Trans Recall Menu

4 - Setup Menu

16:

20

05/04/2014

MODEM

5

The communications adapter

The communication adapter is the bridge between your terminal and its power and data in

one connection.

Ports

The adapter has four ports and they are:

1. Data cable to the TD iCT250

2. Power

3. Internet In

4. Phone Line In

Communication options

The TD iCT250 solution oers two options for communications: dial-up or Ethernet. You as

the merchant can set this however you wish to suit your existing place of business’ setup. To

learn more about communication options see page 20.

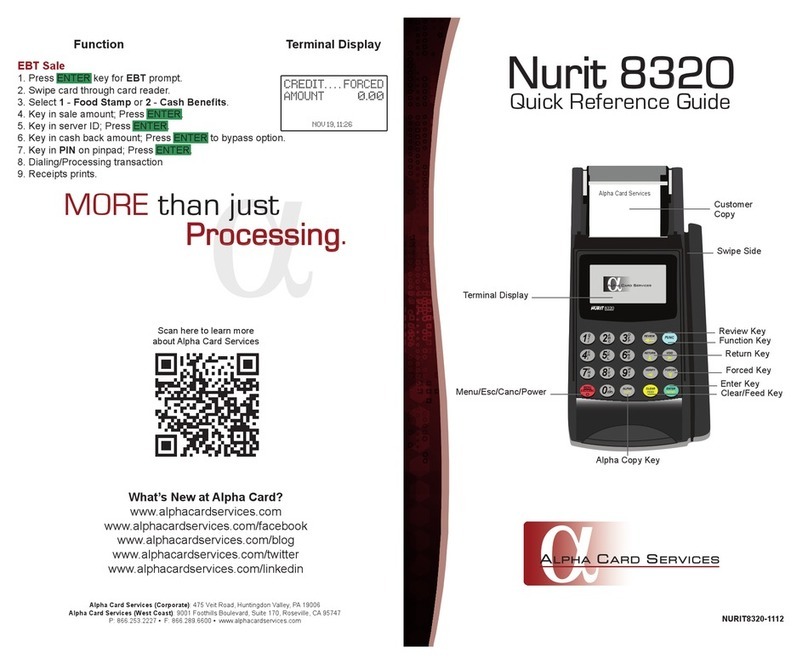

The PINpad

This is an optional piece of hardware. When connected to your terminal it is used by the customer

to enter information and select options regarding the transaction. If you don’t have a PINpad,

the customer will use the terminal to enter information.

1. Function keys

The F1 and F4 keys can be used to

select onscreen options.

2. Navigation keys

Use the F2 and F3 arrow keys to

navigate the screens and menus.

3. Command keys

• Cancel

• Correction

• OK (or Enter)

4. Card readers

a) Insert chipped cards

b) Contactless cards

c) Swipe cards

ETHIN

RS232

12

34

1

9

* . , #

2A

CB3D

FE

4G

IH5J

LK6M

ON

8T

VU

7PR

Q

SW

YX

Z

0

F

CHQ SAV / EP

iPP320

CANC

ANNUL CORR OK

F1 F2 F3 F4

Welcome / Bonjour

1

2

3

4a

4b

4c

1

If you use a PINpad, you must process all inserted chip cards on it. Swiped cards can be

processed on either the terminal or the PINpad.

6

Navigation

Once you get to the desired screen, use the following keys to navigate it:

• Press F2 or F3 to scroll down or up one menu selection.

• Press OK to select an on menu screen option.

• Press F1 or F4 to select an on screen option.

Cardholder Privacy and Security

Please refer to the Cardholder Privacy sheet in your Merchant welcome kit. It contains

important information about your responsibilities to your customers and their personal

and transaction information.

Terminal security

It is the Merchant’s responsibility to secure the terminal, any user IDs or passwords and to

prevent unauthorized use. In any event the Merchant will be liable for any unauthorized

use of the terminal or any user IDs or passwords. There are three user security settings:

• No security (Default)

No access restriction to the terminal functionality listed below.

• Medium Security

Access is restricted to certain features by a supervisor or manager ID and password.

• High Security

Access is restricted to certain features by a manager ID and password.

The following functions can be individually protected:

• End of Day

• Manual Account #

• Batch Reports

• B.Day reports

• Customized Reports

• Batch Close

• Recent Error Report

Please call the TD Merchant Solutions Help Desk at 18003631163 to change the

security level on your terminal.

7

Fraud prevention

Manually entered credit card numbers

This is the ability to manually enter a credit card number into the terminal for a purchase

transaction when a customer is performing a card-not-present purchase.

Transaction type Default settings

Manually entering a credit card number on the terminal

This is the ability to manually enter a credit card number

into the terminal for a purchase transaction when a

customer is performing a card-present purchase.

Protected by supervisor ID and

password

Mail order / Telephone order purchase

This is the ability to manually enter a credit card number

into the terminal for a purchase transaction when a

customer is performing a card-not-present purchase.

Disabled

Force post purchase

This is the ability to perform a transaction with a

manually entered authorization number versus the

transaction being authorized automatically through

the terminal.

Disabled

Call for authorization

You can enable/disable call for authorization transactions.

Financial Transactions

The TD iCT250 solution can perform the following transactions:

• Sale (purchase)

• Phone / Mail sale

• Force post

• Return (refund)

• Void

• Partial authorization

• Pre-authorization*

* These optional transactions are covered in our online documentation at

www.tdmerchantsolutions.com/posresources.

We understand that the default settings that come with this terminal may not fully meet

your businesses’ needs. Should you wish to amend these default settings, please contact

the TD Merchant Solutions Help Desk at 18003631163 to learn about your options.

8

Accepted card types

Your terminal(s) will accept whatever cards you indicated when you signed your contract with

TD Merchant Solutions. If you wish to adjust your accepted card list, please call the TD Merchant

Solutions Help Desk at 18003631163 to change the security level on your terminal.

PINpad transactions

When a PINpad is connected to the terminal the customer will use it exclusively to enter

and information and make selections. For the transactions in this document we show

the customer PINpad key options. If you only have a terminal, the customer will also use

the terminal to enter information.

Special transactions

Cashback

This option only works for debit cards. You can set this up yourself, but any changes done

by you on terminal will be overwritten whenever a day close is performed. It’s better if you

call in to make these changes so that they are permanent.

Partial authorizations

This option allows for partial payments. If the institution that holds the card does not

indicate that there are suicient funds available for the sale, the terminal will indicate

that a balance is required. In this case the customer would then have the option to oer

a second form of payment for the balance or to cancel the entire transaction.

Tip

You can set this up yourself, but any changes done by you on terminal will be overwritten

whenever a day close is performed. It’s better if you call in to make these changes so that

they are permanent.

• Depending on your security settings, you may be required to enter a supervisor ID

and password to proceed with any transaction.

• Press 0on the terminal to reprint the most recent customer receipt.

• If the receipt has a signature line on it, the customer must sign it.

9

Sale (credit card)

1. Press F1.

2. Enter the total dollar amount for the sale and press OK.

3. If you have tips enabled you will see the following steps.

a) Customer conirms the dollar amount and presses Yes or No.

b) Customer enters/selects the tip amount/option and presses OK.

c) Customer conirms the dollar amount and presses Accept or Change.

4. Perform one of the following payment methods.

Contactless

a) The customer taps their contactless-enabled credit card on the

contactless card reader. The customer may be required to swipe or

insert their card in some cases.

b) Ask the customer if they would like a receipt: Yes or No.

c) The screen shows that authorization number, the transaction total and

the receipts print if requested.

Insert card

a) The customer inserts their credit card.

b) The customer enters their PIN and presses OK.

c) The screen shows that authorization number, the transaction total and

the receipts print.

Swipe card

a) The customer swipes their credit card.

b) Verify the card info with what is on the terminal screen and press OK.

c) The screen shows that authorization number, the transaction total and

the receipts print. The customer must sign the signature ield on the

merchant copy.

Manual entry

a) Enter the account number and press OK.

b) Enter the expiry date and press OK.

c) A manual imprint of the credit card is required. Make the imprint and

press OK.

d) Enter the CVD number and press OK. This number is generally located

on the back of the credit card. This is can be an optional step depending

on your settings.

e) Indicate if the card was present for the transaction: Yes or No. The

customer must sign the signature ield on the merchant copy.

10

5. If the payment type used has insuicient funds to pay the entire sale amount you

may see the following:

a) The receipt will print showing how much was applied to the sale.

b) The screen shows a balance owed.

c) The customer decides the how they will pay the balance (Cash or Card).

If the customer selects card, follow the appropriate steps for the selected

card type: credit or debit.

6. The screen shows that authorization number, the transaction total and the

receipts print. If the receipt is from a swipe or manual card entry transaction,

the customer must sign the signature ield on the merchant copy.

Sale (debit card)

1. Press F1.

2. Enter the dollar amount and press OK.

3. If you have tips enabled you will see the following steps.

a) Customer conirms the dollar amount and presses Yes or No.

b) Customer enters/selects the tip amount/option and presses OK.

c) Customer conirms the dollar amount and presses Accept or Change.

4. Perform one of the following payment methods.

Contactless

a) The customer taps their contactless-enabled debit card. The customer

may be required to swipe or insert their card in some cases.

b) Ask the customer if they would like a receipt: Yes or No.

Insert / swipe card

a) The customer selects the account to use: CHQ or SAV.

b) The customer enters their PIN and presses OK.

5. If you have cashback enabled you will see the following steps.

a) Customer conirms if they want cashback or not: YES or NO.

b) Customer enters / selects the cashback amount/option and presses OK.

c) Customer conirms the new total amount: Accept or Change.

6. The screen shows that authorization number, the transaction total and the

receipts print.

If the customer selects cash the transaction will end. Ensure that you

receive the correct cash amount for the balance of the transaction.

11

Sale (phone or mail)

These instructions are used for sales where the card is not present. If the card is present

at sale, see Sale (credit card). If you use the incorrect sale transaction you could incur

extra charges.

1. Press F4 Phone / Mail Sale.

2. Enter the dollar amount and press OK.

3. Enter the account number and press OK.

4. Enter the expiry date and press OK.

5. Indicate the order type; a phone or a mail order.

6. If it is a phone order, enter the CVD number and press OK

7. The screen shows that authorization number, the transaction total and the receipts print.

Force post (sale or phone / mail)

This option is only used when you can’t process a credit card sale normally through the

network whether due to communication problem or that the force post is requested via

the terminal.

1. Press OK Force Post Force Sale or Force Ph/Mail.

2. Enter the dollar amount and press OK.

3. Perform one of the following payment methods.

Swipe card

a) Verify the card info with what is on the screen and press OK. Go to step 4.

Manually enter card

a) Enter the account number and press OK.

b) Enter the expiry date and press OK.

c) Indicate the order type; a phone or a mail order.

d) A manual imprint of the credit card is required. Make the imprint and press OK.

e) If it is a phone order, enter the CVD number and press OK. Go to step 4.

4. Enter the authorization number and press OK.

5. The screen shows that authorization number, the transaction total and the

receipts print. The customer must sign the signature ield on the merchant copy

for a Force post sale transaction.

There are risks performing transactions when the credit card is not present. Ensure that

you perform all of the available security checks for phone / mail sale.

Before you perform this transaction you must call the TD Merchant Help Desk at

18003631163 and receive an authorization number.

12

Transaction recall

This option recalls a transaction so that you can view or void it for any transactions that were

performed in the current open batch. If a day close has been completed you can only recall

transactions after the last day close or batch close. Pre-authorization transactions are covered

in our online documentation at www.tdmerchantsolutions.com/posresources.

1. Press the Admin key Trans Recall Menu.

2. Select one of the following options:

by Detail

This recalls the details all of transactions in the open batch.

a) Scroll to the transaction and press Select. Go to step 3.

by Amount

This recalls any transaction for the entered dollar amount in the open batch.

a) Swipe the card or enter the dollar amount and press OK.

b) If more than one transaction appears, scroll to the desired one and

press Select. Go to step 3.

by Account # (credit cards only)

This recalls any transaction for the entered card account number in the open batch.

a) Swipe the credit card or enter the card account number and press OK.

b) Scroll to the transaction and press Select. Go to step 3.

by Invoice #

This recalls the transaction for the entered invoice number.

a) Enter the invoice number that you want to recall and press OK. Go to step 3.

by Trace #

This only recalls the transaction connected to the trace number in the open batch.

a) Enter the trace number that you want to recall and press OK. Go to step 3.

3. Verify that the it is the correct transaction information on the screen and do

one of the following:

a) Press Void to cancel the transaction and print the voided receipts.

b) Press Back to select a dierent transaction.

c) Press Cancel to exit the screen.

13

Void

This transaction is used to correct a previously entered transaction from the terminal in the

current, open business day. You can also use Transaction Recall to recall and cancel / void

a transaction based on information other than the trace number.

1. Press OK Void.

2. Enter the trace number for the transaction to be voided and press OK.

3. Verify that this is the correct transaction: Void or Back. If you select back, you

can enter a new trace number to void.

4. The voided transaction receipts print.

Return

You can only perform a return on a transaction that has already been submitted for reimbursement.

1. Press OK Return.

2. Enter the dollar amount and press OK.

3. Customer conirms the dollar amount and presses Yes or No.

4. Perform one of the following return payment methods.

Insert card

a) Verify the card info with what is on the screen and press OK.

b) The customer may be required to enter their PIN. Go to step 5.

Swipe card

a) Verify the card info with what is on the screen and press OK. Go to step 5.

Manually enter card

a) Enter the account number and press OK.

b) Enter the expiry date and press OK. This is four digits in length.

c) Indicate if the return is for a phone / mail sale: Yes or No. Go to step 5.

Insert / swipe card

a) The customer selects the account to use: CHQ or SAV.

b) The customer enters their PIN and presses OK. Go to step 5.

5. The screen shows that authorization number, the transaction total and the receipts print.

If you have closed the business day that the transaction was performed in, you can only

perform a return. The option to void the transaction is no longer available.

Debit returns are disabled by default. If you wish to activate debit returns on your terminal

please call the TD Merchant Solutions Help Desk at 18003631163.

14

Receipts

Each transaction has a dierent receipt and most of the information is purely for record

keeping. There is important information that you need to be aware of to ensure that your

transactions have completed correctly.

Reprinting receipts

1. Press the Admin key Reprint Menu and select a reprint option.

2. To reprint the last receipt, select which copy you want to reprint (Merchant,

Customer or Both) and press OK.

3. The receipt reprints and is noted as a duplicate.

OR

2. To reprint a previous receipt, select one of the following options:

All

a) Scroll through the available receipts, select the desired one and press OK.

Go to step 3.

Invoice #

a) Enter the invoice number and press OK. Go to step 3.

Account #

a) Swipe the card or enter the account number and press OK. Go to step 3.

Approval Code

a) Enter the approval code and OK. Go to step 3.

3. Select which receipt to reprint (Merchant, Customer or Both) and press OK.

4. The receipt reprints and is noted as a duplicate.

Receipt examples

Transaction type

COnline chip card transaction

CN Chip card No Signature

Required transaction

CO O-line chip card transaction

MManually entered mag card transaction

MC Manually entered fall back of a chip card transaction

RF Contactless transaction

SSwiped mag card transaction

SC Swiped chip card fall back transaction

SN Swiped No Signature Required transaction

15

Card type

AM American Express

DP Debit

DS Discover/Diner

MC MasterCard

VI Visa

Important information

Trace # The trace number associated with the transaction

Inv # The invoice number associated with the transaction.

Auth # The authorization number associated with the transaction

Signature The card issuer determines when a signatures is required for a

transaction so ensure that the client signs these receipts.

Approved Always ensure that the transaction was approved as it could be DECLINED.

Merchant Name

Address

City, Province

Merchant Number

Terminal ID

SALE

06-16-2016 12:41:02

A

cct # 455763******1632 S

Card Type VI

Name: nnnnnnn

Trace # 010103

Inv # 109

Auth #089090 RRN 001003099

Sale $9.00

TOTAL $9.00

+++++++++++++++++++++++

00 APPROVED-THANK YOU

+++++++++++++++++++++++

Retain this copy for your

records

Merchant copy

ADVERTISEMENT LINE 1

ADVERTISEMENT LINE 2

ADVERTISEMENT LINE 3

ADVERTISEMENT LINE 4

ADVERTISEMENT LINE 5

ADVERTISEMENT LINE 6

ADVERTISEMENT LINE 7

ADVERTISEMENT LINE 8

ADVERTISEMENT LINE 9

Credit Card Debit Card

Merchant Name

Address

City, Province

Merchant Number

Terminal ID

SALE

06-16-2016 12:41:02

Acct # 476173******0010 C

Card Type DP

Name: nnnnnnnnn

A00000000980840

Trace # 060072

Inv # 124

Auth #008635 RRN 001003099

TVR 8000048000 TSI 6800

TC 98952D8874F69BD1

Sale $25.00

TOTAL $25.00

+++++++++++++++++++++++

00 APPROVED-THANK YOU

+++++++++++++++++++++++

Retain this copy for your

records

Merchant copy

ADVERTISEMENT LINE 1

ADVERTISEMENT LINE 2

ADVERTISEMENT LINE 3

ADVERTISEMENT LINE 4

ADVERTISEMENT LINE 5

ADVERTISEMENT LINE 6

16

Business Day Functions

To start a business day, log onto a terminal that has had the day close function performed

on it. Depending on the logon method, it may be as simple as a user performing transactions

to entering a logon ID and password.

Performing a day close

You have a deadline to perform a day close. This is called your balancing window and it is

set on the system. If your day close is done before your balancing window ends, you’ll

receive the same or next business day deposit for credit and debit card totals. Otherwise,

they will be forwarded to the next business day.

You must close your business day on each terminal in order to maintain accurate records

and balance your accounts. Closing the business day is important as it:

• Sends any stored transactions (SAFs).

• Closes all open batches.

• Prints selected reports.

• Checks for mail, and downloads.

• Downloads available updates.

• Starts a new business day on the terminal by opening a new batch.

1. Press the Admin key Business Day Menu End of Day.

2. Conirm that you want to close the business day: Yes or No.

3. The end of day reports print.

4. The terminal reboots.

A day close is automatically performed on your terminal every three to ive business

days if one isn’t performed sooner by you.

A batch is a group of transactions that you must submit to the issuer to accept

in order for you to be paid. Once you close the batch or perform and end of

day, these transactions are sent to the issuer for settlement and then they will

deposit the funds into your account.

• This process may take a while if a lot of transactions have been conducted

during the day, or you are using a dial-up connection.

• Once the process is started, do not process any transactions, press any

buttons or disconnect your Internet service on the terminal in question.

Other manuals for iCT250

1

Table of contents

Other TD Payment Terminal manuals

Popular Payment Terminal manuals by other brands

VeriFone

VeriFone VX 520 Series Quick reference guide

Ingenico

Ingenico iCT220, iCT250 user guide

Ingenico

Ingenico iCT220, iCT250 quick start guide

dejavoo

dejavoo Z8 Quick reference guide

Ingenico

Ingenico FLEX IPP320 installation guide

Alpha Card Services

Alpha Card Services Nurit 8320 Quick reference guide